As a business owner or an accountant, you're likely familiar with the complexities of tax season. One of the most critical forms you'll need to file is the Form 1120-PC, also known as the U.S. Property and Casualty Insurance Company Income Tax Return. In this article, we'll delve into the essential facts about Form 1120-PC, helping you navigate the world of insurance company taxation with confidence.

Understanding the importance of Form 1120-PC is crucial for insurance companies, as it affects their tax obligations and financial reporting. The form is used to report the income, deductions, and credits of property and casualty insurance companies, providing the IRS with a comprehensive picture of their financial activities. By grasping the key facts about Form 1120-PC, you'll be better equipped to ensure compliance and minimize potential errors or penalties.

Who Needs to File Form 1120-PC?

Form 1120-PC is specifically designed for property and casualty insurance companies, which include:

- Insurance companies that provide coverage for property damage, such as homeowners' or auto insurance

- Casualty insurance companies that offer liability coverage, such as workers' compensation or umbrella policies

- Insurance companies that provide a combination of property and casualty coverage

These companies must file Form 1120-PC annually to report their income, deductions, and credits to the IRS.

What Information is Reported on Form 1120-PC?

The form requires insurance companies to provide detailed information about their financial activities, including:

- Income from premiums, investments, and other sources

- Deductions for claims, operating expenses, and taxes

- Credits for dividends, interest, and other allowable credits

- A balance sheet and income statement, providing a snapshot of the company's financial position

Insurance companies must also report specific information related to their insurance activities, such as:

- Premiums earned and unearned

- Losses and loss expenses

- Policyholder dividends and refunds

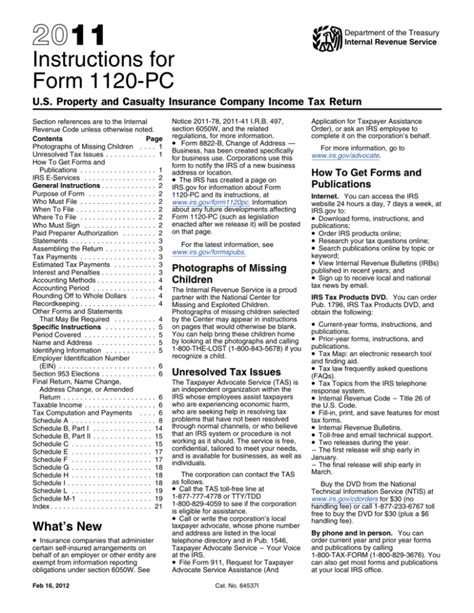

Key Components of Form 1120-PC

Form 1120-PC consists of several key components, including:

- Part I: Income and Deductions

- Part II: Balance Sheet

- Part III: Income Statement

- Schedule A: Premiums Earned and Unearned

- Schedule B: Losses and Loss Expenses

Each component requires insurance companies to provide detailed information about their financial activities, ensuring that the IRS has a comprehensive understanding of their tax obligations.

Due Date and Filing Requirements

The due date for filing Form 1120-PC is typically March 15th for calendar-year taxpayers, with a six-month extension available upon request. Insurance companies can file the form electronically or by mail, but electronic filing is generally recommended for faster processing and reduced errors.

Penalties and Interest for Late or Inaccurate Filing

Insurance companies that fail to file Form 1120-PC on time or provide inaccurate information may be subject to penalties and interest. The IRS may impose a penalty of up to 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%.

Additionally, interest may be charged on the unpaid tax, starting from the original due date. To avoid these penalties and interest, it's essential to ensure accurate and timely filing of Form 1120-PC.

Common Challenges and Best Practices

Insurance companies often face challenges when filing Form 1120-PC, including:

- Ensuring accurate reporting of income and deductions

- Navigating complex tax laws and regulations

- Managing the flow of financial data and information

To overcome these challenges, best practices include:

- Maintaining accurate and detailed financial records

- Consulting with tax professionals or accountants

- Utilizing tax preparation software to streamline the filing process

By following these best practices and understanding the essential facts about Form 1120-PC, insurance companies can ensure compliance with tax regulations and minimize potential errors or penalties.

We hope this article has provided you with a comprehensive understanding of Form 1120-PC and its significance in the world of insurance company taxation. Share your thoughts and experiences with filing Form 1120-PC in the comments section below. If you have any questions or need further clarification on any of the topics discussed, feel free to ask.

What is the purpose of Form 1120-PC?

+Form 1120-PC is used to report the income, deductions, and credits of property and casualty insurance companies to the IRS.

Who needs to file Form 1120-PC?

+Form 1120-PC is specifically designed for property and casualty insurance companies, which include insurance companies that provide coverage for property damage, liability coverage, or a combination of both.

What is the due date for filing Form 1120-PC?

+The due date for filing Form 1120-PC is typically March 15th for calendar-year taxpayers, with a six-month extension available upon request.