The formation of a non-profit corporation and the application for tax exemption can be a complex and time-consuming process. In this article, we will guide you through the steps to form a 501(c)(3) non-profit corporation and apply for tax exemption.

Understanding Non-Profit Corporations

A non-profit corporation is a type of corporation that is organized and operated exclusively for charitable, scientific, literary, or educational purposes. Non-profit corporations are exempt from paying federal income taxes, and donors may be eligible to deduct their contributions from their taxable income.

Benefits of Forming a Non-Profit Corporation

Forming a non-profit corporation provides several benefits, including:

- Tax exemption: Non-profit corporations are exempt from paying federal income taxes.

- Limited liability: Members and directors of a non-profit corporation have limited liability protection.

- Credibility: Forming a non-profit corporation can enhance your organization's credibility and reputation.

- Fundraising: Non-profit corporations can solicit donations and apply for grants.

Forming a 501(c)(3) Non-Profit Corporation

To form a 501(c)(3) non-profit corporation, you must follow these steps:

- Choose a Business Name: Choose a unique and descriptive name for your non-profit corporation.

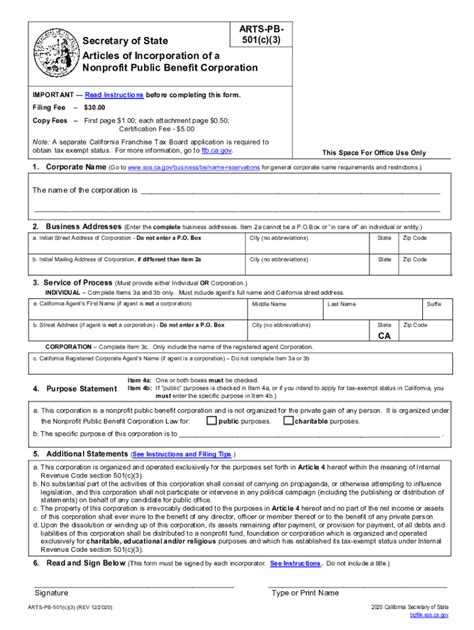

- File Articles of Incorporation: File Articles of Incorporation with the Secretary of State in the state where you plan to operate.

- Obtain an EIN: Obtain an Employer Identification Number (EIN) from the IRS.

- Create a Business Plan: Develop a comprehensive business plan that outlines your mission, goals, and objectives.

- Establish a Board of Directors: Establish a board of directors that will oversee the management and operations of your non-profit corporation.

Applying for Tax Exemption

To apply for tax exemption, you must file Form 1023 with the IRS. Here are the steps to follow:

- Gather Required Documents: Gather all required documents, including your Articles of Incorporation, business plan, and financial statements.

- Complete Form 1023: Complete Form 1023, which includes providing information about your non-profit corporation, including its mission, goals, and objectives.

- Submit Form 1023: Submit Form 1023 to the IRS, along with the required filing fee.

- Wait for IRS Review: Wait for the IRS to review your application, which can take several months.

Required Documents for Form 1023

Here are the required documents that you must submit with Form 1023:

- Articles of Incorporation

- Business plan

- Financial statements

- Proof of payment of the filing fee

Maintaining Tax Exemption

To maintain tax exemption, your non-profit corporation must comply with the following requirements:

- File Annual Information Returns: File annual information returns with the IRS, including Form 990.

- Maintain Records: Maintain accurate and detailed records, including financial statements and meeting minutes.

- Comply with State and Local Laws: Comply with state and local laws, including laws related to charitable solicitations.

Consequences of Losing Tax Exemption

If your non-profit corporation loses tax exemption, it may face significant consequences, including:

- Loss of credibility and reputation

- Loss of fundraising opportunities

- Liability for back taxes and penalties

Conclusion

Forming a 501(c)(3) non-profit corporation and applying for tax exemption can be a complex and time-consuming process. However, with the right guidance and support, you can navigate the process successfully. Remember to maintain accurate and detailed records, comply with state and local laws, and file annual information returns to maintain tax exemption.

We hope this article has provided you with a comprehensive guide to forming a 501(c)(3) non-profit corporation and applying for tax exemption. If you have any further questions or concerns, please do not hesitate to comment below.

What is a 501(c)(3) non-profit corporation?

+A 501(c)(3) non-profit corporation is a type of corporation that is organized and operated exclusively for charitable, scientific, literary, or educational purposes.

How do I form a 501(c)(3) non-profit corporation?

+To form a 501(c)(3) non-profit corporation, you must choose a business name, file Articles of Incorporation, obtain an EIN, create a business plan, and establish a board of directors.

What is the difference between a non-profit corporation and a for-profit corporation?

+A non-profit corporation is organized and operated exclusively for charitable, scientific, literary, or educational purposes, whereas a for-profit corporation is organized and operated to generate profits for its shareholders.