As a business owner in Texas, navigating the complex world of sales tax exemptions can be overwhelming. Form 50-135, also known as the "Exemption Certification for Certain Tangible Personal Property," is a crucial document that can help you save on sales tax. But what exactly is Form 50-135, and how can you use it to your advantage?

In this comprehensive guide, we'll walk you through the ins and outs of Form 50-135, covering what it is, how to fill it out, and the benefits of using it. By the end of this article, you'll be well-equipped to navigate the world of Texas sales tax exemptions and save your business money.

What is Form 50-135?

Form 50-135 is a certification document used by the Texas Comptroller's office to verify that a business is eligible for a sales tax exemption on certain tangible personal property. This form is required for businesses that want to claim an exemption on items such as machinery, equipment, and other tangible personal property used in their operations.

Who is Eligible for Form 50-135?

Not all businesses are eligible to use Form 50-135. To qualify, a business must meet one of the following criteria:

- Be a manufacturer or processor of tangible personal property

- Be a provider of taxable services

- Be a retailer or wholesaler of tangible personal property

- Be a government agency or non-profit organization

If your business meets one of these criteria, you may be eligible to use Form 50-135 to claim a sales tax exemption.

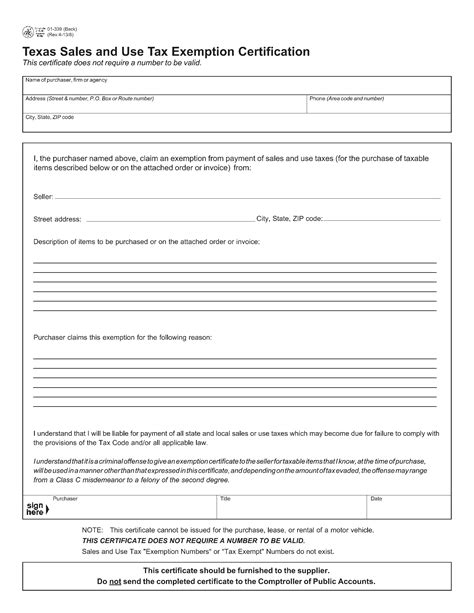

How to Fill Out Form 50-135

Filling out Form 50-135 can seem daunting, but it's actually a straightforward process. Here's a step-by-step guide to help you get started:

- Business Information: Start by filling in your business name, address, and phone number.

- Exemption Type: Check the box that corresponds to the type of exemption you're claiming. You can choose from one of the following:

- Manufacturing

- Processing

- Providing taxable services

- Retailing or wholesaling

- Description of Property: Provide a detailed description of the tangible personal property you're purchasing. This should include the item name, quantity, and purchase price.

- Certification: Sign and date the form, certifying that the information provided is accurate and that you're eligible for the exemption.

Benefits of Using Form 50-135

Using Form 50-135 can save your business money on sales tax. Here are just a few benefits of using this form:

- Reduced Tax Liability: By claiming an exemption on eligible property, you can reduce your business's tax liability.

- Increased Cash Flow: With reduced tax liability, you'll have more cash on hand to invest in your business.

- Competitive Advantage: By taking advantage of sales tax exemptions, you can stay competitive in your industry and attract more customers.

Common Mistakes to Avoid

When filling out Form 50-135, it's essential to avoid common mistakes that can lead to delays or even penalties. Here are a few mistakes to watch out for:

- Inaccurate Business Information: Make sure to fill in your business name, address, and phone number correctly.

- Incomplete Property Description: Provide a detailed description of the property you're purchasing, including the item name, quantity, and purchase price.

- ** Unsigned or Undated Form**: Make sure to sign and date the form to certify that the information provided is accurate.

FAQs

What is the deadline for submitting Form 50-135?

+Form 50-135 must be submitted within 90 days of the purchase date.

Can I use Form 50-135 for all purchases?

+No, Form 50-135 is only for eligible purchases of tangible personal property.

How long is Form 50-135 valid?

+Form 50-135 is valid for a period of 4 years from the date of submission.

By following this comprehensive guide, you'll be well on your way to navigating the world of Texas sales tax exemptions and saving your business money. Remember to fill out Form 50-135 accurately and submit it on time to avoid delays or penalties. If you have any further questions or concerns, don't hesitate to reach out to the Texas Comptroller's office for assistance.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Share this article with your colleagues and friends to help them navigate the complex world of Texas sales tax exemptions.