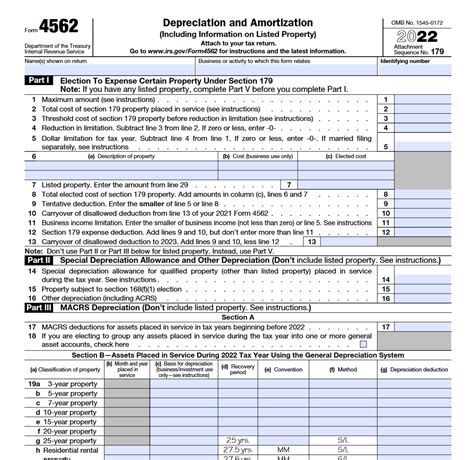

As a business owner, it's essential to understand the tax implications of depreciating and amortizing assets. The Form 4562, also known as the Depreciation and Amortization form, is a crucial document that helps you calculate and report the depreciation and amortization of your business assets. In this article, we'll delve into the world of Form 4562, exploring its importance, benefits, and steps to complete it accurately.

Why is Form 4562 important?

Form 4562 is a vital document that allows businesses to claim depreciation and amortization deductions on their tax returns. Depreciation is the decrease in value of tangible assets, such as buildings, vehicles, and equipment, over time due to wear and tear. Amortization, on the other hand, is the decrease in value of intangible assets, such as patents, copyrights, and trademarks. By claiming these deductions, businesses can reduce their taxable income, resulting in lower tax liabilities.

Benefits of Form 4562

Completing Form 4562 accurately can bring numerous benefits to your business, including:

- Reduced tax liabilities: By claiming depreciation and amortization deductions, you can lower your taxable income and reduce your tax bill.

- Increased cash flow: Lower tax liabilities can result in increased cash flow, which can be used to invest in your business or pay off debts.

- Improved financial planning: Form 4562 helps you keep track of your assets' depreciation and amortization, allowing you to make informed financial decisions.

How to complete Form 4562

Completing Form 4562 requires attention to detail and a thorough understanding of depreciation and amortization rules. Here's a step-by-step guide to help you complete the form accurately:

- Identify your assets: List all your business assets, including tangible and intangible assets, and determine their initial cost.

- Determine the asset's useful life: Determine the useful life of each asset, which is the number of years the asset is expected to remain in service.

- Choose a depreciation method: Choose a depreciation method, such as the Modified Accelerated Cost Recovery System (MACRS) or the straight-line method.

- Calculate depreciation: Calculate the depreciation for each asset using the chosen method.

- Report depreciation: Report the total depreciation for all assets on Line 12 of Form 4562.

- Calculate amortization: Calculate the amortization for intangible assets, such as patents and copyrights.

- Report amortization: Report the total amortization on Line 13 of Form 4562.

Types of depreciation methods

There are several depreciation methods to choose from, including:

- Modified Accelerated Cost Recovery System (MACRS): This method accelerates depreciation in the early years of an asset's life.

- Straight-line method: This method depreciates assets evenly over their useful life.

- Units-of-production method: This method depreciates assets based on the number of units produced.

Common mistakes to avoid

When completing Form 4562, avoid the following common mistakes:

- Incorrect asset classification: Ensure that you classify assets correctly, as this affects the depreciation method and useful life.

- Inaccurate depreciation calculations: Double-check your depreciation calculations to ensure accuracy.

- Failure to report amortization: Don't forget to report amortization for intangible assets.

Best practices for record-keeping

To ensure accurate completion of Form 4562, follow these best practices for record-keeping:

- Maintain accurate asset records: Keep detailed records of all business assets, including purchase dates, costs, and useful lives.

- Track depreciation and amortization: Regularly track depreciation and amortization for each asset.

- Consult with a tax professional: Consult with a tax professional to ensure accurate completion of Form 4562.

Frequently asked questions

Here are some frequently asked questions about Form 4562:

What is Form 4562 used for?

+Form 4562 is used to claim depreciation and amortization deductions on business assets.

What is the difference between depreciation and amortization?

+Depreciation is the decrease in value of tangible assets, while amortization is the decrease in value of intangible assets.

Can I claim depreciation on all business assets?

+No, not all business assets are eligible for depreciation. Consult with a tax professional to determine which assets qualify.

In conclusion

Completing Form 4562 accurately is crucial for businesses to claim depreciation and amortization deductions. By following the steps outlined in this article and avoiding common mistakes, you can ensure accurate completion of the form and reduce your tax liabilities. Remember to maintain accurate records and consult with a tax professional if needed.