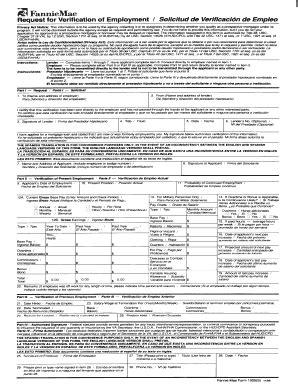

As a mortgage professional, you understand the importance of accurate and efficient loan processing. One crucial step in this process is completing Form 1005, also known as the Uniform Residential Loan Application, for Fannie Mae. This form serves as the foundation for your borrowers' loan applications, and its accuracy can significantly impact the success of the loan. In this article, we'll provide you with 5 valuable tips to ensure you complete Form 1005 correctly and efficiently, helping you to streamline your loan processing workflow.

Tip 1: Gather All Required Documents and Information

Before starting to complete Form 1005, make sure you have gathered all the necessary documents and information from your borrowers. This includes identification, income verification, asset documentation, and credit reports. Having all the required information readily available will save you time and reduce errors. Create a checklist to ensure you don't miss any essential documents.

- Identification: Driver's license, passport, or state ID

- Income verification: Pay stubs, W-2 forms, tax returns

- Asset documentation: Bank statements, investment accounts, retirement accounts

- Credit reports: Obtain a tri-merge credit report or individual credit reports from the three major credit bureaus

Organize Your Documents

Organize your documents in a logical and accessible manner. This will help you quickly locate the information you need to complete the form. Consider using a spreadsheet or a document management system to keep track of the documents and their corresponding borrowers.

Tip 2: Understand the Form's Sections and Requirements

Form 1005 is divided into several sections, each with its own specific requirements. Take the time to review the form's instructions and understand what information is required for each section.

- Section 1: Borrower Information

- Section 2: Loan Information

- Section 3: Property Information

- Section 4: Income and Employment

- Section 5: Assets and Liabilities

- Section 6: Credit History

- Section 7: Loan Request

- Section 8: Declarations

Focus on Accuracy

Accuracy is crucial when completing Form 1005. Double-check your entries to ensure they are correct and consistent throughout the form. A single mistake can lead to delays or even loan rejection.

Tip 3: Use Clear and Concise Language

When completing the form, use clear and concise language to describe the borrower's information. Avoid using abbreviations or acronyms that may be unfamiliar to the underwriter or other stakeholders.

- Use full names and addresses

- Specify employment details, including job title and dates of employment

- Clearly describe income sources, including base salary, bonuses, and commissions

Avoid Ambiguity

Ambiguity can lead to misunderstandings and delays. Make sure to provide enough information to avoid ambiguity and ensure the underwriter can make an informed decision.

Tip 4: Complete the Form Electronically

Completing Form 1005 electronically can save you time and reduce errors. Consider using a loan origination system (LOS) or a document preparation software to streamline the process.

- Auto-populate fields with borrower information

- Reduce errors with built-in validation rules

- Easily update and revise the form as needed

Take Advantage of Technology

Technology can greatly improve the efficiency and accuracy of the loan processing workflow. Take advantage of tools and software designed to streamline the process and reduce errors.

Tip 5: Review and Verify the Form

Once you've completed the form, review and verify the information to ensure accuracy and completeness.

- Check for errors and inconsistencies

- Verify borrower information against supporting documents

- Ensure all required fields are completed

Get it Right the First Time

Reviewing and verifying the form can save you time and reduce errors in the long run. Take the time to ensure the form is accurate and complete, and you'll be more likely to get it right the first time.

By following these 5 tips, you can ensure that you complete Form 1005 accurately and efficiently, streamlining your loan processing workflow and improving the overall borrower experience.

What is Form 1005?

+Form 1005, also known as the Uniform Residential Loan Application, is a standardized form used by Fannie Mae to collect information from borrowers for mortgage loan applications.

Why is accuracy important on Form 1005?

+Accuracy is crucial on Form 1005 because errors or inconsistencies can lead to delays or even loan rejection. Ensuring the form is accurate and complete helps to streamline the loan processing workflow and improves the overall borrower experience.

Can I complete Form 1005 electronically?

+Yes, you can complete Form 1005 electronically using a loan origination system (LOS) or a document preparation software. This can help to reduce errors and streamline the process.