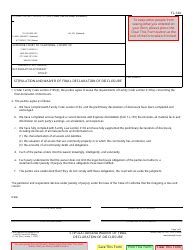

As a Californian, understanding the intricacies of state-specific forms can be overwhelming, especially when it comes to complex topics like taxation and property ownership. The FL-144 form, also known as the "Judgment Debtor's Statement of Assets," is a crucial document that plays a significant role in the state's judicial system. If you're unsure about what this form entails or how it affects you, keep reading to discover five essential facts about the FL-144 form in California.

The FL-144 form is a court-ordered document that requires judgment debtors to disclose their financial assets and information. This form is typically used in cases where a creditor has obtained a judgment against a debtor and is seeking to collect on that debt. The form is designed to provide the creditor with a comprehensive understanding of the debtor's financial situation, including their income, expenses, assets, and debts.

What Information is Required on the FL-144 Form?

When completing the FL-144 form, debtors are required to provide detailed information about their financial assets and obligations. This includes:

- Personal identifying information, such as name, address, and social security number

- Employment information, including income and job title

- A list of all assets, including real estate, vehicles, bank accounts, and investments

- A list of all debts, including credit cards, loans, and mortgages

- Information about any pending lawsuits or court cases

- A statement of income and expenses

This information is used by the creditor to determine the debtor's ability to pay the outstanding debt and to identify potential assets that can be used to satisfy the judgment.

Who is Required to Complete the FL-144 Form?

The FL-144 form is typically required for individuals or businesses that have been ordered by a California court to provide financial information to a creditor. This can include:

- Judgment debtors who have been ordered to pay a debt

- Defendants in a lawsuit who are required to provide financial information

- Businesses that have been sued and are required to provide financial information

In general, anyone who has been ordered by a California court to provide financial information may be required to complete the FL-144 form.

What are the Consequences of Not Completing the FL-144 Form?

Failure to complete the FL-144 form can result in serious consequences, including:

- Contempt of court charges

- Fines and penalties

- Additional court costs and fees

- Potential asset seizure or garnishment

It's essential to take the FL-144 form seriously and provide accurate and complete information to avoid these consequences.

How to Complete the FL-144 Form

Completing the FL-144 form can be a daunting task, especially for those who are not familiar with the process. Here are some tips to help you complete the form accurately:

- Read the instructions carefully and make sure you understand what information is required

- Gather all necessary documents and financial information before starting the form

- Be honest and accurate when providing information

- Use a black pen and write legibly

- Sign and date the form

It's also a good idea to consult with an attorney or financial advisor if you're unsure about how to complete the form or if you have complex financial situations.

Common Mistakes to Avoid When Completing the FL-144 Form

When completing the FL-144 form, it's essential to avoid common mistakes that can lead to delays or penalties. Here are some mistakes to avoid:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Not providing required documentation

- Not disclosing all assets and debts

- Making false statements or misrepresenting financial information

By avoiding these common mistakes, you can ensure that your FL-144 form is complete and accurate, reducing the risk of delays or penalties.

Conclusion and Next Steps

In conclusion, the FL-144 form is a critical document that plays a significant role in California's judicial system. By understanding what the form entails and how to complete it accurately, you can avoid common mistakes and ensure that your financial information is presented correctly. If you're required to complete the FL-144 form, take the time to read the instructions carefully, gather all necessary documentation, and seek advice from an attorney or financial advisor if needed. Remember, accuracy and honesty are crucial when completing the FL-144 form.

We hope this article has provided valuable insights into the FL-144 form and its significance in California's judicial system. If you have any questions or comments, please feel free to share them below.

What is the purpose of the FL-144 form?

+The FL-144 form is used to require judgment debtors to disclose their financial assets and information.

Who is required to complete the FL-144 form?

+Individuals or businesses that have been ordered by a California court to provide financial information to a creditor.

What are the consequences of not completing the FL-144 form?

+Contempt of court charges, fines and penalties, additional court costs and fees, and potential asset seizure or garnishment.