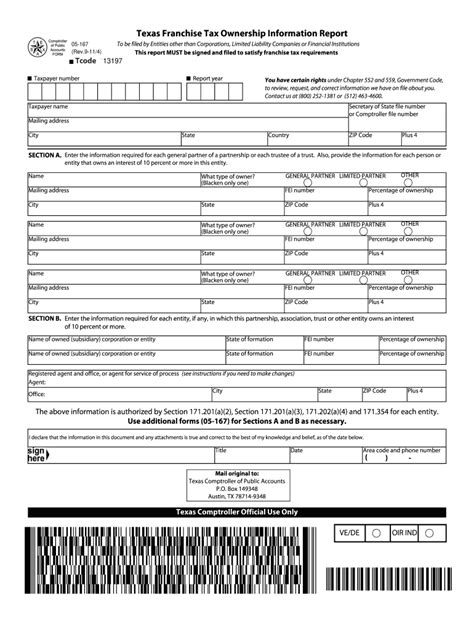

Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. One crucial step in filing taxes is completing Form 05-167, also known as the Texas Franchise Tax Public Information Report. This form is required for businesses operating in Texas, and it's essential to fill it out accurately to avoid delays or penalties. In this article, we'll guide you through the process of filling out Form 05-167 correctly.

Understanding Form 05-167

Before we dive into the specifics of filling out Form 05-167, let's take a moment to understand what this form is and why it's necessary. The Texas Franchise Tax Public Information Report is a document required by the Texas Comptroller's office, which provides information about a business's ownership structure, revenue, and other financial details. This form is used to determine a business's franchise tax liability and to ensure compliance with Texas tax laws.

Who Needs to File Form 05-167?

Not all businesses operating in Texas need to file Form 05-167. However, if your business meets certain criteria, you'll need to complete and submit this form. These criteria include:

- Your business is a corporation, limited liability company (LLC), or limited partnership

- Your business has total revenue of $1.23 million or more

- Your business is a registered agent or has a registered agent in Texas

- Your business has a franchise tax permit

If your business meets any of these criteria, it's essential to file Form 05-167 accurately to avoid penalties or delays.

Step 1: Gather Required Information

Before you start filling out Form 05-167, make sure you have all the necessary information. This includes:

- Your business's name and address

- Your business's tax ID number (FEIN)

- Your business's ownership structure (e.g., sole proprietorship, partnership, corporation)

- Your business's revenue and expense information

- Your business's franchise tax permit number (if applicable)

Having this information readily available will help you complete the form accurately and efficiently.

Step 2: Complete the Ownership Structure Section

The ownership structure section of Form 05-167 requires you to provide information about your business's ownership structure. This includes:

- The name and address of each owner

- The percentage of ownership for each owner

- The type of ownership (e.g., individual, corporation, partnership)

Accurate completion of this section is crucial, as it affects your business's franchise tax liability.

Step 3: Report Revenue and Expenses

The revenue and expenses section of Form 05-167 requires you to report your business's total revenue and expenses for the tax year. This includes:

- Total revenue from all sources

- Total expenses, including cost of goods sold, operating expenses, and other expenses

Accurate reporting of revenue and expenses is essential, as it affects your business's franchise tax liability.

Step 4: Complete the Franchise Tax Permit Section

If your business has a franchise tax permit, you'll need to complete this section of Form 05-167. This includes:

- Your business's franchise tax permit number

- The date your business's franchise tax permit was issued

- The date your business's franchise tax permit expires

Accurate completion of this section is crucial, as it affects your business's franchise tax liability.

Step 5: Review and Submit the Form

Once you've completed Form 05-167, review it carefully to ensure accuracy. Make sure to sign and date the form, and submit it to the Texas Comptroller's office by the deadline.

Common Mistakes to Avoid

When filling out Form 05-167, there are several common mistakes to avoid. These include:

- Inaccurate or incomplete information

- Failure to report revenue or expenses

- Failure to sign and date the form

- Failure to submit the form by the deadline

Avoiding these common mistakes will help ensure your business's franchise tax liability is accurate and that you avoid penalties or delays.

What is Form 05-167, and why do I need to file it?

+Form 05-167 is the Texas Franchise Tax Public Information Report, which is required for businesses operating in Texas. It provides information about a business's ownership structure, revenue, and other financial details, and is used to determine a business's franchise tax liability.

Who needs to file Form 05-167?

+Businesses that meet certain criteria, including corporations, LLCs, and limited partnerships, with total revenue of $1.23 million or more, or those with a registered agent or franchise tax permit in Texas, need to file Form 05-167.

What information do I need to gather before filling out Form 05-167?

+You'll need to gather information about your business's name and address, tax ID number, ownership structure, revenue and expense information, and franchise tax permit number (if applicable).

We hope this guide has helped you understand how to fill out Form 05-167 correctly. Remember to gather all the necessary information, complete each section accurately, and review the form carefully before submitting it. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the Texas Comptroller's office for assistance.