As a business owner or accountant, navigating the complexities of tax season can be overwhelming. One of the most crucial documents for partnerships and S corporations is Form 1065, specifically Schedule K-1. This form is used to report the income, deductions, and credits of the business, as well as the partner's or shareholder's share of these items. However, deciphering the codes on Schedule K-1 can be a daunting task, even for experienced professionals. In this article, we will delve into the world of Form 1065 Schedule K-1 codes, explaining their meanings and significance.

Understanding the Importance of Form 1065 Schedule K-1

Before diving into the codes, it's essential to comprehend the purpose of Form 1065 Schedule K-1. This document is used to report the business income, deductions, and credits, as well as the partner's or shareholder's share of these items. The information reported on Schedule K-1 is used to complete the partner's or shareholder's individual tax return, Form 1040. The form is typically filed by partnerships, S corporations, and certain other entities.

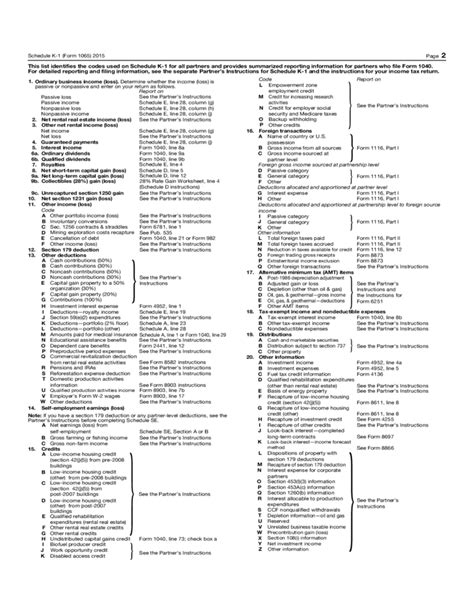

Form 1065 Schedule K-1 Codes Explained

The codes on Schedule K-1 are used to identify specific types of income, deductions, and credits. These codes are essential for accurately reporting the business's financial information and ensuring compliance with tax laws. Let's explore the most common codes found on Schedule K-1:

Codes for Ordinary Business Income (Loss)

- Code A: Ordinary business income (loss)

- Code B: Interest income

- Code C: Dividend income

- Code D: Royalty income

- Code E: Capital gains (loss)

- Code F: Section 1231 gains (loss)

These codes represent the various types of ordinary business income, including interest, dividends, royalties, capital gains, and Section 1231 gains.

Codes for Separately Stated Items

- Code G: Net short-term capital gain (loss)

- Code H: Net long-term capital gain (loss)

- Code I: Section 1231 gain (loss)

- Code J: Other income (loss)

- Code K: Other deductions

These codes represent separately stated items, which are not included in the ordinary business income (loss) calculation.

Codes for Tax Credits

- Code L: Low-income housing credit

- Code M: Renewable energy production credit

- Code N: Investment credit

- Code O: Research credit

- Code P: Work opportunity credit

These codes represent various tax credits available to the business, including low-income housing credits, renewable energy production credits, investment credits, research credits, and work opportunity credits.

Codes for Self-Employment Tax

- Code Q: Self-employment tax deduction

- Code R: Self-employment tax liability

These codes represent the self-employment tax deduction and liability, which are essential for accurately calculating the partner's or shareholder's self-employment tax obligations.

Codes for Other Items

- Code S: Unrelated business taxable income

- Code T: Recapture of low-income housing credit

- Code U: Recapture of investment credit

- Code V: Recapture of research credit

These codes represent other items, including unrelated business taxable income, recapture of low-income housing credits, investment credits, and research credits.

Practical Examples and Applications

To illustrate the application of these codes, let's consider a few examples:

- Example 1: A partnership has $100,000 in ordinary business income, which would be reported on Code A.

- Example 2: An S corporation has $50,000 in dividend income, which would be reported on Code C.

- Example 3: A partnership has a net short-term capital gain of $20,000, which would be reported on Code G.

In each of these examples, the codes on Schedule K-1 are used to accurately report the business's financial information and ensure compliance with tax laws.

Conclusion and Next Steps

Deciphering the codes on Form 1065 Schedule K-1 is a crucial step in accurately reporting the business's financial information and ensuring compliance with tax laws. By understanding the meanings and significance of these codes, business owners and accountants can navigate the complexities of tax season with confidence. If you have any questions or concerns about Form 1065 Schedule K-1 codes, we encourage you to reach out to a tax professional or comment below.

FAQs

What is Form 1065 Schedule K-1?

+Form 1065 Schedule K-1 is a document used to report the income, deductions, and credits of a partnership or S corporation, as well as the partner's or shareholder's share of these items.

What are the codes on Schedule K-1?

+The codes on Schedule K-1 are used to identify specific types of income, deductions, and credits, such as ordinary business income, separately stated items, tax credits, and self-employment tax.

Why is it important to accurately report the codes on Schedule K-1?

+Accurately reporting the codes on Schedule K-1 is essential for ensuring compliance with tax laws and accurately calculating the partner's or shareholder's tax obligations.