Understanding and completing Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, can be a daunting task for many taxpayers. The form is used to calculate and report the underpayment of estimated taxes throughout the year. The process involves a series of calculations that can be complex, but with the right guidance, you can navigate it with ease. Here are five tips to help you complete the Form 2210 worksheet efficiently.

Understanding the Purpose of Form 2210

The primary purpose of Form 2210 is to determine if you owe a penalty for underpaying your estimated taxes throughout the year. The IRS requires taxpayers to make estimated tax payments each quarter if they expect to owe more than $1,000 in taxes for the year. This applies to individuals, estates, and trusts.

Who Needs to File Form 2210?

You may need to file Form 2210 if you:

- Are self-employed and expect to owe more than $1,000 in taxes for the year

- Have income that is not subject to withholding, such as investments or retirement accounts

- Expect to owe more than $1,000 in taxes for the year due to other sources of income

Tip 1: Gather All Necessary Documents

Before starting the Form 2210 worksheet, gather all necessary documents, including:

- Your tax return from the previous year

- Your estimated tax payment records

- Your income statements, including 1099s and W-2s

- Your expense records, including business expenses and deductions

Having all the necessary documents will help you accurately complete the form and avoid errors.

What Documents Do You Need for Form 2210?

You will need the following documents to complete Form 2210:

- Form 1040: Your individual income tax return

- Form 1099: Your income statements from sources such as freelance work or investments

- Form W-2: Your wage and tax statements from your employer

- Your estimated tax payment records

Tip 2: Determine Your Required Annual Payment

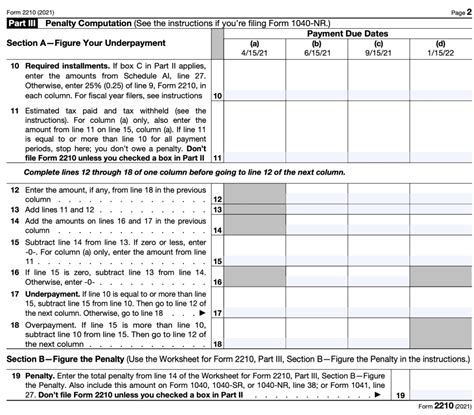

The next step is to determine your required annual payment. This is the amount you should have paid in estimated taxes throughout the year. You can calculate this by completing the Form 2210 worksheet, which takes into account your prior year's tax liability and your current year's income.

How to Calculate Your Required Annual Payment

To calculate your required annual payment, follow these steps:

- Complete the Form 2210 worksheet using your prior year's tax liability and your current year's income.

- Calculate your total tax liability for the year.

- Divide your total tax liability by 4 to determine your required quarterly payment.

Tip 3: Calculate Your Underpayment Amount

Once you have determined your required annual payment, calculate your underpayment amount. This is the amount you underpaid in estimated taxes throughout the year. You can calculate this by subtracting your actual payments from your required annual payment.

How to Calculate Your Underpayment Amount

To calculate your underpayment amount, follow these steps:

- Subtract your actual payments from your required annual payment.

- If the result is a negative number, you have underpaid your estimated taxes.

Tip 4: Determine Your Penalty Amount

If you have underpaid your estimated taxes, you may be subject to a penalty. The penalty is calculated based on the underpayment amount and the number of quarters you underpaid. You can use the Form 2210 worksheet to calculate your penalty amount.

How to Calculate Your Penalty Amount

To calculate your penalty amount, follow these steps:

- Complete the Form 2210 worksheet to determine your underpayment amount.

- Multiply your underpayment amount by the penalty rate.

- The result is your penalty amount.

Tip 5: Review and Complete the Form 2210 Worksheet

Once you have completed the previous steps, review and complete the Form 2210 worksheet. Make sure to accurately complete all sections and calculations. If you are unsure about any part of the form, consider consulting a tax professional.

How to Complete the Form 2210 Worksheet

To complete the Form 2210 worksheet, follow these steps:

- Complete the identification section with your name and taxpayer identification number.

- Complete the calculation sections using your prior year's tax liability and your current year's income.

- Calculate your required annual payment, underpayment amount, and penalty amount.

- Sign and date the form.

By following these five tips, you can complete the Form 2210 worksheet with ease and accuracy. Remember to gather all necessary documents, determine your required annual payment, calculate your underpayment amount, determine your penalty amount, and review and complete the Form 2210 worksheet.

If you have any questions or concerns about completing Form 2210, consider consulting a tax professional. They can help you navigate the process and ensure you accurately complete the form.

We hope this article has provided you with valuable information and insights into completing Form 2210. If you have any questions or comments, please feel free to share them below.

What is Form 2210 used for?

+Form 2210 is used to calculate and report the underpayment of estimated taxes throughout the year.

Who needs to file Form 2210?

+You may need to file Form 2210 if you are self-employed, have income that is not subject to withholding, or expect to owe more than $1,000 in taxes for the year.

What documents do I need to complete Form 2210?

+You will need your tax return from the previous year, estimated tax payment records, income statements, and expense records.