As an individual or organization, filing tax forms can be a daunting task, especially when dealing with complex forms like the Form 3921. The Form 3921 is used to report employee stock purchase plan (ESPP) transactions, and it's essential to file it accurately and on time to avoid any penalties or fines. One of the most popular tax preparation software is TurboTax, and in this article, we will explore five ways to file Form 3921 with TurboTax easily.

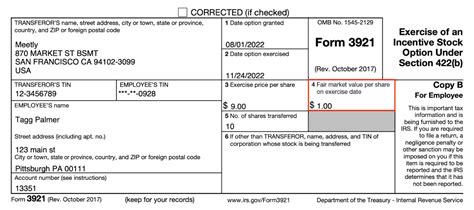

The importance of filing Form 3921 cannot be overstated. The form provides the Internal Revenue Service (IRS) with essential information about ESPP transactions, including the number of shares purchased, the purchase price, and the fair market value of the shares. By filing Form 3921 accurately, you can ensure compliance with tax laws and regulations, avoid penalties, and take advantage of tax benefits.

In the following sections, we will provide a comprehensive guide on how to file Form 3921 with TurboTax easily.

Understanding Form 3921 Requirements

Before we dive into the process of filing Form 3921 with TurboTax, it's essential to understand the requirements and eligibility criteria for filing the form.

Form 3921 is used to report ESPP transactions, which include the purchase of company stock by employees through a qualified plan. The form requires information about the employer, the employee, the type of transaction, and the fair market value of the shares.

To file Form 3921, you must meet specific eligibility criteria, including:

- The employer must have an ESPP in place

- The employee must have purchased company stock through the ESPP

- The employee must have received a qualifying disposition of the shares (e.g., sale, transfer, or exchange)

By understanding the requirements and eligibility criteria, you can ensure that you file Form 3921 accurately and on time.

How to File Form 3921 with TurboTax

Now that we have covered the requirements and eligibility criteria, let's move on to the process of filing Form 3921 with TurboTax.

Here are five ways to file Form 3921 with TurboTax easily:

Method 1: Using the TurboTax Deluxe Edition

The TurboTax Deluxe Edition is a popular choice for individuals and organizations that need to file complex tax forms like Form 3921. To file Form 3921 using the TurboTax Deluxe Edition, follow these steps:

- Create a TurboTax account or log in to your existing account

- Select the "Other Income" option and choose "ESPP" from the dropdown menu

- Enter the required information, including the employer's name, the employee's name, and the fair market value of the shares

- TurboTax will guide you through the process and ensure that you file the form accurately

Method 2: Using the TurboTax Premier Edition

The TurboTax Premier Edition is another option for filing Form 3921. This edition provides additional features and support for complex tax situations. To file Form 3921 using the TurboTax Premier Edition, follow these steps:

- Create a TurboTax account or log in to your existing account

- Select the "Investments" option and choose "ESPP" from the dropdown menu

- Enter the required information, including the employer's name, the employee's name, and the fair market value of the shares

- TurboTax will guide you through the process and ensure that you file the form accurately

Method 3: Using the TurboTax Self-Employed Edition

The TurboTax Self-Employed Edition is designed for individuals who are self-employed or have complex tax situations. To file Form 3921 using the TurboTax Self-Employed Edition, follow these steps:

- Create a TurboTax account or log in to your existing account

- Select the "Business Income" option and choose "ESPP" from the dropdown menu

- Enter the required information, including the employer's name, the employee's name, and the fair market value of the shares

- TurboTax will guide you through the process and ensure that you file the form accurately

Method 4: Using the TurboTax Business Edition

The TurboTax Business Edition is designed for businesses that need to file complex tax forms like Form 3921. To file Form 3921 using the TurboTax Business Edition, follow these steps:

- Create a TurboTax account or log in to your existing account

- Select the "Business Income" option and choose "ESPP" from the dropdown menu

- Enter the required information, including the employer's name, the employee's name, and the fair market value of the shares

- TurboTax will guide you through the process and ensure that you file the form accurately

Method 5: Using the TurboTax Live Service

The TurboTax Live Service is a premium service that provides live support from certified tax professionals. To file Form 3921 using the TurboTax Live Service, follow these steps:

- Create a TurboTax account or log in to your existing account

- Select the "Live Service" option and choose "ESPP" from the dropdown menu

- Enter the required information, including the employer's name, the employee's name, and the fair market value of the shares

- A certified tax professional will guide you through the process and ensure that you file the form accurately

In conclusion, filing Form 3921 with TurboTax is a straightforward process that can be completed using one of the five methods outlined above. By understanding the requirements and eligibility criteria, you can ensure that you file the form accurately and on time.

We hope this article has provided you with valuable insights and guidance on how to file Form 3921 with TurboTax easily. If you have any questions or comments, please feel free to share them below.

What is Form 3921 used for?

+Form 3921 is used to report employee stock purchase plan (ESPP) transactions, including the purchase of company stock by employees through a qualified plan.

Who is required to file Form 3921?

+Employers with an ESPP in place are required to file Form 3921 for each employee who purchases company stock through the plan.

What information is required on Form 3921?

+The form requires information about the employer, the employee, the type of transaction, and the fair market value of the shares.