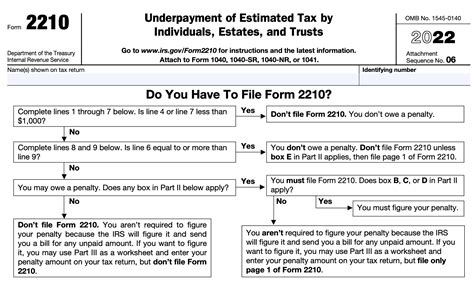

The world of tax forms can be overwhelming, especially when it comes to navigating the intricacies of Form 2210, the Underpayment of Estimated Tax by Individuals, Estates, and Trusts. Among the various lines and calculations, Line 4 can be particularly perplexing. In this article, we will delve into the world of Line 4, breaking down its purpose, calculation, and implications, making it easier for you to understand and accurately complete your tax return.

What is Form 2210 and why is it important?

Before we dive into Line 4, let's take a step back and explore the purpose of Form 2210. This form is used to calculate the underpayment of estimated tax by individuals, estates, and trusts. Estimated tax is the method used to pay tax on income that isn't subject to withholding, such as self-employment income, interest, dividends, and capital gains. The IRS requires taxpayers to make estimated tax payments each quarter if they expect to owe more than $1,000 in taxes for the year.

Understanding Line 4: The Annualized Estimated Tax Worksheet

Line 4 of Form 2210 is where you calculate the annualized estimated tax using the Annualized Estimated Tax Worksheet. This worksheet is designed to help taxpayers who have fluctuating income throughout the year, making it challenging to accurately estimate their tax liability.

How to calculate Line 4

To calculate Line 4, you will need to complete the Annualized Estimated Tax Worksheet, which is divided into four columns: Column A, Column B, Column C, and Column D. Each column represents a different quarter of the year, and you will need to calculate the estimated tax for each quarter.

Here's a step-by-step guide to completing the worksheet:

- Column A (January 1 - March 31): Calculate the estimated tax for the first quarter by multiplying the income earned during this period by the tax rate.

- Column B (April 1 - May 31): Calculate the estimated tax for the second quarter by multiplying the income earned during this period by the tax rate.

- Column C (June 1 - August 31): Calculate the estimated tax for the third quarter by multiplying the income earned during this period by the tax rate.

- Column D (September 1 - December 31): Calculate the estimated tax for the fourth quarter by multiplying the income earned during this period by the tax rate.

Once you have completed the calculations for each column, you will need to add the amounts together to get the total annualized estimated tax. This total is then reported on Line 4 of Form 2210.

What are the implications of Line 4?

The Annualized Estimated Tax Worksheet is an essential tool for taxpayers with fluctuating income. By using this worksheet, you can accurately calculate your estimated tax liability and avoid penalties. If you fail to make accurate estimated tax payments, you may be subject to penalties and interest on the underpaid amount.

In addition, Line 4 plays a crucial role in determining the underpayment of estimated tax, which is calculated on Form 2210, Line 11. This calculation will help you determine if you owe penalties and interest on the underpaid amount.

Common mistakes to avoid when calculating Line 4

To ensure accuracy and avoid penalties, it's essential to avoid common mistakes when calculating Line 4. Here are a few mistakes to watch out for:

- Inaccurate income reporting: Make sure to accurately report your income for each quarter. Inaccurate reporting can lead to incorrect estimated tax calculations.

- Incorrect tax rate: Ensure you are using the correct tax rate for each quarter. Tax rates can change throughout the year, so it's essential to use the correct rate for each period.

- Math errors: Double-check your calculations to avoid math errors. A simple mistake can lead to inaccurate estimated tax calculations.

Best practices for completing Form 2210 and Line 4

To ensure you accurately complete Form 2210 and Line 4, follow these best practices:

- Keep accurate records: Keep accurate records of your income and expenses throughout the year. This will help you accurately complete the Annualized Estimated Tax Worksheet.

- Consult a tax professional: If you're unsure about how to complete Form 2210 or Line 4, consult a tax professional. They can guide you through the process and ensure you accurately complete the form.

- Use tax software: Consider using tax software to help you complete Form 2210 and Line 4. Tax software can guide you through the process and reduce the risk of errors.

Conclusion: Take control of your tax liability

Completing Form 2210 and Line 4 can be a daunting task, but by understanding the purpose and calculation of Line 4, you can take control of your tax liability. Remember to accurately report your income, use the correct tax rate, and avoid math errors. By following these best practices, you can ensure you accurately complete Form 2210 and avoid penalties.

Take the next step

If you have any questions or concerns about Form 2210 or Line 4, share them in the comments below. Don't forget to share this article with others who may benefit from understanding the intricacies of Form 2210.

What is the purpose of Form 2210?

+Form 2210 is used to calculate the underpayment of estimated tax by individuals, estates, and trusts.

How do I calculate Line 4 of Form 2210?

+To calculate Line 4, complete the Annualized Estimated Tax Worksheet, which is divided into four columns, each representing a different quarter of the year.

What are the implications of Line 4?

+The Annualized Estimated Tax Worksheet is an essential tool for taxpayers with fluctuating income. By using this worksheet, you can accurately calculate your estimated tax liability and avoid penalties.