Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. In this article, we will provide a comprehensive guide to help you navigate the NJ Form 1040 instructions, ensuring you file your taxes accurately and efficiently.

Every year, millions of New Jersey residents file their taxes using the NJ Form 1040. While the process may seem complex, breaking it down into manageable steps makes it more approachable. In the following sections, we will delve into the intricacies of the NJ Form 1040 instructions, providing you with a clear understanding of what to expect and how to complete the form accurately.

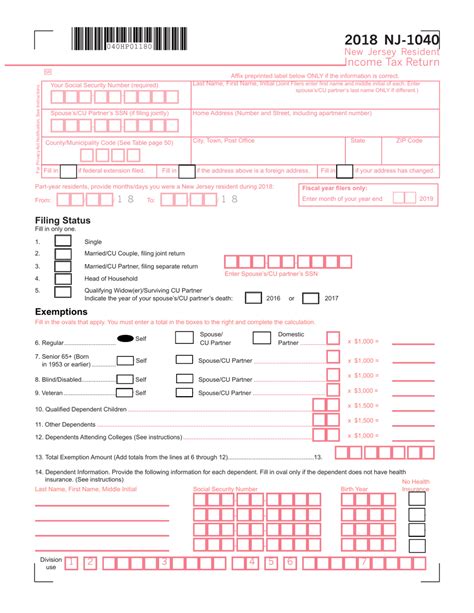

Understanding the NJ Form 1040

The NJ Form 1040 is the standard form used by New Jersey residents to file their state income taxes. It is used to report income, claim deductions and credits, and calculate the amount of taxes owed or refunded. The form consists of multiple sections, each with its own set of instructions and requirements.

Who Needs to File the NJ Form 1040?

Not everyone is required to file the NJ Form 1040. You must file if:

- You are a resident of New Jersey and have gross income exceeding the filing threshold.

- You are a non-resident with income sourced from New Jersey.

- You are required to file a federal income tax return.

Gathering Required Documents

Before starting the filing process, gather all necessary documents, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense records

Completing the NJ Form 1040

The NJ Form 1040 consists of multiple sections. Here's a step-by-step guide to help you complete the form:

- Section 1: Personal Information

- Enter your name, address, and Social Security number.

- Check the box if you are filing jointly or as a single person.

- Section 2: Income

- Report your gross income from all sources, including wages, salaries, tips, and self-employment income.

- Enter the total amount from your W-2 and 1099 forms.

- Section 3: Deductions and Credits

- Claim deductions for charitable donations, medical expenses, and mortgage interest.

- Enter the total amount of credits, including the earned income tax credit (EITC) and child tax credit.

- Section 4: Tax Calculation

- Calculate your total tax liability using the tax tables or tax calculator.

- Enter the amount of taxes withheld from your W-2 forms.

Additional Requirements and Forms

Depending on your situation, you may need to complete additional forms, such as:

- NJ-1040-H: If you have income from self-employment or a small business.

- NJ-1040-V: If you are making a payment with your tax return.

- NJ-1040-X: If you need to amend your original tax return.

Electronic Filing and Payment Options

The New Jersey Division of Taxation offers electronic filing and payment options, making it easier and more convenient to file your taxes. You can:

- E-file your tax return through the New Jersey Taxation website.

- Make online payments using a credit card or e-check.

Avoiding Common Errors

To avoid common errors, make sure to:

- Double-check your math calculations.

- Verify your Social Security number and address.

- Ensure you have all required documents and attachments.

What to Do If You Need Help

If you need assistance with the NJ Form 1040 instructions or have questions about the filing process, you can:

- Contact the New Jersey Division of Taxation directly.

- Visit the New Jersey Taxation website for online resources and FAQs.

- Seek the help of a tax professional or accountant.

Conclusion: You're Ready to File!

Filing your New Jersey state income taxes using the NJ Form 1040 instructions may seem intimidating, but by following these steps and guidelines, you'll be well on your way to completing your tax return accurately and efficiently. Remember to gather all required documents, complete the form carefully, and take advantage of electronic filing and payment options.

Now that you've completed the NJ Form 1040 instructions, you're ready to file your tax return. If you have any further questions or concerns, please don't hesitate to ask.

Take Action: Share Your Thoughts!

Have you filed your New Jersey state income taxes using the NJ Form 1040? Share your experiences and tips in the comments below. Help others by sharing this article on social media, and don't forget to follow us for more informative content on taxation and finance.

What is the deadline for filing the NJ Form 1040?

+The deadline for filing the NJ Form 1040 is typically April 15th of each year.

Can I file the NJ Form 1040 electronically?

+Yes, you can e-file your NJ Form 1040 through the New Jersey Taxation website.

What is the penalty for late filing of the NJ Form 1040?

+The penalty for late filing of the NJ Form 1040 is 5% of the unpaid tax per month, up to a maximum of 25%.