The world of insider trading and financial regulations can be complex and daunting, even for seasoned investors and corporate professionals. Among the various forms and filings required by regulatory bodies, Form 4 is one of the most scrutinized, particularly when it comes to transaction code F. In this article, we will delve into the world of Form 4 transaction code F, exploring its intricacies, implications, and insider insights.

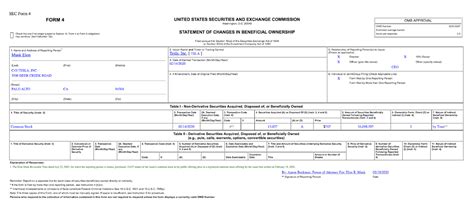

For those unfamiliar with the terminology, Form 4 is a filing required by the Securities and Exchange Commission (SEC) whenever an insider, such as an executive, director, or significant shareholder, engages in a transaction involving the company's securities. These transactions can include purchases, sales, awards, and other changes in ownership or interest. The form is designed to provide transparency and help prevent insider trading by making such transactions publicly available.

Transaction code F, in particular, refers to the exercise of derivative securities, such as stock options or warrants. This type of transaction involves the conversion of a derivative security into the underlying security, typically common stock. To decode the intricacies of Form 4 transaction code F, it's essential to understand the various components involved and the implications of such transactions.

Understanding Form 4 Transaction Code F

When an insider exercises derivative securities, they are converting the right to purchase or acquire the underlying security into actual ownership. This can be done through various means, such as stock options, warrants, or other types of derivative instruments. Transaction code F is used to report these exercises on Form 4.

The key components of Form 4 transaction code F include:

- Date of Exercise: The date on which the insider exercised the derivative security.

- Number of Securities: The number of underlying securities acquired through the exercise.

- Price per Security: The price at which the insider acquired the securities.

- Transaction Value: The total value of the transaction, calculated by multiplying the number of securities by the price per security.

Example of Form 4 Transaction Code F

To illustrate the concept, let's consider an example:Suppose an executive, John Doe, exercises 1,000 stock options to acquire common stock in his company, XYZ Inc. The exercise price is $50 per share, and the transaction occurs on January 10, 2023. The Form 4 filing would report the transaction as follows:

- Date of Exercise: January 10, 2023

- Number of Securities: 1,000

- Price per Security: $50

- Transaction Value: $50,000

In this example, John Doe has exercised his stock options to acquire 1,000 shares of XYZ Inc. common stock at a price of $50 per share, resulting in a total transaction value of $50,000.

Implications of Form 4 Transaction Code F

The exercise of derivative securities, as reported on Form 4 transaction code F, can have significant implications for both the insider and the company. Some of the key implications include:

- Increased Insider Ownership: The exercise of derivative securities can result in an increase in the insider's ownership stake in the company, potentially influencing their decision-making and interests.

- Changes in Share Price: The exercise of derivative securities can impact the company's share price, particularly if the transaction is large or involves a significant number of shares.

- Insider Trading Concerns: The exercise of derivative securities can raise concerns about insider trading, particularly if the transaction occurs during a blackout period or in conjunction with other significant events.

Insider Insights: Decoding Form 4 Transaction Code F

To gain a deeper understanding of Form 4 transaction code F, it's essential to consider the following insider insights:- Watch for Patterns: Analyze the insider's transaction history to identify patterns or trends in their behavior, potentially indicating a change in sentiment or strategy.

- Consider the Timing: Examine the timing of the transaction in relation to other significant events, such as earnings announcements or mergers and acquisitions.

- Evaluate the Impact: Assess the potential impact of the transaction on the company's share price and the insider's ownership stake.

By decoding Form 4 transaction code F and gaining a deeper understanding of the implications and insider insights, investors and corporate professionals can make more informed decisions and navigate the complex world of insider trading and financial regulations.

Best Practices for Filing Form 4 Transaction Code F

To ensure accurate and timely filing of Form 4 transaction code F, insiders and companies should follow best practices, including:

- Maintaining Accurate Records: Ensure that all transaction records are accurate, complete, and up-to-date.

- Filing in a Timely Manner: File Form 4 in a timely manner, typically within two business days of the transaction.

- Disclosing Material Information: Disclose all material information regarding the transaction, including the date, number of securities, and price per security.

By following these best practices, insiders and companies can minimize the risk of errors, ensure compliance with regulatory requirements, and maintain transparency in their transactions.

Conclusion

In conclusion, Form 4 transaction code F is a critical component of the SEC's insider trading regulations, providing transparency into the transactions of insiders and significant shareholders. By understanding the intricacies of transaction code F, insiders and companies can navigate the complex world of financial regulations and make informed decisions. Whether you're an investor, corporate professional, or simply interested in the world of insider trading, decoding Form 4 transaction code F is essential for gaining a deeper understanding of the financial markets.What is Form 4 transaction code F?

+Form 4 transaction code F refers to the exercise of derivative securities, such as stock options or warrants, as reported on Form 4.

What are the implications of Form 4 transaction code F?

+The exercise of derivative securities can result in an increase in insider ownership, changes in share price, and concerns about insider trading.

What are the best practices for filing Form 4 transaction code F?

+Best practices include maintaining accurate records, filing in a timely manner, and disclosing material information regarding the transaction.