In the world of taxation, few forms are as crucial to businesses and individuals alike as Form 4562, the form used for depreciation and amortization. The correct completion of this form can significantly impact one's tax liability, making it a vital aspect of tax planning and compliance. Despite its importance, many find navigating the complexities of depreciation and amortization daunting. This article aims to demystify the process, providing a comprehensive guide on how to master Form 4562.

Understanding Depreciation and Amortization

Before delving into the specifics of Form 4562, it's essential to grasp the concepts of depreciation and amortization. Depreciation refers to the decrease in value of tangible assets over time due to wear and tear, whereas amortization is the allocation of the cost of intangible assets over their useful life. Both concepts allow businesses to claim a portion of these costs as deductions against their taxable income, thereby reducing their tax liability.

Key Differences Between Depreciation and Amortization

- Tangible vs. Intangible Assets: Depreciation applies to tangible assets like machinery, vehicles, and buildings, while amortization applies to intangible assets such as patents, copyrights, and goodwill.

- Useful Life: Tangible assets have a more predictable useful life, making depreciation calculations more straightforward. Intangible assets, however, can have less clear-cut useful lives, complicating amortization calculations.

- Depreciation Methods: Depreciation can be calculated using various methods, including the straight-line method, declining balance method, and the Modified Accelerated Cost Recovery System (MACRS). Amortization, typically, uses the straight-line method.

Mastering Form 4562: 5 Essential Tips

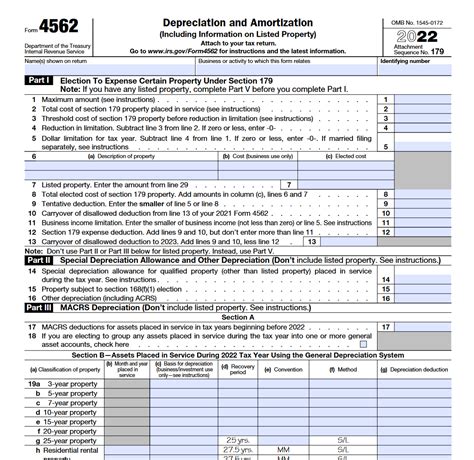

Form 4562 is divided into several sections, each addressing different aspects of depreciation and amortization. To master this form, focus on the following areas:

Tip 1: Accurate Asset Listing

The first step in accurately completing Form 4562 is to maintain a comprehensive list of all assets that are subject to depreciation or amortization. This list should include the asset's description, date placed in service, cost basis, and the depreciation or amortization method used.

- Inventory All Assets: Ensure you have a record of all assets, including those acquired through purchases, trades, or as part of business startups.

- Record Keeping: Maintain detailed records of each asset, including receipts and documentation of the asset's cost and the date it was placed in service.

Tip 2: Choosing the Right Depreciation Method

The choice of depreciation method can significantly impact the amount of depreciation claimed each year. The Modified Accelerated Cost Recovery System (MACRS) is the most commonly used method for depreciation.

- MACRS: This method offers faster depreciation rates than other methods, which can lead to larger depreciation deductions in the early years of an asset's life.

- Bonus Depreciation: In some years, the tax code allows for bonus depreciation, which can significantly increase the amount of depreciation that can be claimed in the first year.

Tip 3: Understanding Section 179 Deductions

Section 179 of the tax code allows businesses to deduct the full cost of certain assets in the year of purchase, up to a specified limit.

- Qualifying Assets: Section 179 deductions can be claimed on tangible personal property, such as machinery and equipment, and certain improvements to non-residential real property.

- Limits: Be aware of the annual limit on Section 179 deductions and the phase-out threshold. These limits can change from year to year.

Tip 4: Properly Reporting Depreciation and Amortization

Accurate reporting of depreciation and amortization on Form 4562 requires careful attention to detail.

- Part I: This section is used to report depreciation and amortization for assets placed in service before the current tax year.

- Part II: New assets placed in service during the current tax year are reported here.

- Part III: Section 179 deductions are claimed in this section.

Tip 5: Compliance and Record Keeping

Finally, ensuring compliance with tax laws and maintaining thorough records is crucial.

- Tax Law Changes: Stay informed about changes in tax laws that could affect depreciation and amortization rules.

- Record Keeping: Maintain detailed records of all depreciation and amortization calculations, as well as the documentation supporting these claims.

Practical Applications and Examples

To illustrate the practical application of the concepts discussed, consider the following example:

- Example: A small business purchases a piece of machinery for $10,000. The machinery has a useful life of 5 years. Using the straight-line method, the annual depreciation would be $2,000.

Understanding how to apply these principles can significantly impact a business's bottom line.

FAQs

What is the difference between depreciation and amortization?

+Depreciation refers to the decrease in value of tangible assets, while amortization is the allocation of the cost of intangible assets over their useful life.

What is Form 4562 used for?

+Form 4562 is used to report depreciation and amortization for business assets.

Can I claim depreciation on all business assets?

+No, not all assets qualify for depreciation. Assets must be used for business purposes and have a determinable useful life.

By understanding and applying the concepts outlined in this guide, individuals and businesses can better navigate the complexities of Form 4562, ensuring accurate and advantageous reporting of depreciation and amortization. Whether you're a seasoned tax professional or just starting to explore the world of taxation, mastering Form 4562 is a valuable skill that can lead to significant tax savings.