As a business owner, it's essential to understand the intricacies of tax filing, particularly when it comes to Schedule D of Form 1120. This schedule is used to report the sale or exchange of capital assets, and it can have a significant impact on your business's tax liability. In this article, we'll provide you with five essential tips for filing Form 1120 Schedule D, ensuring that you're in compliance with the IRS and minimizing your tax burden.

Understanding the Basics of Schedule D

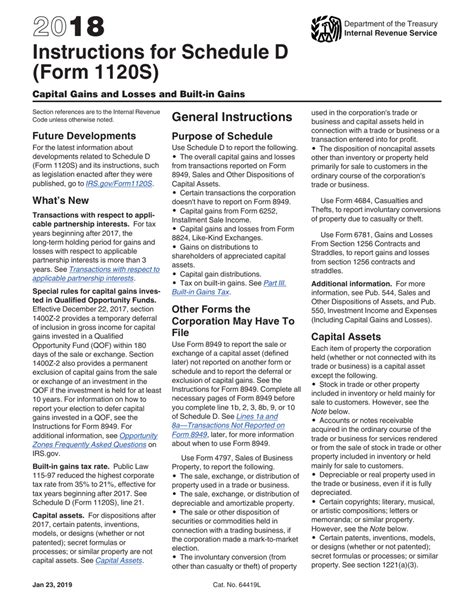

Before we dive into the tips, it's essential to understand the basics of Schedule D. This schedule is used to report the sale or exchange of capital assets, which can include:

- Stocks and bonds

- Real estate

- Business assets, such as equipment and vehicles

- Investments, such as mutual funds and exchange-traded funds (ETFs)

The schedule is divided into two parts: Part I, which reports sales and other dispositions of capital assets, and Part II, which reports gains and losses from the sale or exchange of capital assets.

Tip #1: Keep Accurate Records

To accurately complete Schedule D, you'll need to keep accurate records of your capital asset transactions. This includes:

- Dates of purchase and sale

- Cost basis of the asset

- Sales proceeds

- Any commissions or fees paid

These records will help you determine the gain or loss on the sale or exchange of each asset, which is essential for completing Schedule D.

Reporting Gains and Losses

Reporting Gains and Losses on Schedule D

When reporting gains and losses on Schedule D, it's essential to understand the IRS's rules for capital gains and losses. The IRS allows you to offset gains with losses, but there are limits to the amount of losses you can deduct.

- Short-term gains and losses: These are gains and losses from assets held for one year or less. Short-term gains are taxed as ordinary income, while short-term losses can be deducted against ordinary income.

- Long-term gains and losses: These are gains and losses from assets held for more than one year. Long-term gains are taxed at a lower rate than ordinary income, while long-term losses can be deducted against ordinary income.

Tip #2: Calculate Your Gain or Loss

To calculate your gain or loss on the sale or exchange of a capital asset, you'll need to subtract the cost basis from the sales proceeds. The cost basis includes the original purchase price, plus any commissions or fees paid.

- Example: You purchased 100 shares of XYZ stock for $10,000. You sell the stock for $15,000, paying a commission of $500. Your gain would be $4,500 ($15,000 - $10,000 - $500).

Tip #3: Report Section 1231 Gains and Losses

Section 1231 gains and losses are reported on Schedule D, but they're treated differently than capital gains and losses. Section 1231 gains and losses are reported on Part I of Schedule D, and they're used to calculate the net gain or loss from the sale or exchange of business assets.

- Example: You sell a business asset, such as a piece of equipment, for a gain of $10,000. You also sell another business asset, such as a vehicle, for a loss of $5,000. Your net Section 1231 gain would be $5,000.

Tip #4: Claim the 20% Qualified Business Income Deduction

The Tax Cuts and Jobs Act (TCJA) introduced the qualified business income (QBI) deduction, which allows eligible businesses to deduct up to 20% of their qualified business income. This deduction can significantly reduce your tax liability, but it's only available to eligible businesses.

- Example: Your business has qualified business income of $100,000. You may be eligible to deduct up to $20,000 (20% of $100,000) as a QBI deduction.

Tip #5: Seek Professional Help

Filing Form 1120 Schedule D can be complex, especially if you have multiple capital asset transactions. Seeking professional help from a tax advisor or accountant can ensure that you're in compliance with the IRS and taking advantage of all eligible deductions.

Get Help with Form 1120 Schedule D

Filing Form 1120 Schedule D requires attention to detail and a thorough understanding of the IRS's rules and regulations. By following these five essential tips, you can ensure that you're in compliance with the IRS and minimizing your tax burden. If you're unsure about any aspect of the process, don't hesitate to seek professional help.

What is Form 1120 Schedule D?

+Form 1120 Schedule D is a tax form used to report the sale or exchange of capital assets, such as stocks, bonds, and business assets.

How do I calculate my gain or loss on Schedule D?

+To calculate your gain or loss on Schedule D, subtract the cost basis from the sales proceeds. The cost basis includes the original purchase price, plus any commissions or fees paid.

What is the qualified business income (QBI) deduction?

+The QBI deduction is a tax deduction introduced by the Tax Cuts and Jobs Act (TCJA), which allows eligible businesses to deduct up to 20% of their qualified business income.