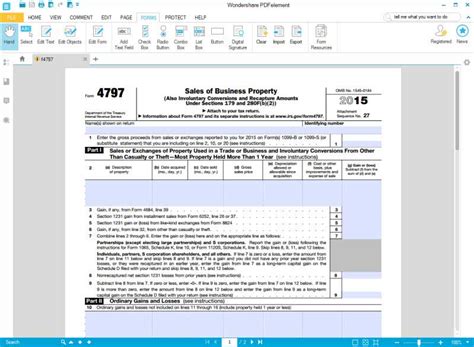

The Form 4797, also known as the Sales of Business Property, is a crucial document for businesses that have sold or disposed of certain types of property. This form is used to report the sale or exchange of business property, such as real estate, machinery, or equipment, and to calculate any gain or loss from the sale. In this article, we will provide a step-by-step guide on how to fill out Form 4797, including the necessary instructions and information to ensure accurate and successful filing.

Understanding the Importance of Form 4797

Before we dive into the instructions, it's essential to understand the significance of Form 4797. The form is used to report the sale or exchange of business property, which can have a substantial impact on a company's tax liability. By accurately completing Form 4797, businesses can ensure they are taking advantage of all eligible deductions and credits, while also avoiding any potential penalties or fines.

Who Needs to File Form 4797?

Not all businesses need to file Form 4797. However, if your business has sold or disposed of any of the following types of property, you will need to complete and file this form:

- Real estate, including buildings and land

- Machinery and equipment

- Vehicles, including cars, trucks, and airplanes

- Patents and copyrights

- Other business property, such as art, collectibles, or investments

Step 1: Gather Necessary Information

Before starting the filing process, you will need to gather certain information and documents. These include:

- A copy of the sale or exchange agreement

- The original purchase price and date of the property

- The depreciation and amortization records for the property

- Any improvements or additions made to the property

- The sales price and date of the property

Step 2: Determine the Type of Property Sold

Form 4797 requires you to identify the type of property sold or exchanged. This includes:

- Section 1231 property, such as real estate and machinery

- Section 1245 property, such as equipment and vehicles

- Section 1250 property, such as patents and copyrights

- Other business property

Filing Form 4797: A Step-By-Step Guide

Now that we have covered the basics, let's move on to the step-by-step guide for filing Form 4797.

Part I: Property Sold or Exchanged

In this section, you will need to provide information about the property sold or exchanged. This includes:

- The type of property (Section 1231, Section 1245, etc.)

- The original purchase price and date

- The depreciation and amortization records

- Any improvements or additions made to the property

- The sales price and date

Part II: Gain or Loss from Sale or Exchange

In this section, you will need to calculate the gain or loss from the sale or exchange of the property. This includes:

- The total sales price

- The total depreciation and amortization

- The gain or loss from the sale or exchange

Part III: Recapture of Depreciation

If you have sold or exchanged Section 1245 property, you will need to complete this section. This includes:

- The total depreciation and amortization

- The recapture of depreciation

Part IV: Summary of Gain or Loss

In this section, you will need to summarize the gain or loss from the sale or exchange of the property. This includes:

- The total gain or loss

- The amount of gain or loss that is taxable

Signing and Filing Form 4797

Once you have completed Form 4797, you will need to sign and date it. You will also need to attach any supporting documentation, such as the sale or exchange agreement and depreciation records. Finally, you will need to file the form with the IRS by the required deadline.

Common Mistakes to Avoid When Filing Form 4797

When filing Form 4797, there are several common mistakes to avoid. These include:

- Failing to report all sales or exchanges of business property

- Incorrectly calculating the gain or loss from the sale or exchange

- Failing to complete all required sections of the form

- Not attaching supporting documentation

Conclusion

Filing Form 4797 can be a complex and time-consuming process. However, by following the step-by-step guide outlined above, you can ensure accurate and successful filing. Remember to gather all necessary information and documentation, determine the type of property sold, and complete all required sections of the form. By avoiding common mistakes and seeking professional help when needed, you can ensure that your business is taking advantage of all eligible deductions and credits.

We hope this article has provided you with a comprehensive guide to Form 4797 instructions. If you have any questions or need further clarification, please don't hesitate to comment below.

What is Form 4797 used for?

+Form 4797 is used to report the sale or exchange of business property, such as real estate, machinery, or equipment, and to calculate any gain or loss from the sale.

Who needs to file Form 4797?

+Businesses that have sold or disposed of certain types of property, such as real estate, machinery, or equipment, need to file Form 4797.

What information do I need to gather before filing Form 4797?

+You will need to gather information such as the original purchase price and date of the property, depreciation and amortization records, and the sales price and date.