As a resident of Oregon, understanding the intricacies of state income tax can be a daunting task. One of the most crucial forms you'll need to familiarize yourself with is the Oregon Form 40. This form is used to report your income and calculate your tax liability for the year. In this article, we'll break down the Oregon Form 40 instructions, highlighting the 7 key things you need to know to ensure a smooth filing process.

Understanding the Purpose of Oregon Form 40

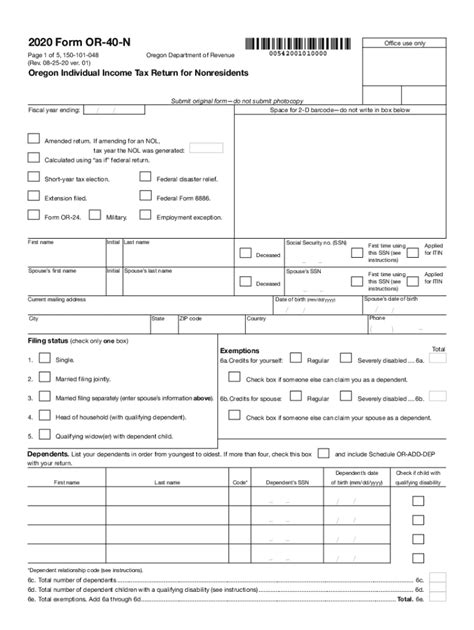

The Oregon Form 40 is the state's equivalent of the federal Form 1040. It's used to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections, each designed to guide you through the process of reporting your income and calculating your tax.

Who Needs to File Oregon Form 40?

Not everyone is required to file Oregon Form 40. You'll need to file this form if you're a resident of Oregon and you meet certain income requirements. For the 2022 tax year, you'll need to file Oregon Form 40 if your gross income exceeds the following thresholds:

- Single filers: $1,225 or more

- Joint filers: $2,450 or more

- Head of household: $1,825 or more

Gathering Necessary Documents

Before you start filling out Oregon Form 40, you'll need to gather several documents. These include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

Understanding Oregon Tax Rates

Oregon has a progressive tax system, which means that your tax rate increases as your income increases. The state has nine tax brackets, ranging from 5% to 9.9%. To calculate your tax liability, you'll need to determine which tax bracket you fall into based on your income.

Filing Status and Dependents

Your filing status and number of dependents can affect your tax liability. Oregon recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

You'll also need to report the number of dependents you're claiming. This can include children, elderly parents, or disabled individuals who rely on you for support.

Claiming Deductions and Credits

Oregon allows you to claim several deductions and credits to reduce your tax liability. These include:

- Standard deduction: $2,630 for single filers, $5,260 for joint filers

- Itemized deductions: medical expenses, mortgage interest, charitable donations

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

Reporting Income and Calculating Tax

Once you've gathered your documents and determined your filing status, you can start reporting your income and calculating your tax liability. You'll need to report your income from all sources, including:

- Wages and salaries

- Freelance work and self-employment income

- Interest and dividends

- Capital gains and losses

You'll then use the Oregon tax tables or tax calculator to determine your tax liability.

Electronic Filing and Payment Options

Oregon offers several options for filing and paying your state income tax. You can:

- E-file your return through the Oregon Department of Revenue website

- Mail your return to the Oregon Department of Revenue

- Pay your tax liability online, by phone, or by mail

Avoiding Common Errors

To avoid delays or penalties, make sure to avoid common errors when filing Oregon Form 40. These include:

- Failing to sign and date the form

- Incorrectly reporting income or deductions

- Failing to pay the required tax liability

- Missing deadlines for filing and payment

Seeking Help and Resources

If you're unsure about any aspect of the Oregon Form 40 instructions, there are several resources available to help. You can:

- Contact the Oregon Department of Revenue for assistance

- Consult a tax professional or accountant

- Use tax preparation software to guide you through the process

What is the deadline for filing Oregon Form 40?

+The deadline for filing Oregon Form 40 is April 15th of each year.

Can I file Oregon Form 40 electronically?

+What is the Oregon standard deduction?

+The Oregon standard deduction is $2,630 for single filers and $5,260 for joint filers.

We hope this article has provided you with a comprehensive understanding of the Oregon Form 40 instructions. By following these guidelines and seeking help when needed, you'll be well on your way to accurately filing your state income tax return. If you have any further questions or concerns, please don't hesitate to reach out.