The Form 1120 Schedule G is a crucial component of the United States corporate tax return, providing essential information on controlled corporations. As a taxpayer, understanding the purpose and requirements of this schedule is vital to ensure accurate and compliant tax filing.

The Importance of Controlled Corporations

Controlled corporations play a significant role in the business world, allowing companies to expand their operations, manage risks, and optimize tax strategies. A controlled corporation is a separate entity that is owned and controlled by another corporation, known as the parent company. The parent company typically holds a majority of the voting power or shares of the controlled corporation.

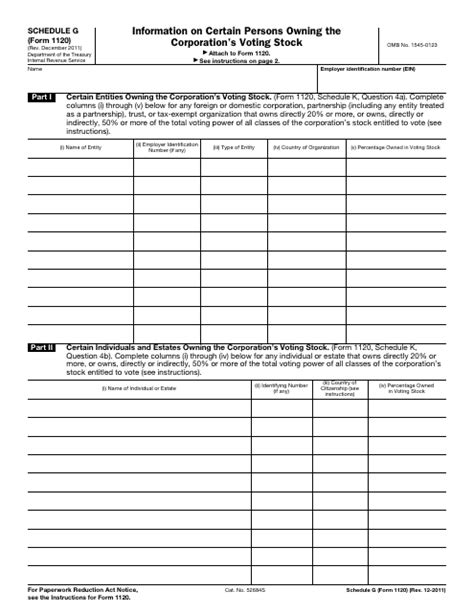

What is Form 1120 Schedule G?

Form 1120 Schedule G, also known as Information on Controlled Corporations, is a supplemental schedule to the Form 1120 corporate tax return. Its primary purpose is to provide detailed information about the controlled corporations owned by the parent company. This schedule helps the Internal Revenue Service (IRS) to:

- Identify the controlled corporations and their relationships with the parent company

- Determine the parent company's taxable income and deductions

- Apply tax laws and regulations to the controlled corporations

Who Must File Form 1120 Schedule G?

The following corporations are required to file Form 1120 Schedule G:

- Parent companies with controlled corporations, either domestic or foreign

- Corporations with a majority of voting power or shares in another corporation

- Corporations with a significant amount of control or influence over another corporation

What Information is Required on Form 1120 Schedule G?

Form 1120 Schedule G requires the following information:

- Name, address, and employer identification number (EIN) of each controlled corporation

- Type of control (voting power or shares)

- Percentage of control

- Country of incorporation (for foreign controlled corporations)

- Type of business activity (e.g., manufacturing, services, etc.)

- Gross income and total assets of each controlled corporation

Benefits of Filing Form 1120 Schedule G

Accurate and timely filing of Form 1120 Schedule G provides several benefits, including:

- Compliance with tax laws and regulations

- Reduced risk of audits and penalties

- Improved tax planning and optimization

- Enhanced transparency and accountability

Common Challenges and Solutions

Common challenges when filing Form 1120 Schedule G include:

- Complexity of controlled corporation structures

- Difficulty in determining control and ownership

- Inadequate record-keeping and documentation

Solutions to these challenges include:

- Consulting with tax professionals and advisors

- Maintaining accurate and detailed records

- Utilizing tax software and tools

Best Practices for Filing Form 1120 Schedule G

To ensure accurate and compliant filing of Form 1120 Schedule G, follow these best practices:

- Maintain detailed records of controlled corporations and their relationships

- Consult with tax professionals and advisors

- Utilize tax software and tools

- Review and update Form 1120 Schedule G annually

By understanding the purpose and requirements of Form 1120 Schedule G, taxpayers can ensure accurate and compliant tax filing, reduce the risk of audits and penalties, and optimize their tax strategies.

What is a controlled corporation?

+A controlled corporation is a separate entity that is owned and controlled by another corporation, known as the parent company.

Who must file Form 1120 Schedule G?

+Parent companies with controlled corporations, either domestic or foreign, must file Form 1120 Schedule G.

What information is required on Form 1120 Schedule G?

+Form 1120 Schedule G requires information on the controlled corporations, including name, address, EIN, type of control, percentage of control, and more.