As a landlord in California, providing your tenants with a certificate of rent paid is a crucial step in ensuring they can claim their rent payments on their tax returns. Form 3804-Cr, also known as the California Certificate of Rent Paid, is a document that serves as proof of rent payments made by tenants to their landlords. In this article, we will delve into the importance of Form 3804-Cr, its benefits, and provide a step-by-step guide on how to complete it.

What is Form 3804-Cr?

Form 3804-Cr is a California state tax form that landlords are required to provide to their tenants by January 31st of each year. The form serves as proof of rent payments made by the tenant to the landlord in the previous tax year. The certificate includes essential information such as the landlord's name and address, the tenant's name and address, the rental property address, and the total amount of rent paid during the tax year.

Why is Form 3804-Cr Important?

Form 3804-Cr is important for several reasons:

- It serves as proof of rent payments, which tenants can use to claim a deduction on their California state tax returns.

- It helps tenants who are eligible for the Renter's Credit to claim their credit.

- It provides a record of rent payments, which can be useful in case of disputes or audits.

Benefits of Form 3804-Cr

The benefits of Form 3804-Cr are numerous:

- Tax Benefits: By providing Form 3804-Cr, landlords enable their tenants to claim a deduction on their California state tax returns, which can result in significant tax savings.

- Renter's Credit: Eligible tenants can claim the Renter's Credit, which can provide additional tax savings.

- Accurate Record-Keeping: Form 3804-Cr provides a record of rent payments, which can help prevent disputes and ensure accurate record-keeping.

How to Complete Form 3804-Cr

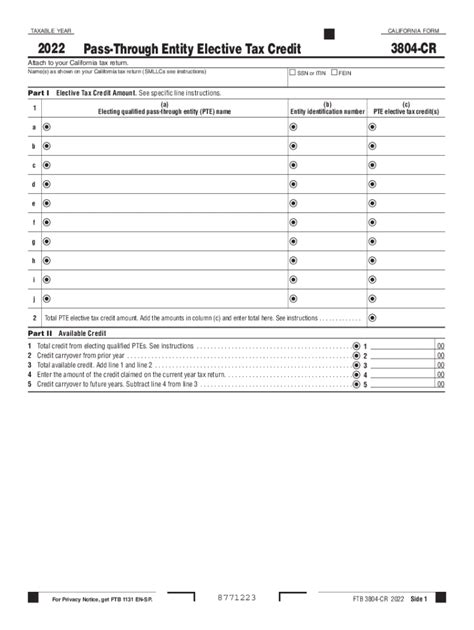

Completing Form 3804-Cr is a straightforward process. Here's a step-by-step guide:

- Landlord's Information: Enter the landlord's name, address, and tax identification number (if applicable).

- Tenant's Information: Enter the tenant's name and address.

- Rental Property Information: Enter the rental property address and the total amount of rent paid during the tax year.

- Certification: Sign and date the form, certifying that the information provided is accurate.

Important Deadlines

- January 31st: Form 3804-Cr must be provided to tenants by January 31st of each year.

- April 15th: Tenants must file their California state tax returns by April 15th to claim the Renter's Credit.

Conclusion and Next Steps

In conclusion, Form 3804-Cr is an essential document that provides proof of rent payments and enables tenants to claim tax benefits. By completing the form accurately and providing it to tenants on time, landlords can ensure their tenants receive the tax benefits they are eligible for.

If you have any questions or need further assistance, please don't hesitate to ask. We encourage you to share this article with fellow landlords and tenants to raise awareness about the importance of Form 3804-Cr.

Additional Resources:

- California Franchise Tax Board:

- California Department of Housing and Community Development:

What is the purpose of Form 3804-Cr?

+Form 3804-Cr serves as proof of rent payments made by tenants to their landlords, which can be used to claim a deduction on their California state tax returns.

Who is eligible for the Renter's Credit?

+Eligible tenants who pay rent on a primary residence in California and meet certain income and rent payment requirements may be eligible for the Renter's Credit.

What is the deadline for providing Form 3804-Cr to tenants?

+Form 3804-Cr must be provided to tenants by January 31st of each year.