As the deadline for filing taxes approaches, many corporations are scrambling to ensure they have all the necessary forms and schedules completed accurately. One of the most important schedules for corporations is Schedule O, which is used to report information about the corporation's shareholders. In this article, we will provide 5 tips for filing Form 1120 Schedule O to help corporations avoid common mistakes and ensure compliance with the IRS.

Understanding Schedule O

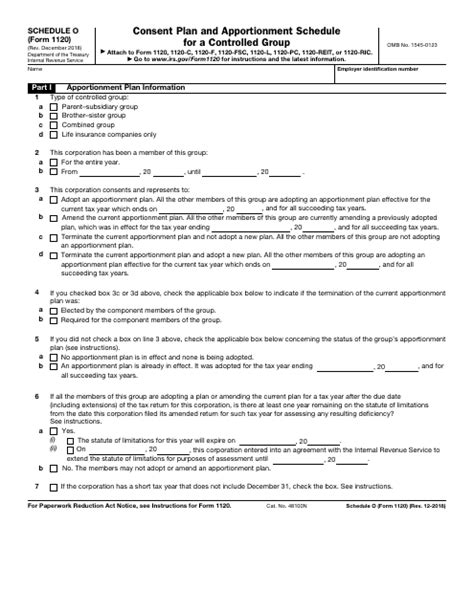

Before we dive into the tips, it's essential to understand what Schedule O is and what it's used for. Schedule O is a supplemental schedule that is attached to Form 1120, which is the standard form used by corporations to report their income tax. Schedule O is used to report information about the corporation's shareholders, including their names, addresses, and the number of shares they own.

Tip 1: Ensure Accuracy in Shareholder Information

One of the most critical aspects of Schedule O is ensuring the accuracy of shareholder information. The IRS requires corporations to report the name, address, and number of shares owned by each shareholder. This information must be accurate, as any errors or discrepancies can lead to delays in processing the tax return.

To ensure accuracy, corporations should:

- Verify shareholder information against their records

- Use the correct format for reporting shareholder information

- Ensure all required fields are completed

Tip 2: Report Changes in Shareholder Ownership

Corporations must report any changes in shareholder ownership on Schedule O. This includes changes in the number of shares owned, changes in the shareholder's name or address, and any new shareholders.

To report changes in shareholder ownership:

- Use the correct code to indicate the type of change

- Report the date of the change

- Provide the required documentation to support the change

Tip 3: Identify Controlled Groups

Schedule O also requires corporations to identify controlled groups, which are groups of shareholders that own a significant amount of stock in the corporation. Controlled groups must be identified, and the corporation must report the percentage of ownership for each group.

To identify controlled groups:

- Determine the percentage of ownership for each shareholder

- Identify any groups of shareholders that own a significant amount of stock

- Report the controlled group information on Schedule O

Tip 4: Complete All Required Schedules and Forms

In addition to Schedule O, corporations may be required to complete other schedules and forms, such as Schedule K-1 or Form 5471. These forms provide additional information about the corporation's income and shareholders.

To ensure compliance:

- Determine which schedules and forms are required

- Complete all required schedules and forms accurately

- Attach all required schedules and forms to Form 1120

Tip 5: Seek Professional Help

Finally, it's essential to seek professional help when filing Form 1120 and Schedule O. A tax professional can help ensure accuracy and compliance with the IRS, reducing the risk of errors and delays.

To seek professional help:

- Consult with a tax professional or accountant

- Provide all required documentation and information

- Review and approve the completed return before filing

Common Mistakes to Avoid

When filing Schedule O, there are several common mistakes to avoid, including:

- Inaccurate shareholder information

- Failure to report changes in shareholder ownership

- Failure to identify controlled groups

- Incomplete or inaccurate schedules and forms

By avoiding these common mistakes and following the 5 tips outlined above, corporations can ensure compliance with the IRS and avoid delays in processing their tax return.

Conclusion

Filing Form 1120 and Schedule O can be complex and time-consuming, but by following these 5 tips, corporations can ensure accuracy and compliance with the IRS. Remember to seek professional help, report changes in shareholder ownership, and identify controlled groups to avoid common mistakes. By taking the time to complete Schedule O accurately, corporations can avoid delays and ensure a smooth tax filing process.

What is Schedule O used for?

+Schedule O is used to report information about a corporation's shareholders, including their names, addresses, and the number of shares they own.

Who must file Schedule O?

+Corporations that are required to file Form 1120 must also file Schedule O if they have shareholders.

What is a controlled group?

+A controlled group is a group of shareholders that own a significant amount of stock in the corporation.