As an employee in India, it's essential to understand the process of claiming your Provident Fund (PF) settlement after leaving a job. The EPF Form 19 is a crucial document in this process, and in this article, we will guide you through the steps to fill it out and claim your PF settlement.

The Employees' Provident Fund (EPF) is a retirement savings scheme managed by the Employees' Provident Fund Organisation (EPFO). It's a mandatory savings plan for employees in India, where a portion of the employee's salary is deducted and deposited into their EPF account. After leaving a job, employees can claim their PF settlement using EPF Form 19.

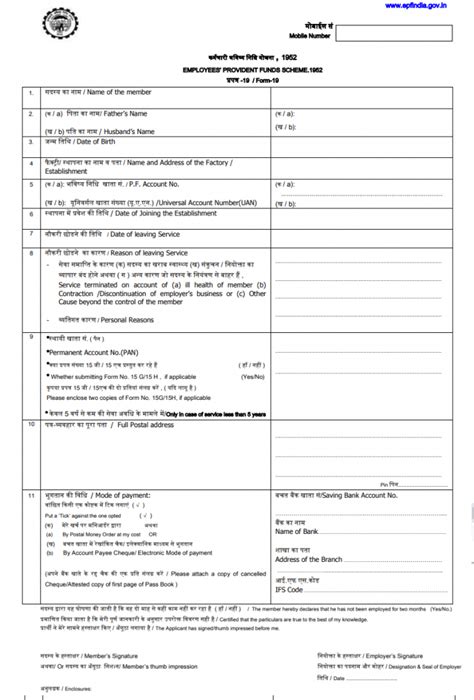

What is EPF Form 19?

EPF Form 19 is a claim form used by employees to withdraw their PF amount after leaving a job. The form is available on the EPFO website and can be downloaded and filled out by the employee. The form requires various details, including the employee's personal and employment information, PF account number, and bank account details.

Eligibility to Claim PF Settlement

To be eligible to claim PF settlement, an employee must have completed at least 7 years of service with the same employer or have reached the age of 55 years. If an employee has completed less than 7 years of service, they can still claim their PF amount, but it will be subject to certain conditions.

Types of PF Claims

There are three types of PF claims that can be made using EPF Form 19:

- Final PF Settlement: This is the most common type of claim, where the employee withdraws their entire PF amount after leaving a job.

- Partial PF Withdrawal: In this type of claim, the employee can withdraw a portion of their PF amount for specific purposes, such as purchasing a house or financing their children's education.

- PF Advance: This type of claim allows employees to withdraw a portion of their PF amount for emergency purposes, such as medical expenses or repayment of loans.

How to Fill EPF Form 19

Filling out EPF Form 19 requires careful attention to detail. Here are the steps to follow:

- Download the form: Download EPF Form 19 from the EPFO website and print it out.

- Fill out the form: Fill out the form with your personal and employment details, PF account number, and bank account details.

- Attach required documents: Attach a copy of your PAN card, Aadhaar card, and bank passbook to the form.

- Sign the form: Sign the form and get it attested by your employer or a gazetted officer.

- Submit the form: Submit the form to the EPFO office or your employer's HR department.

Documents Required for EPF Form 19

The following documents are required to be attached with EPF Form 19:

- PAN card

- Aadhaar card

- Bank passbook

- Copy of EPF account statement

- Copy of employer's certificate

How to Track EPF Claim Status

After submitting EPF Form 19, you can track the status of your claim online or through the EPFO mobile app. Here are the steps to follow:

- Visit the EPFO website: Visit the EPFO website and click on the "Know Your Claim Status" tab.

- Enter your PF account number: Enter your PF account number and click on "Submit".

- Check your claim status: Check your claim status online or through the EPFO mobile app.

FAQs

What is the minimum service period required to claim PF settlement?

+The minimum service period required to claim PF settlement is 7 years.

Can I claim PF settlement after 5 years of service?

+No, you cannot claim PF settlement after 5 years of service. You need to complete at least 7 years of service to be eligible for PF settlement.

How long does it take to process EPF claims?

+EPF claims are usually processed within 30 days of submission.

In conclusion, claiming PF settlement using EPF Form 19 is a straightforward process that requires careful attention to detail. By following the steps outlined in this article, you can ensure a smooth and hassle-free experience. If you have any further questions or concerns, feel free to ask in the comments section below.