As a homeowner or a real estate professional, you may have come across the term "FNMA Form 1103" in the process of buying or selling a property. But what exactly is this form, and why is it so important in the mortgage industry? In this article, we will delve into the essential facts about FNMA Form 1103, also known as the Uniform Residential Loan Application.

The Importance of FNMA Form 1103

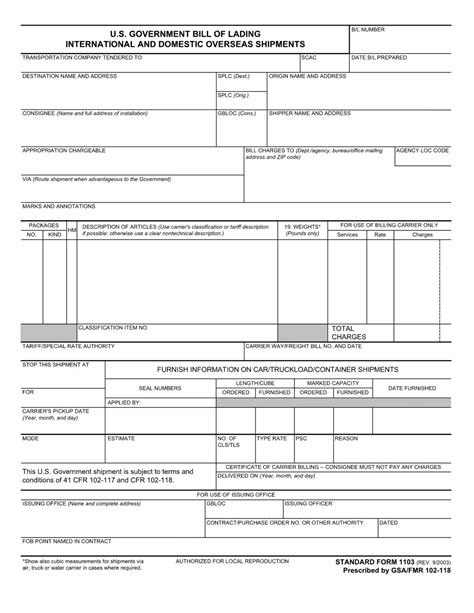

FNMA Form 1103 is a standardized form used by lenders to collect financial information from borrowers who are applying for a mortgage. The form is designed to provide lenders with a comprehensive understanding of the borrower's creditworthiness and ability to repay the loan. It is an essential document in the mortgage application process, and its accuracy and completeness are crucial in determining the borrower's eligibility for a loan.

Here are five essential facts about FNMA Form 1103 that you should know:

What is FNMA Form 1103?

FNMA Form 1103, also known as the Uniform Residential Loan Application, is a standardized form used by lenders to collect financial information from borrowers who are applying for a mortgage. The form is designed to provide lenders with a comprehensive understanding of the borrower's creditworthiness and ability to repay the loan.

What Information Does FNMA Form 1103 Require?

FNMA Form 1103 requires borrowers to provide detailed financial information, including their income, assets, debts, and credit history. The form also asks for information about the property being purchased, including its address, value, and type of property. Additionally, borrowers must provide documentation to support the information provided on the form, such as pay stubs, bank statements, and tax returns.

Why is FNMA Form 1103 Important?

FNMA Form 1103 is important because it provides lenders with a standardized way of evaluating a borrower's creditworthiness and ability to repay a loan. The form helps lenders to assess the borrower's financial risk and make informed decisions about loan approval and interest rates. It also helps to ensure that borrowers are not taking on too much debt and that they have a reasonable chance of repaying the loan.

What Happens if FNMA Form 1103 is Not Completed Accurately?

If FNMA Form 1103 is not completed accurately, it can lead to delays or even denial of the loan application. Lenders may request additional documentation or information to verify the borrower's financial information, which can slow down the loan application process. In some cases, inaccurate or incomplete information on the form may lead to loan approval at a higher interest rate or with less favorable terms.

How Can Borrowers Ensure Accurate Completion of FNMA Form 1103?

Borrowers can ensure accurate completion of FNMA Form 1103 by carefully reviewing the form and providing accurate and complete information. They should also ensure that they have all the required documentation to support the information provided on the form. It is also recommended that borrowers work with a qualified loan officer or mortgage broker who can guide them through the loan application process and ensure that the form is completed accurately and correctly.

Additional Tips for Completing FNMA Form 1103

Here are some additional tips for completing FNMA Form 1103:

- Read the form carefully: Before starting to fill out the form, read it carefully to understand what information is required and what documentation is needed to support the information provided.

- Use black ink: Use black ink to fill out the form, as this will help to ensure that the form is easy to read and scan.

- Do not leave blank spaces: Do not leave any blank spaces on the form, as this can lead to delays or even denial of the loan application. If a question does not apply to you, write "N/A" or "Not Applicable" in the space provided.

- Sign and date the form: Sign and date the form in the presence of a notary public, if required by the lender.

Best Practices for Lenders When Reviewing FNMA Form 1103

Here are some best practices for lenders when reviewing FNMA Form 1103:

- Verify the borrower's identity: Verify the borrower's identity and ensure that the information provided on the form matches the information on file.

- Review the form for completeness: Review the form for completeness and accuracy, and request additional documentation or information if necessary.

- Use the form to evaluate creditworthiness: Use the form to evaluate the borrower's creditworthiness and ability to repay the loan.

- Maintain accurate records: Maintain accurate records of the loan application process, including the FNMA Form 1103 and any supporting documentation.

Conclusion

In conclusion, FNMA Form 1103 is an essential document in the mortgage application process. It provides lenders with a standardized way of evaluating a borrower's creditworthiness and ability to repay a loan. Borrowers should ensure that they complete the form accurately and provide all required documentation to support the information provided on the form. Lenders should also follow best practices when reviewing the form, including verifying the borrower's identity, reviewing the form for completeness and accuracy, using the form to evaluate creditworthiness, and maintaining accurate records.

We hope that this article has provided you with a comprehensive understanding of FNMA Form 1103 and its importance in the mortgage industry. If you have any questions or comments, please feel free to share them with us.

What is FNMA Form 1103?

+FNMA Form 1103, also known as the Uniform Residential Loan Application, is a standardized form used by lenders to collect financial information from borrowers who are applying for a mortgage.

What information does FNMA Form 1103 require?

+FNMA Form 1103 requires borrowers to provide detailed financial information, including their income, assets, debts, and credit history. The form also asks for information about the property being purchased, including its address, value, and type of property.

Why is FNMA Form 1103 important?

+FNMA Form 1103 is important because it provides lenders with a standardized way of evaluating a borrower's creditworthiness and ability to repay a loan. The form helps lenders to assess the borrower's financial risk and make informed decisions about loan approval and interest rates.