Understanding Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit

As the world shifts towards more sustainable and environmentally friendly transportation options, the demand for plug-in electric vehicles (PEVs) has increased significantly. To encourage this trend, the US government offers a tax credit for qualified plug-in electric drive motor vehicles through Form 8936. In this article, we will delve into the complete instructions for Form 8936, helping you understand the eligibility criteria, calculation of the credit, and the steps to claim this benefit.

What is Form 8936?

Form 8936 is a tax form used to calculate the Qualified Plug-in Electric Drive Motor Vehicle Credit. This credit is available to individuals and businesses that purchase a qualified plug-in electric vehicle. The credit is designed to incentivize the adoption of PEVs, reducing greenhouse gas emissions and dependence on fossil fuels.

Eligibility Criteria for Form 8936

To qualify for the credit, the vehicle must meet the following criteria:

- Be a four-wheeled vehicle with a gross vehicle weight rating of less than 14,000 pounds

- Be propelled by a rechargeable battery with a capacity of at least 4 kilowatt-hours

- Have a plug-in rechargeable battery

- Be made by a qualified manufacturer

- Be acquired for personal or business use

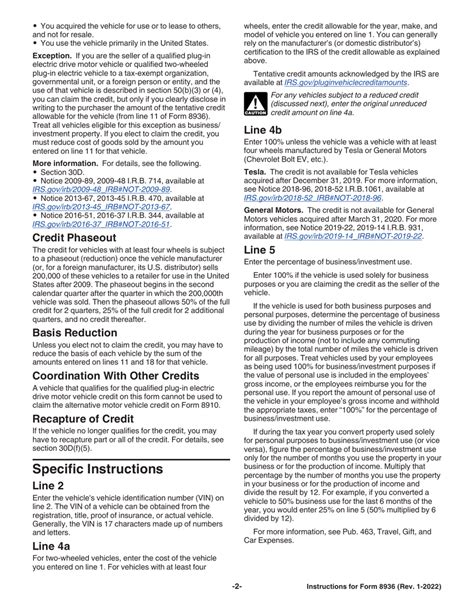

Additionally, the credit is phased out for manufacturers that have sold more than 200,000 qualified vehicles. This phase-out begins in the second quarter of the calendar year following the quarter in which the 200,000th vehicle was sold.

Calculating the Credit

The credit is calculated based on the vehicle's battery capacity and gross vehicle weight rating. The base credit is $2,500, with an additional $417 for each kilowatt-hour of battery capacity in excess of 4 kilowatt-hours. The total credit is capped at $7,500.

Steps to Claim the Credit

To claim the credit, follow these steps:

- Complete Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit, and attach it to your tax return (Form 1040).

- Enter the Vehicle Identification Number (VIN) and the manufacturer's name on the form.

- Calculate the credit using the formula provided on the form.

- Report the credit on Line 53 of Form 1040.

- Keep a copy of the form and supporting documentation, such as the vehicle's purchase agreement and VIN, in case of an audit.

Additional Requirements

- The vehicle must be purchased, not leased, to qualify for the credit.

- The credit is non-refundable, meaning it can only reduce the taxpayer's liability to zero.

- The credit is subject to phase-out, as mentioned earlier.

Manufacturer Certification and Vehicle Eligibility

The IRS requires manufacturers to certify that their vehicles meet the eligibility criteria. The certification is typically provided on the manufacturer's website or in the vehicle's documentation. Some popular manufacturers that offer qualified vehicles include:

- Tesla

- General Motors (Chevrolet Bolt EV)

- Nissan (Leaf)

- BMW (i3)

- Volkswagen (e-Golf)

Reporting Requirements for Manufacturers

Manufacturers must report the VIN, make, and model of each qualified vehicle sold, as well as the total number of vehicles sold, to the IRS. This information is used to track the phase-out of the credit.

Phase-out of the Credit

The credit begins to phase out for manufacturers that have sold more than 200,000 qualified vehicles. The phase-out is as follows:

- 50% of the credit in the second quarter of the calendar year following the quarter in which the 200,000th vehicle was sold

- 25% of the credit in the third quarter of the calendar year following the quarter in which the 200,000th vehicle was sold

- 0% of the credit in the fourth quarter of the calendar year following the quarter in which the 200,000th vehicle was sold

Conclusion

Form 8936 provides a valuable incentive for individuals and businesses to adopt environmentally friendly transportation options. By understanding the eligibility criteria, calculation of the credit, and steps to claim the credit, you can take advantage of this benefit and contribute to a more sustainable future.

Engage with Us

Have you claimed the Qualified Plug-in Electric Drive Motor Vehicle Credit? Share your experience and ask questions in the comments below. Share this article with friends and family who may be interested in purchasing a plug-in electric vehicle.

What is the maximum credit available for qualified plug-in electric vehicles?

+The maximum credit available is $7,500.

Which manufacturers offer qualified plug-in electric vehicles?

+Some popular manufacturers that offer qualified vehicles include Tesla, General Motors (Chevrolet Bolt EV), Nissan (Leaf), BMW (i3), and Volkswagen (e-Golf).

How is the credit phased out for manufacturers that have sold more than 200,000 qualified vehicles?

+The credit is phased out as follows: 50% of the credit in the second quarter of the calendar year following the quarter in which the 200,000th vehicle was sold, 25% of the credit in the third quarter of the calendar year following the quarter in which the 200,000th vehicle was sold, and 0% of the credit in the fourth quarter of the calendar year following the quarter in which the 200,000th vehicle was sold.