Arizona's Beneficiary Deed Form, also known as a Beneficiary Deed or Transfer on Death (TOD) Deed, is a powerful tool for property owners in the Grand Canyon State. This document allows individuals to transfer their property to beneficiaries upon their death, while avoiding the probate process. In this article, we will delve into the details of the Arizona Beneficiary Deed Form, exploring its benefits, working mechanisms, and steps to create one.

The importance of having a clear plan for the distribution of one's property after death cannot be overstated. Without proper planning, heirs may face lengthy and costly probate proceedings, potentially leading to disputes and financial burdens. The Arizona Beneficiary Deed Form provides a straightforward solution to these concerns, allowing property owners to ensure a smooth transfer of their assets to their chosen beneficiaries.

Benefits of the Arizona Beneficiary Deed Form

The Arizona Beneficiary Deed Form offers several benefits, including:

- Avoidance of probate: By transferring property directly to beneficiaries, the probate process is bypassed, saving time, money, and reducing the risk of disputes.

- Tax benefits: The Beneficiary Deed Form allows property owners to minimize taxes, as the transfer of property is not subject to income tax or gift tax.

- Flexibility: Beneficiaries can be changed or updated at any time, providing flexibility and control over the distribution of one's property.

- Medicaid and VA benefits protection: The Beneficiary Deed Form can help protect Medicaid and VA benefits, ensuring that beneficiaries receive the benefits they are entitled to.

How the Arizona Beneficiary Deed Form Works

The Arizona Beneficiary Deed Form is a type of deed that allows property owners to transfer their property to beneficiaries upon their death. Here's a step-by-step explanation of how it works:

- Create the deed: The property owner creates a Beneficiary Deed Form, naming the beneficiaries and specifying the property to be transferred.

- Record the deed: The deed is recorded with the county recorder's office, providing public notice of the transfer.

- Retain ownership: The property owner retains ownership and control of the property during their lifetime.

- Transfer upon death: Upon the property owner's death, the property is automatically transferred to the beneficiaries, bypassing the probate process.

Steps to Create an Arizona Beneficiary Deed Form

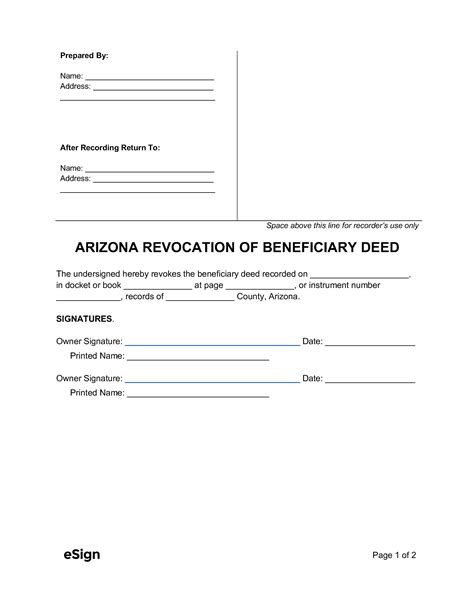

To create an Arizona Beneficiary Deed Form, follow these steps:

- Gather information: Collect the necessary information, including the property owner's name, property description, and beneficiary names.

- Choose a deed type: Select the correct type of deed, such as a Beneficiary Deed Form or a Transfer on Death (TOD) Deed.

- Complete the deed: Fill out the deed form, ensuring accuracy and completeness.

- Sign and notarize: Sign the deed in the presence of a notary public, acknowledging the transfer.

- Record the deed: Record the deed with the county recorder's office, providing public notice of the transfer.

Common Mistakes to Avoid

When creating an Arizona Beneficiary Deed Form, it's essential to avoid common mistakes, including:

- Incorrect property description: Ensure the property description is accurate and complete.

- Inadequate beneficiary information: Provide clear and complete beneficiary information, including names and addresses.

- Failure to record: Record the deed with the county recorder's office to provide public notice of the transfer.

Arizona Beneficiary Deed Form vs. Trusts

The Arizona Beneficiary Deed Form and trusts are both estate planning tools, but they serve different purposes. Here's a comparison:

- Purpose: The Arizona Beneficiary Deed Form is designed to transfer property upon death, while trusts are used to manage assets during lifetime and after death.

- Complexity: Trusts are generally more complex and require ongoing management, while the Arizona Beneficiary Deed Form is a relatively simple document.

- Cost: Trusts can be more costly to establish and maintain, while the Arizona Beneficiary Deed Form is a low-cost option.

Arizona Beneficiary Deed Form and Medicaid Planning

The Arizona Beneficiary Deed Form can be an essential tool in Medicaid planning, as it allows property owners to protect their assets while qualifying for Medicaid benefits. Here's how:

- Medicaid eligibility: The Beneficiary Deed Form helps ensure Medicaid eligibility by transferring property to beneficiaries, reducing the risk of disqualification.

- Asset protection: The deed protects assets from Medicaid's look-back period, ensuring that beneficiaries receive the assets they are entitled to.

Conclusion

The Arizona Beneficiary Deed Form is a powerful tool for property owners in Arizona, providing a straightforward solution for transferring property to beneficiaries upon death. By understanding the benefits, working mechanisms, and steps to create a Beneficiary Deed Form, individuals can ensure a smooth transfer of their assets and protect their loved ones.

We encourage you to share your thoughts and experiences with the Arizona Beneficiary Deed Form in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is the purpose of the Arizona Beneficiary Deed Form?

+The Arizona Beneficiary Deed Form is designed to transfer property upon death, allowing property owners to avoid the probate process and ensure a smooth transfer of their assets to their chosen beneficiaries.

How does the Arizona Beneficiary Deed Form work?

+The Arizona Beneficiary Deed Form is a type of deed that allows property owners to transfer their property to beneficiaries upon their death. The deed is recorded with the county recorder's office, providing public notice of the transfer. Upon the property owner's death, the property is automatically transferred to the beneficiaries, bypassing the probate process.

Can I change or update the beneficiaries on my Arizona Beneficiary Deed Form?

+Yes, you can change or update the beneficiaries on your Arizona Beneficiary Deed Form at any time. Simply create a new deed, naming the updated beneficiaries, and record it with the county recorder's office.