The world of tax forms can be overwhelming, especially for small business owners and self-employed individuals in Michigan. One crucial form that requires attention is the Michigan Form 5049, also known as the "Employee's Withholding Exemption Certificate". This form is a critical component of the state's tax compliance process, and understanding its filing requirements is essential to avoid penalties and ensure seamless tax processing. In this article, we will delve into the five essential filing requirements of Michigan Form 5049, providing you with a comprehensive guide to navigate this complex process.

What is Michigan Form 5049?

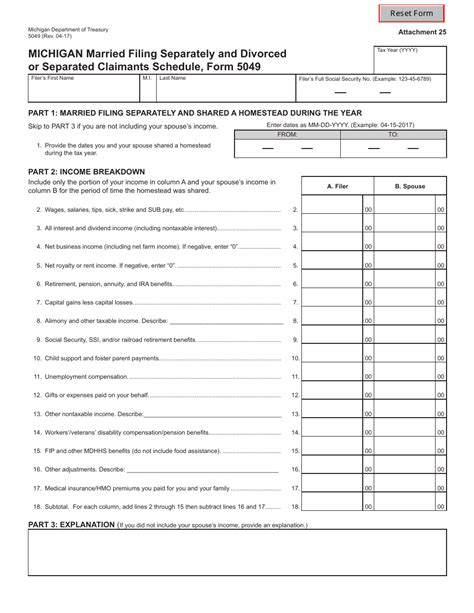

Before we dive into the filing requirements, let's quickly define what Michigan Form 5049 is. This form is used by employers to certify the withholding exemptions for their employees. It helps the state determine the correct amount of income tax to withhold from an employee's wages. The form is typically submitted to the Michigan Department of Treasury, along with other required tax documents.

Filing Requirement 1: Employee Eligibility

The first essential filing requirement for Michigan Form 5049 is determining employee eligibility. Employers must ensure that each employee completes the form accurately, indicating their withholding exemptions. The form requires employees to provide their name, address, Social Security number, and exemption status. Employers must verify this information to ensure compliance with state tax regulations.

Filing Requirement 2: Withholding Exemptions

Understanding Withholding Exemptions

Withholding exemptions are a critical component of Michigan Form 5049. Employees can claim exemptions based on their marital status, number of dependents, and other factors. Employers must understand the different types of exemptions available, including:

- Single person exemption

- Married person exemption

- Head of household exemption

- Dependent exemption

Employers must also be aware of the exemption limits and requirements, as outlined in the Michigan Income Tax Act.

Filing Requirement 3: Required Documents

Supporting Documents for Michigan Form 5049

In addition to the completed Michigan Form 5049, employers must submit supporting documents to the Michigan Department of Treasury. These documents may include:

- Employee's federal Form W-4

- Proof of residency

- Proof of exemption status

Employers must ensure that these documents are accurate and complete, as incomplete or inaccurate submissions may result in penalties or delays.

Filing Requirement 4: Filing Deadlines

Employers must submit Michigan Form 5049 to the Michigan Department of Treasury by the required filing deadline. The deadline varies depending on the employer's filing frequency:

- Monthly filers: 15th day of the following month

- Quarterly filers: 30th day of the following quarter

- Annual filers: January 31st of the following year

Employers must ensure that they meet these deadlines to avoid penalties and interest.

Filing Requirement 5: Record Keeping

Record Keeping Requirements for Michigan Form 5049

Finally, employers must maintain accurate records of Michigan Form 5049 submissions. This includes:

- Completed employee forms

- Supporting documents

- Submission receipts

Employers must retain these records for at least three years from the submission date, as required by the Michigan Department of Treasury.

Take Action

Now that you understand the five essential filing requirements for Michigan Form 5049, it's time to take action. Ensure that your employees complete the form accurately, and submit it to the Michigan Department of Treasury by the required deadlines. Verify employee eligibility, withholding exemptions, and supporting documents to avoid penalties and delays. Maintain accurate records of submissions, and stay compliant with Michigan tax regulations.

FAQ Section

Who is required to file Michigan Form 5049?

+Employers in Michigan are required to file Michigan Form 5049 for each employee, regardless of the employee's exemption status.

What is the penalty for failing to file Michigan Form 5049?

+The penalty for failing to file Michigan Form 5049 can range from $50 to $500, depending on the employer's filing frequency and the number of employees affected.

How often must employers submit Michigan Form 5049?

+Employers must submit Michigan Form 5049 to the Michigan Department of Treasury by the required filing deadline, which varies depending on the employer's filing frequency.