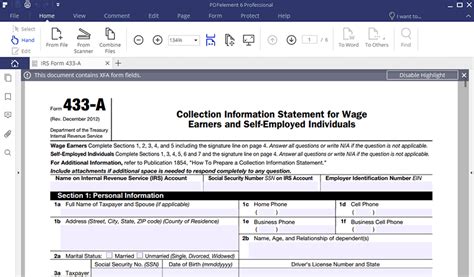

The Form 433-A, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document required by the Internal Revenue Service (IRS) to assess an individual's financial situation and determine their ability to pay outstanding tax debts. Filling out this form accurately is crucial, as it can significantly impact the IRS's decision on whether to accept an installment agreement, offer in compromise, or temporarily suspend collection activities. In this article, we will explore five ways to fill out Form 433-A correctly, ensuring you provide the most accurate and complete information to the IRS.

Understanding the Purpose of Form 433-A

Before we dive into the instructions, it's essential to understand the purpose of Form 433-A. The IRS uses this form to gather information about your income, expenses, assets, and liabilities to determine your ability to pay outstanding tax debts. The form is typically required when an individual owes back taxes and is seeking an installment agreement, offer in compromise, or currently not collectible (CNC) status.

1. Gather Required Documents and Information

To fill out Form 433-A correctly, you'll need to gather various documents and information, including:

- Your most recent tax return (Form 1040)

- Pay stubs or proof of income

- Bank statements

- Investment accounts (e.g., stocks, bonds, retirement accounts)

- Asset valuations (e.g., real estate, vehicles, jewelry)

- Liability information (e.g., credit cards, loans, mortgages)

- Monthly expense records (e.g., utility bills, rent/mortgage payments, food expenses)

Having this information readily available will help you accurately complete the form and avoid delays in processing.

2. Complete Part 1: Wage Earner Information

Part 1 of Form 433-A is designed for wage earners, and it requires information about your employment, income, and deductions. Ensure you:

- List your employer's name, address, and contact information

- Provide your job title, hire date, and hours worked per week

- Report your gross income, including any tips or commissions

- List all deductions, including federal income tax, state income tax, and other withholdings

Be accurate when reporting your income, as this will directly impact the IRS's assessment of your ability to pay.

3. Complete Part 2: Self-Employment Information

If you're self-employed, you'll need to complete Part 2 of Form 433-A. This section requires information about your business, including:

- Business name, address, and type (e.g., sole proprietorship, partnership, corporation)

- Business income, including gross receipts and cost of goods sold

- Business expenses, including rent, utilities, and supplies

- Net profit or loss from self-employment

Ensure you accurately report your business income and expenses, as this will impact the IRS's assessment of your ability to pay.

4. Report Assets and Liabilities

Parts 3 and 4 of Form 433-A require you to list your assets and liabilities. Be sure to:

- Report all assets, including cash, bank accounts, investments, and real estate

- List all liabilities, including credit cards, loans, mortgages, and other debts

- Provide accurate valuations for all assets and liabilities

This information will help the IRS determine your net worth and assess your ability to pay outstanding tax debts.

5. Calculate Your Monthly Expenses

Part 5 of Form 433-A requires you to list your monthly expenses, including:

- Housing expenses (e.g., rent/mortgage, utilities, insurance)

- Food expenses

- Transportation expenses (e.g., car loan/lease, gas, insurance)

- Minimum debt payments (e.g., credit cards, loans)

- Other expenses (e.g., entertainment, miscellaneous)

Be accurate when reporting your monthly expenses, as this will directly impact the IRS's assessment of your ability to pay.

Additional Tips and Considerations

When filling out Form 433-A, keep the following tips and considerations in mind:

- Be honest and accurate when reporting your income, expenses, assets, and liabilities.

- Ensure you provide complete and detailed information to avoid delays in processing.

- Use the IRS's guidelines and instructions to ensure you're filling out the form correctly.

- Consider seeking the help of a tax professional or financial advisor if you're unsure about any aspect of the form.

By following these five ways to fill out Form 433-A correctly, you'll be able to provide the IRS with an accurate and complete picture of your financial situation, which will help determine your ability to pay outstanding tax debts.

What is Form 433-A used for?

+Form 433-A is used by the IRS to gather information about an individual's income, expenses, assets, and liabilities to determine their ability to pay outstanding tax debts.

Who needs to fill out Form 433-A?

+Individuals who owe back taxes and are seeking an installment agreement, offer in compromise, or currently not collectible (CNC) status typically need to fill out Form 433-A.

What documents do I need to fill out Form 433-A?

+You'll need to gather various documents, including your most recent tax return, pay stubs, bank statements, investment accounts, asset valuations, and liability information.

We hope this article has provided you with a comprehensive guide on how to fill out Form 433-A correctly. Remember to be honest and accurate when reporting your income, expenses, assets, and liabilities, and consider seeking the help of a tax professional or financial advisor if you're unsure about any aspect of the form.