As a taxpayer, you're required to report your income and expenses to the Internal Revenue Service (IRS) each year. For many individuals, this involves completing Form 1040, which is the standard form used for personal income tax returns. However, if you have interest and dividend income, you may also need to complete Schedule B, which is a supplemental form that provides more detailed information about these types of income. In this article, we'll explore five ways to complete Form 1040 Schedule B, making it easier for you to navigate the process and ensure accuracy.

What is Form 1040 Schedule B?

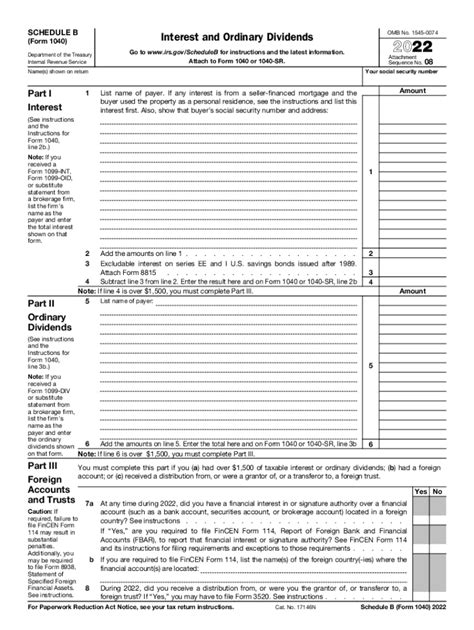

Form 1040 Schedule B is a supplemental form that's used to report interest and dividend income. This form is required if you have more than $1,500 in interest and dividend income, or if you have any foreign accounts or trusts. The form requires you to list each source of interest and dividend income, including the payer's name, address, and the amount of income received.

Why Do I Need to Complete Form 1040 Schedule B?

Completing Form 1040 Schedule B is an essential part of the tax filing process if you have interest and dividend income. This form helps the IRS to ensure that you're reporting all of your income accurately, and it also helps to identify any potential errors or discrepancies. Additionally, completing Schedule B can help you to claim any applicable deductions or credits, such as the qualified dividend income deduction.

5 Ways to Complete Form 1040 Schedule B

Now that we've covered the basics of Form 1040 Schedule B, let's dive into five ways to complete it accurately and efficiently.

1. Gather All Required Documents

Before you start completing Schedule B, make sure you have all the necessary documents. These may include:

- 1099-INT forms for interest income

- 1099-DIV forms for dividend income

- Bank statements and investment accounts

- Foreign account statements (if applicable)

Having all these documents readily available will help you to ensure accuracy and completeness when completing the form.

2. Report Interest Income Accurately

Interest income is reported on Part I of Schedule B. You'll need to list each source of interest income, including the payer's name, address, and the amount of income received. Make sure to include all types of interest income, such as:

- Interest from bank accounts and savings accounts

- Interest from bonds and Treasury bills

- Interest from mortgages and other debt obligations

3. Report Dividend Income Accurately

Dividend income is reported on Part II of Schedule B. You'll need to list each source of dividend income, including the payer's name, address, and the amount of income received. Make sure to include all types of dividend income, such as:

- Dividends from stocks and mutual funds

- Dividends from real estate investment trusts (REITs)

- Dividends from master limited partnerships (MLPs)

4. Complete the Foreign Account and Trust Sections (If Applicable)

If you have foreign accounts or trusts, you'll need to complete the relevant sections on Schedule B. This includes reporting any foreign accounts, trusts, or entities that you have an interest in, as well as any foreign gifts or inheritances.

5. Review and Double-Check Your Work

Finally, make sure to review and double-check your work on Schedule B. This includes verifying that all income is accurately reported, and that all calculations are correct. You can use tax software or consult with a tax professional to help ensure accuracy and completeness.

Tips and Tricks for Completing Form 1040 Schedule B

Here are some additional tips and tricks to keep in mind when completing Form 1040 Schedule B:

- Use tax software or consult with a tax professional if you're unsure about any part of the process.

- Keep accurate records of all income and expenses, including receipts and bank statements.

- Make sure to report all types of interest and dividend income, including any foreign accounts or trusts.

- Take advantage of any applicable deductions or credits, such as the qualified dividend income deduction.

Common Mistakes to Avoid When Completing Form 1040 Schedule B

Here are some common mistakes to avoid when completing Form 1040 Schedule B:

- Failing to report all interest and dividend income

- Incorrectly calculating interest and dividend income

- Failing to complete the foreign account and trust sections (if applicable)

- Not keeping accurate records of income and expenses

By avoiding these common mistakes, you can ensure that your tax return is accurate and complete, and that you're taking advantage of all applicable deductions and credits.

Conclusion

Completing Form 1040 Schedule B can seem daunting, but by following these five steps, you can ensure accuracy and completeness. Remember to gather all required documents, report interest and dividend income accurately, complete the foreign account and trust sections (if applicable), review and double-check your work, and take advantage of any applicable deductions or credits. With these tips and tricks, you'll be well on your way to completing Schedule B with confidence.

What is Form 1040 Schedule B?

+Form 1040 Schedule B is a supplemental form that's used to report interest and dividend income.

Why do I need to complete Form 1040 Schedule B?

+Completing Form 1040 Schedule B is an essential part of the tax filing process if you have interest and dividend income.

What documents do I need to complete Form 1040 Schedule B?

+You'll need to gather all required documents, including 1099-INT forms, 1099-DIV forms, bank statements, and investment accounts.