California, known for its scenic landscapes, diverse culture, and innovative economy, is also home to a complex web of tax regulations. For businesses operating within the state, understanding and navigating these regulations is crucial for compliance and avoiding unnecessary penalties. One key document in this landscape is the California Form 3893, also known as the "Pass-Through Entity Annual Tax Return." This form is pivotal for pass-through entities, such as partnerships and limited liability companies (LLCs), as it reports their annual income, deductions, and credits to the state of California. In this comprehensive guide, we will delve into the specifics of California Form 3893, its importance, and provide a step-by-step filing guide to ensure businesses can accurately and efficiently complete this critical annual requirement.

Understanding California Form 3893

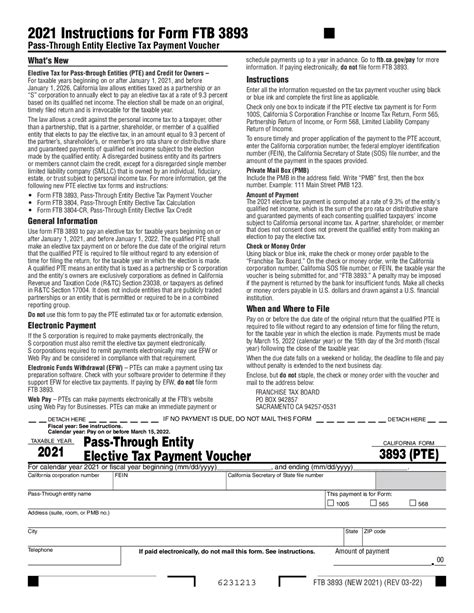

California Form 3893 serves as the annual tax return for pass-through entities, including partnerships, S corporations, and limited liability companies (LLCs) classified as partnerships for federal tax purposes. The form is designed to report the entity's income, deductions, and credits to the state of California. Unlike the federal return, which primarily focuses on the entity's operations and financial transactions, Form 3893 places a strong emphasis on the entity's California-specific activities and financial dealings.

Who Needs to File Form 3893?

Entities required to file Form 3893 include:

- Partnerships (including limited liability partnerships and limited partnerships)

- S corporations

- Limited liability companies (LLCs) that are classified as partnerships for federal tax purposes

- Estates and trusts

Entities that are not subject to California taxation, or those that have no California-source income, may still be required to file Form 3893 under certain circumstances. It's essential for each entity to assess its specific situation and consult the California Franchise Tax Board's (FTB) guidelines to ensure compliance.

Step-By-Step Filing Guide for California Form 3893

Step 1: Gather Required Documents and Information

Before starting the filing process, it's crucial to gather all necessary documents and information. This includes:

- Federal income tax return (Form 1065 for partnerships, Form 1120S for S corporations)

- Financial statements (balance sheet and income statement)

- California tax returns from previous years (if applicable)

- Any additional schedules or attachments as required by the FTB

Step 2: Determine the Filing Status

The entity's filing status will dictate which version of Form 3893 to use and how to report income and deductions. The primary filing statuses for pass-through entities in California include:

- Single-member LLCs (classified as disregarded entities)

- Multi-member LLCs (classified as partnerships)

- S corporations

- Estates and trusts

Step 3: Calculate Income and Deductions

Using the gathered financial information, calculate the entity's total income and deductions. This step is critical, as it directly impacts the entity's tax liability. California has specific rules and regulations regarding income sourcing and deductions, so it's essential to consult the FTB's guidelines to ensure accuracy.

Step 4: Complete Form 3893

With the income and deductions calculated, proceed to complete Form 3893. The form consists of multiple sections, each focusing on different aspects of the entity's financial situation:

- Income: Report all California-source income, including business income, rental income, and capital gains.

- Deductions: Claim all eligible deductions, including business expenses, charitable contributions, and depreciation.

- Credits: Claim any applicable tax credits, such as the research and development credit or the low-income housing credit.

Step 5: Attach Required Schedules and Statements

Depending on the entity's specific situation, additional schedules and statements may be required to support the information reported on Form 3893. Common attachments include:

- Schedule K (Capital Gains and Losses)

- Schedule D (Depreciation and Amortization)

- Statement of Financial Condition

Step 6: Submit the Return

Once Form 3893 is complete, along with any required attachments, submit the return to the California Franchise Tax Board. The FTB accepts electronic and paper filings, but electronic filing is recommended for faster processing and reduced errors.

Additional Considerations and Tips

- Filing Deadline: The filing deadline for Form 3893 is typically March 15th for calendar-year entities and the 15th day of the third month following the close of the fiscal year for fiscal-year entities.

- Estimated Tax Payments: Pass-through entities are required to make estimated tax payments if their tax liability exceeds $500. Failure to make these payments can result in penalties and interest.

- Record Keeping: Maintain accurate and detailed records to support the information reported on Form 3893. These records should be kept for a minimum of four years from the filing date.

By following this step-by-step guide and staying informed about California's tax regulations, pass-through entities can ensure accurate and timely filing of Form 3893. Remember, compliance is key to avoiding unnecessary penalties and ensuring the financial health of your business.

Stay Engaged and Take Action

If you found this guide helpful in understanding and navigating the complexities of California Form 3893, consider sharing your experiences or insights in the comments section below. For those seeking additional guidance or looking to stay updated on the latest tax regulations, consider:

- Following reputable tax and financial news sources

- Consulting with a tax professional or financial advisor

- Participating in webinars or workshops focused on tax compliance and planning

By staying informed and engaged, businesses can better navigate the ever-changing landscape of tax regulations and ensure compliance with California Form 3893.

What is the purpose of California Form 3893?

+California Form 3893 serves as the annual tax return for pass-through entities, reporting their income, deductions, and credits to the state of California.

Who needs to file Form 3893?

+Entities required to file Form 3893 include partnerships, S corporations, and limited liability companies (LLCs) classified as partnerships for federal tax purposes, as well as estates and trusts.

What is the filing deadline for Form 3893?

+The filing deadline for Form 3893 is typically March 15th for calendar-year entities and the 15th day of the third month following the close of the fiscal year for fiscal-year entities.