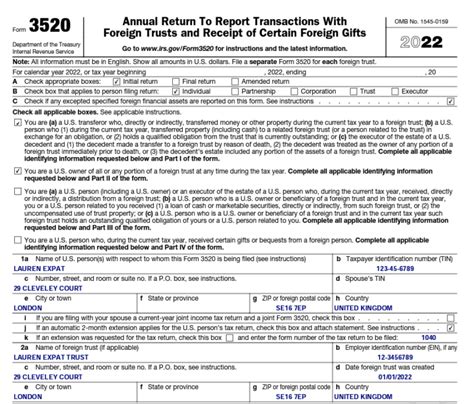

The world of tax filing can be complex and overwhelming, especially for individuals who receive foreign gifts or inheritances. One of the forms that often causes confusion is the Form 3520, Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. In this article, we will explore the ins and outs of Form 3520, its requirements, and how TurboTax can make the filing process easier.

What is Form 3520?

Form 3520 is a report filed with the Internal Revenue Service (IRS) to disclose transactions with foreign trusts and the receipt of certain foreign gifts. The form is used to report various transactions, including the creation, transfer, or distribution of foreign trusts, as well as the receipt of gifts or inheritances from foreign sources. The form is typically filed by individuals, trusts, and estates that have engaged in these types of transactions.

Who Needs to File Form 3520?

Not everyone needs to file Form 3520. However, if you have engaged in any of the following activities, you may be required to file:

- Created or transferred property to a foreign trust

- Received a distribution or transfer from a foreign trust

- Received a foreign gift or inheritance exceeding $100,000 from a single source

- Made a transfer to a foreign trust in exchange for an obligation (such as a note or bond)

What Information is Required on Form 3520?

When filing Form 3520, you will need to provide various pieces of information, including:

- Your name, address, and taxpayer identification number

- The name, address, and taxpayer identification number of the foreign trust or gift giver

- A description of the transaction, including the date and amount

- The type of transaction (e.g., creation, transfer, distribution, or gift)

Penalties for Failure to File

Failure to file Form 3520 or providing incomplete or inaccurate information can result in significant penalties. The IRS may impose a penalty of up to 35% of the gross value of the property transferred or received, as well as interest on the penalty.

How TurboTax Can Help

Filing Form 3520 can be a daunting task, especially for those who are not familiar with the process. TurboTax can help make the process easier by guiding you through the form and ensuring that you meet all the necessary requirements.

Benefits of Using TurboTax

Using TurboTax to file Form 3520 offers several benefits, including:

- Easy-to-use interface: TurboTax provides a user-friendly interface that guides you through the form, ensuring that you provide all the necessary information.

- Accuracy guarantee: TurboTax ensures that your form is accurate and complete, reducing the risk of errors and penalties.

- Maximum refund guarantee: TurboTax also guarantees that you will receive the maximum refund you are eligible for.

Step-by-Step Guide to Filing Form 3520 with TurboTax

Filing Form 3520 with TurboTax is a straightforward process that can be completed in a few steps:

- Gather all necessary documents, including records of the transaction, trust documents, and gift receipts.

- Log in to your TurboTax account or create a new one.

- Select the "Other" option on the main menu and choose "Form 3520" from the drop-down list.

- Answer the questions and provide the necessary information, following the prompts and guidance provided by TurboTax.

- Review and edit your form to ensure accuracy and completeness.

- Submit your form to the IRS electronically or by mail.

Tips for Filing Form 3520

To ensure a smooth filing process, keep the following tips in mind:

- Keep accurate records of all transactions, including receipts, invoices, and trust documents.

- Ensure that you file Form 3520 by the deadline, which is typically the same as the deadline for filing your individual tax return.

- Double-check your form for accuracy and completeness before submitting it to the IRS.

Conclusion

Filing Form 3520 can be a complex and daunting task, but with TurboTax, the process is made easier. By following the steps and tips outlined in this article, you can ensure that your form is accurate, complete, and filed on time. Don't let the complexity of Form 3520 filing overwhelm you – let TurboTax guide you through the process and help you avoid penalties and errors.

Additional Resources

For more information on Form 3520 and its requirements, visit the IRS website or consult with a tax professional. You can also find additional resources and guidance on the TurboTax website.

Frequently Asked Questions

What is the deadline for filing Form 3520?

+The deadline for filing Form 3520 is typically the same as the deadline for filing your individual tax return.

Can I file Form 3520 electronically?

+Yes, you can file Form 3520 electronically through the IRS website or using tax software such as TurboTax.

What is the penalty for failure to file Form 3520?

+The penalty for failure to file Form 3520 can be up to 35% of the gross value of the property transferred or received, as well as interest on the penalty.