As a business owner or tax professional, understanding the intricacies of tax forms is crucial for accurate and timely filing. The Form 1065 Schedule M-3 is a critical component of the partnership tax return, and its instructions can be complex and overwhelming. In this article, we will break down the Form 1065 Schedule M-3 instructions into a step-by-step guide, providing clarity and guidance for taxpayers and tax professionals alike.

What is Form 1065 Schedule M-3?

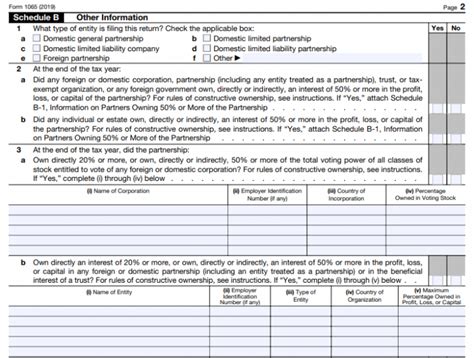

Form 1065 is the tax return form used by partnerships to report their income, deductions, and credits. Schedule M-3, also known as the Net Income (Loss) Reconciliation for Certain Partnerships, is a supporting schedule that provides detailed information about the partnership's financial performance. It is used to reconcile the partnership's net income or loss reported on Form 1065 with the amount reported on the partners' individual tax returns.

Who Needs to File Form 1065 Schedule M-3?

Not all partnerships are required to file Form 1065 Schedule M-3. The following partnerships are exempt:

- Partnerships with fewer than 10 partners

- Partnerships with total assets of less than $10 million

- Partnerships that are not required to file Form 1065

However, if a partnership meets any of the following conditions, it must file Form 1065 Schedule M-3:

- Total assets of $10 million or more

- 10 or more partners

- Reporting a net loss of $100,000 or more

- Reporting a net income of $150,000 or more

Step 1: Gather Required Information

Before starting to complete Form 1065 Schedule M-3, gather the following information:

- Partnership's financial statements (balance sheet and income statement)

- Depreciation and amortization schedules

- Interest income and expense schedules

- Rent and royalty income and expense schedules

- Partnership's tax basis in assets

Step 2: Complete Part I - Financial Information

Part I of Form 1065 Schedule M-3 requires the partnership to report its financial information, including:

- Total assets

- Total liabilities

- Total equity

- Net income (loss) from operations

- Net income (loss) from investments

Use the partnership's financial statements to complete this section.

Step 3: Complete Part II - Reconciliation of Net Income (Loss)

Part II of Form 1065 Schedule M-3 requires the partnership to reconcile its net income (loss) reported on Form 1065 with the amount reported on the partners' individual tax returns.

- Start by reporting the net income (loss) from Part I

- Add or subtract the following adjustments:

- Depreciation and amortization

- Interest income and expense

- Rent and royalty income and expense

- Other adjustments

Step 4: Complete Part III - Classification of Items

Part III of Form 1065 Schedule M-3 requires the partnership to classify its income and expense items into specific categories.

- Use the following categories:

- Ordinary business income

- Capital gains and losses

- Dividend income

- Interest income

- Rent and royalty income

- Other income

Step 5: Complete Part IV - Net Income (Loss) Reconciliation

Part IV of Form 1065 Schedule M-3 requires the partnership to reconcile its net income (loss) reported on Form 1065 with the amount reported on the partners' individual tax returns.

- Start by reporting the net income (loss) from Part II

- Add or subtract the following adjustments:

- Depreciation and amortization

- Interest income and expense

- Rent and royalty income and expense

- Other adjustments

FAQs

What is the purpose of Form 1065 Schedule M-3?

+Form 1065 Schedule M-3 is used to provide detailed information about the partnership's financial performance and to reconcile the partnership's net income or loss reported on Form 1065 with the amount reported on the partners' individual tax returns.

Who needs to file Form 1065 Schedule M-3?

+Partnerships with total assets of $10 million or more, 10 or more partners, reporting a net loss of $100,000 or more, or reporting a net income of $150,000 or more need to file Form 1065 Schedule M-3.

What information is required to complete Form 1065 Schedule M-3?

+The partnership's financial statements, depreciation and amortization schedules, interest income and expense schedules, rent and royalty income and expense schedules, and the partnership's tax basis in assets are required to complete Form 1065 Schedule M-3.

By following these steps and understanding the requirements of Form 1065 Schedule M-3, taxpayers and tax professionals can ensure accurate and timely filing of this critical tax form. If you have any questions or need further clarification, please don't hesitate to comment below.