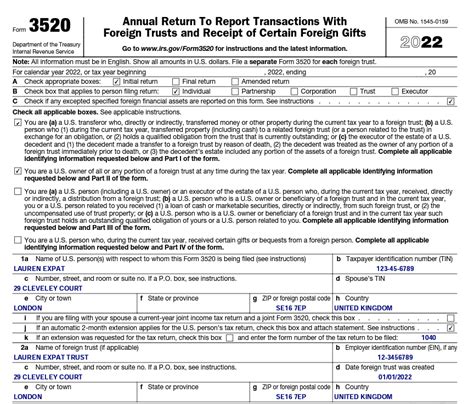

The world of international taxation can be complex and daunting, especially for individuals and businesses with foreign assets or interests. One of the key forms used by the Internal Revenue Service (IRS) to track and report certain foreign transactions is Form 3520. In this article, we will focus on Part IV of Form 3520, which deals with the reporting of certain transactions with foreign trusts.

The importance of accurately completing Form 3520 cannot be overstated, as failure to do so can result in significant penalties. The IRS uses this form to ensure compliance with various tax laws and regulations, including the Foreign Account Tax Compliance Act (FATCA) and the Report of Foreign Bank and Financial Accounts (FBAR).

Understanding Form 3520 Part IV

Form 3520 Part IV requires the reporting of certain transactions with foreign trusts, including the creation, transfer, or receipt of assets from a foreign trust. This part of the form is crucial for ensuring that individuals and businesses comply with the IRS's reporting requirements for foreign trusts.

What is a Foreign Trust?

A foreign trust is a trust that is not considered a domestic trust under U.S. tax laws. Generally, a trust is considered foreign if it is created under the laws of a foreign country or if its administration is subject to the laws of a foreign country.

Examples of Form 3520 Part IV Scenarios

Here are five examples of scenarios that may require reporting on Form 3520 Part IV:

Example 1: Creation of a Foreign Trust

John, a U.S. citizen, creates a trust in the Cayman Islands to hold his foreign investments. The trust is created under Cayman Islands law, and its administration is subject to Cayman Islands law. John must report the creation of the trust on Form 3520 Part IV.

Example 2: Transfer of Assets to a Foreign Trust

Sarah, a U.S. resident, transfers $100,000 to a foreign trust in Switzerland. The trust is created under Swiss law, and its administration is subject to Swiss law. Sarah must report the transfer of assets to the foreign trust on Form 3520 Part IV.

Example 3: Receipt of Assets from a Foreign Trust

Michael, a U.S. citizen, receives a distribution of $50,000 from a foreign trust in the United Kingdom. The trust was created under U.K. law, and its administration is subject to U.K. law. Michael must report the receipt of assets from the foreign trust on Form 3520 Part IV.

Example 4: Loan from a Foreign Trust

Emily, a U.S. resident, receives a loan of $200,000 from a foreign trust in Australia. The trust was created under Australian law, and its administration is subject to Australian law. Emily must report the loan from the foreign trust on Form 3520 Part IV.

Example 5: Sale of Assets to a Foreign Trust

David, a U.S. citizen, sells his foreign real estate to a foreign trust in Canada. The trust was created under Canadian law, and its administration is subject to Canadian law. David must report the sale of assets to the foreign trust on Form 3520 Part IV.

Penalties for Failure to Report

Failure to report certain transactions with foreign trusts on Form 3520 Part IV can result in significant penalties. The IRS may impose penalties of up to $10,000 or 5% of the gross value of the trust's assets, whichever is greater, for failure to report certain transactions.

Conclusion

Accurately completing Form 3520 Part IV is crucial for individuals and businesses with foreign assets or interests. Failure to report certain transactions with foreign trusts can result in significant penalties. It is essential to understand the reporting requirements for foreign trusts and to seek professional advice if necessary.

We invite you to share your thoughts and experiences with Form 3520 Part IV in the comments section below. Have you had to report transactions with a foreign trust on Form 3520 Part IV? What challenges did you face, and how did you overcome them?

FAQ Section:

What is Form 3520?

+Form 3520 is a tax form used by the Internal Revenue Service (IRS) to report certain foreign transactions, including the creation, transfer, or receipt of assets from a foreign trust.

What is a foreign trust?

+A foreign trust is a trust that is not considered a domestic trust under U.S. tax laws. Generally, a trust is considered foreign if it is created under the laws of a foreign country or if its administration is subject to the laws of a foreign country.

What are the penalties for failure to report on Form 3520 Part IV?

+The IRS may impose penalties of up to $10,000 or 5% of the gross value of the trust's assets, whichever is greater, for failure to report certain transactions with foreign trusts on Form 3520 Part IV.