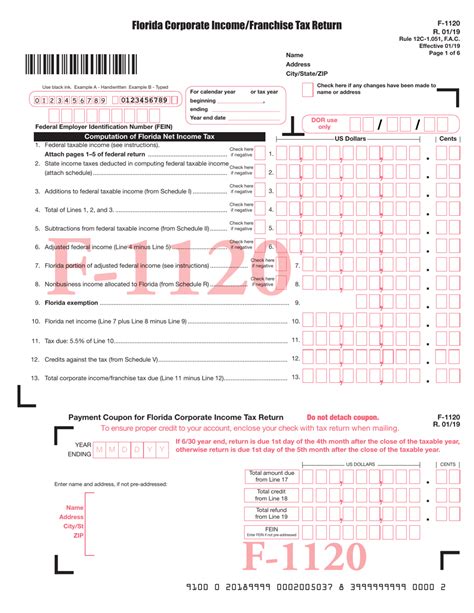

Filing taxes can be a daunting task, especially for businesses operating in the state of Florida. The Florida Form F 1120, also known as the Corporate Income/Franchise Tax Return, is a crucial document that must be filed accurately and on time to avoid penalties and fines. In this article, we will provide you with 5 tips for filing Florida Form F 1120 successfully.

Understanding the Importance of Accurate Filing

Filing taxes is a critical aspect of running a business in Florida. The state's Department of Revenue requires all corporations to file Form F 1120 annually, reporting their income, deductions, and credits. Failure to file or filing inaccurately can result in severe penalties, fines, and even the loss of business licenses. Therefore, it is essential to take the time to understand the requirements and ensure accurate filing.

Tip 1: Gather All Necessary Documents

Before starting the filing process, it is crucial to gather all necessary documents. This includes:

- Federal income tax return (Form 1120)

- Balance sheets and income statements

- Depreciation schedules

- Records of capital gains and losses

- Any other relevant financial documents

Having all the necessary documents in hand will help ensure accuracy and efficiency during the filing process.

**Understanding the Filing Requirements**

Tip 2: Determine Your Filing Status

To file Form F 1120 successfully, you must determine your filing status. This includes:

- Identifying your business type (C-corp, S-corp, partnership, etc.)

- Determining your tax year (calendar or fiscal)

- Identifying any required attachments or schedules

Understanding your filing status will help you complete the form accurately and avoid errors.

Tip 3: Complete the Form Accurately

Completing Form F 1120 requires attention to detail and accuracy. Make sure to:

- Report all income, deductions, and credits accurately

- Complete all required schedules and attachments

- Sign and date the form

Accuracy is crucial when filing taxes. Even small errors can result in delays or penalties.

**Common Errors to Avoid**

- Inaccurate reporting of income or deductions

- Failure to complete required schedules or attachments

- Incorrect calculation of tax liability

By avoiding these common errors, you can ensure a smooth and successful filing process.

Tip 4: Meet the Filing Deadline

The filing deadline for Form F 1120 is typically April 15th for calendar-year taxpayers. However, if you need more time, you can request an automatic six-month extension. Make sure to:

- File Form F 1120 by the deadline or request an extension

- Pay any estimated taxes due to avoid penalties and interest

Missing the filing deadline can result in severe penalties and fines. Make sure to plan ahead and file on time.

Tip 5: Seek Professional Help

Filing taxes can be complex and time-consuming. If you're unsure about any aspect of the process, consider seeking professional help from a certified public accountant (CPA) or tax professional. They can:

- Review your financial documents and ensure accuracy

- Complete Form F 1120 on your behalf

- Represent you in case of an audit or dispute

By seeking professional help, you can ensure a smooth and successful filing process.

**Conclusion: Take Control of Your Tax Filing**

Filing Florida Form F 1120 requires attention to detail, accuracy, and planning. By following these 5 tips, you can ensure a successful filing process and avoid penalties and fines. Remember to gather all necessary documents, determine your filing status, complete the form accurately, meet the filing deadline, and seek professional help if needed. Take control of your tax filing today!

What is the deadline for filing Form F 1120 in Florida?

+The deadline for filing Form F 1120 in Florida is typically April 15th for calendar-year taxpayers. However, if you need more time, you can request an automatic six-month extension.

What are the consequences of filing Form F 1120 inaccurately?

+Filing Form F 1120 inaccurately can result in severe penalties, fines, and even the loss of business licenses. It is essential to take the time to understand the requirements and ensure accurate filing.

Can I file Form F 1120 electronically?

+Yes, you can file Form F 1120 electronically through the Florida Department of Revenue's website. Electronic filing is a convenient and efficient way to file your taxes.