The world of tax forms can be a daunting and complex place, especially for those who are new to the process. One form that often causes confusion is Form 1065X, which is used to amend a partnership's return. In this article, we will break down the 5 steps to complete Form 1065X, making it easier for you to navigate the process.

Completing Form 1065X is a crucial step for partnerships that need to make changes to their previously filed returns. Whether it's to correct errors, report changes, or claim additional credits, this form is essential for ensuring accuracy and compliance with the IRS. By following these 5 steps, you'll be well on your way to successfully completing Form 1065X.

Step 1: Gather Necessary Information

Before starting the process, it's essential to gather all the necessary information. This includes:

- A copy of the original Form 1065, including all schedules and attachments

- Any supporting documentation for the changes being made, such as receipts, invoices, or bank statements

- The partnership's Employer Identification Number (EIN)

- The tax year being amended

Having all the required information readily available will save you time and reduce the risk of errors.

Step 2: Determine the Reason for Filing

It's crucial to determine the reason for filing Form 1065X. This will help you identify the specific changes that need to be made and ensure that you're using the correct form. Some common reasons for filing Form 1065X include:

- Correcting errors or omissions on the original return

- Reporting changes to income, deductions, or credits

- Claiming additional credits or deductions

- Changing the partnership's accounting method

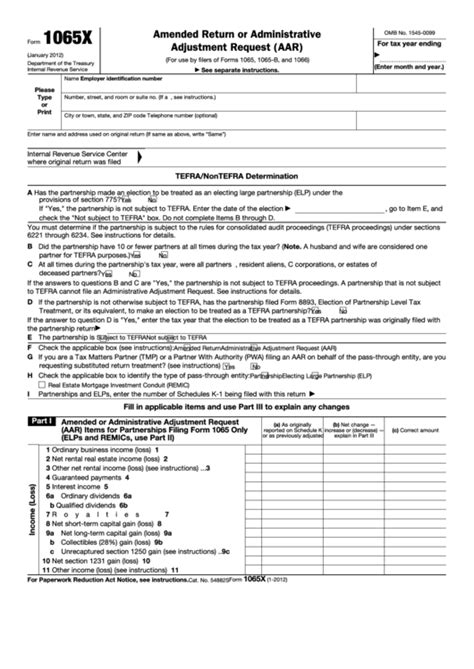

Step 3: Complete the Header Information

The header information on Form 1065X includes the partnership's name, address, and EIN. This information should match the original Form 1065. It's essential to ensure that this information is accurate, as it will be used to identify the partnership and process the amended return.

Step 4: Complete the Amended Return Information

This section of the form requires you to report the changes being made to the original return. This includes:

- Reporting changes to income, deductions, or credits

- Claiming additional credits or deductions

- Changing the partnership's accounting method

It's essential to provide detailed explanations for each change, including the reason for the change and any supporting documentation.

Step 5: Sign and Date the Form

Once you've completed all the necessary sections, it's time to sign and date the form. This is a critical step, as the IRS requires a signature and date to process the amended return. Ensure that the signature is from an authorized partner or representative.

By following these 5 steps, you'll be able to complete Form 1065X accurately and efficiently. Remember to take your time and ensure that all information is accurate and complete. If you're unsure about any aspect of the process, it's always a good idea to consult with a tax professional or the IRS directly.

What is Form 1065X used for?

+Form 1065X is used to amend a partnership's return, including correcting errors, reporting changes, or claiming additional credits.

Who needs to file Form 1065X?

+Partnerships that need to make changes to their previously filed returns must file Form 1065X.

What information do I need to gather before filing Form 1065X?

+You'll need to gather a copy of the original Form 1065, supporting documentation, the partnership's EIN, and the tax year being amended.

We hope this article has provided you with a comprehensive guide to completing Form 1065X. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may find it helpful, and don't forget to check out our other tax-related resources for more information.