As a corporation, managing your finances effectively is crucial to minimizing taxes and maximizing profits. One aspect of corporate taxation that requires attention is the accumulated earnings tax, which is reported on Form 1120 Schedule J. In this article, we will delve into the world of accumulated earnings tax, exploring what it is, how it works, and the importance of Form 1120 Schedule J in the process.

Accumulated earnings tax is a type of tax levied on corporations that accumulate excessive earnings beyond their reasonable business needs. This tax is designed to prevent corporations from avoiding dividend distributions to shareholders, thereby reducing their tax liability. The tax is calculated on the corporation's accumulated earnings, which are the profits retained in the business rather than distributed to shareholders.

What is Form 1120 Schedule J?

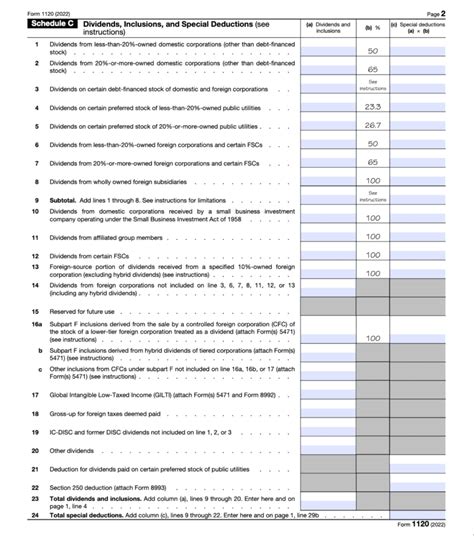

Form 1120 Schedule J is a supporting schedule to the corporate income tax return, Form 1120. It is used to calculate the accumulated earnings tax and report the details of the tax computation. The schedule requires corporations to disclose their accumulated earnings, the amount of tax, and any credits or deductions claimed.

Why is Form 1120 Schedule J important?

Form 1120 Schedule J plays a critical role in the corporate tax compliance process. It helps corporations to accurately calculate their accumulated earnings tax liability, ensuring that they meet their tax obligations. Failure to file Form 1120 Schedule J or underreporting accumulated earnings tax can result in penalties, fines, and even audit scrutiny.

How to Complete Form 1120 Schedule J

Completing Form 1120 Schedule J requires a thorough understanding of the corporation's financial statements and tax returns. Here are the key steps to follow:

- Determine the accumulated earnings: Calculate the corporation's accumulated earnings by adding the beginning balance to the current year's earnings and subtracting any dividends distributed.

- Calculate the tax: Multiply the accumulated earnings by the applicable tax rate, which is typically 20% for corporations.

- Claim credits and deductions: Report any credits or deductions claimed, such as the small business exemption or charitable contributions.

- Complete the schedule: Fill out the schedule, ensuring that all required information is provided, including the corporation's name, address, and tax identification number.

Tips for Minimizing Accumulated Earnings Tax

While Form 1120 Schedule J is a necessary part of corporate tax compliance, there are strategies to minimize accumulated earnings tax:

- Distribute dividends: Regularly distribute dividends to shareholders to reduce accumulated earnings.

- Invest in business growth: Use accumulated earnings to invest in business growth initiatives, such as new equipment, research, and development, or marketing campaigns.

- Claim exemptions and credits: Take advantage of exemptions and credits, such as the small business exemption or charitable contributions.

Common Mistakes to Avoid

When completing Form 1120 Schedule J, it is essential to avoid common mistakes that can result in penalties or audit scrutiny:

- Inaccurate accumulated earnings calculation: Ensure that the accumulated earnings calculation is accurate and complete.

- Failure to claim credits and deductions: Claim all eligible credits and deductions to minimize tax liability.

- Inadequate documentation: Maintain thorough documentation to support the accumulated earnings tax calculation.

Best Practices for Accumulated Earnings Tax Compliance

To ensure accurate and timely compliance with accumulated earnings tax, follow these best practices:

- Regularly review financial statements: Regularly review financial statements to identify potential accumulated earnings tax liabilities.

- Maintain accurate records: Maintain accurate and complete records to support the accumulated earnings tax calculation.

- Consult a tax professional: Consult a tax professional to ensure compliance with all applicable tax laws and regulations.

Conclusion

Accumulated earnings tax is a critical aspect of corporate taxation, and Form 1120 Schedule J plays a vital role in the compliance process. By understanding the importance of Form 1120 Schedule J and following the steps outlined in this article, corporations can minimize their accumulated earnings tax liability and ensure timely compliance with tax laws and regulations.What is the purpose of Form 1120 Schedule J?

+Form 1120 Schedule J is used to calculate and report the accumulated earnings tax, which is levied on corporations that accumulate excessive earnings beyond their reasonable business needs.

How is the accumulated earnings tax calculated?

+The accumulated earnings tax is calculated by multiplying the accumulated earnings by the applicable tax rate, which is typically 20% for corporations.

What are some strategies for minimizing accumulated earnings tax?

+Strategies for minimizing accumulated earnings tax include distributing dividends, investing in business growth initiatives, and claiming exemptions and credits.