As a family law attorney, dealing with the complexities of divorce, child custody, and spousal support can be a daunting task. One of the most critical documents in family law cases is the FL-141 form, also known as the Income and Expense Declaration. This form requires individuals to disclose their financial information, including income, expenses, assets, and debts. Mastering the FL-141 form is essential for family law attorneys to effectively represent their clients and ensure accurate financial reporting. In this article, we will provide five essential tips for mastering the FL-141 form.

Understanding the Purpose of the FL-141 Form

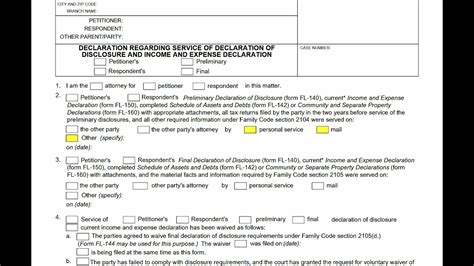

The FL-141 form is a critical document in family law cases, as it provides a comprehensive picture of an individual's financial situation. The form requires disclosure of income, expenses, assets, and debts, which helps the court make informed decisions regarding child support, spousal support, and property division. Accurate completion of the FL-141 form is crucial to ensure that the court has a clear understanding of the individual's financial circumstances.

Tip 1: Gather Accurate Financial Information

To complete the FL-141 form accurately, it is essential to gather all relevant financial documents and information. This includes:

- Pay stubs and W-2 forms

- Tax returns (personal and business)

- Bank statements

- Investment accounts

- Retirement accounts

- Credit card statements

- Loan documents (auto, mortgage, personal)

Having accurate financial information is crucial to ensure that the FL-141 form is completed correctly.

Tip 2: Understand the Different Sections of the FL-141 Form

The FL-141 form is divided into several sections, each requiring specific financial information. Understanding the different sections is crucial to ensure accurate completion of the form. The sections include:

- Section 1: Income

- Section 2: Expenses

- Section 3: Assets

- Section 4: Debts

- Section 5: Business Interests

Each section requires specific financial information, and understanding the requirements of each section is essential to complete the form accurately.

Tip 3: Accurately Calculate Income and Expenses

Calculating income and expenses is a critical part of completing the FL-141 form. Income includes all sources of income, including employment income, self-employment income, and investment income. Expenses include all regular expenses, including housing, transportation, food, and entertainment.

- Use pay stubs and W-2 forms to calculate employment income

- Use tax returns and financial statements to calculate self-employment income

- Use bank statements and credit card statements to calculate expenses

Accurate calculation of income and expenses is essential to ensure that the FL-141 form is completed correctly.

Tip 4: Disclose All Assets and Debts

Disclosure of all assets and debts is crucial to ensure accurate completion of the FL-141 form. Assets include all types of property, including real estate, investments, and personal property. Debts include all types of loans, including credit card debt, auto loans, and mortgages.

- Use financial statements and bank statements to disclose assets

- Use loan documents and credit card statements to disclose debts

Accurate disclosure of assets and debts is essential to ensure that the FL-141 form is completed correctly.

Tip 5: Review and Verify the FL-141 Form

Once the FL-141 form is completed, it is essential to review and verify the information for accuracy. This includes:

- Reviewing the form for completeness and accuracy

- Verifying the information with financial documents and statements

- Ensuring that all required sections are completed

Reviewing and verifying the FL-141 form is crucial to ensure that the court has accurate financial information.

Conclusion

Mastering the FL-141 form is essential for family law attorneys to effectively represent their clients and ensure accurate financial reporting. By following these five essential tips, family law attorneys can ensure that the FL-141 form is completed accurately and that the court has a clear understanding of the individual's financial circumstances. Remember to gather accurate financial information, understand the different sections of the form, accurately calculate income and expenses, disclose all assets and debts, and review and verify the form for accuracy.

What is the purpose of the FL-141 form?

+The FL-141 form is a critical document in family law cases, providing a comprehensive picture of an individual's financial situation. It requires disclosure of income, expenses, assets, and debts, which helps the court make informed decisions regarding child support, spousal support, and property division.

What financial documents are required to complete the FL-141 form?

+To complete the FL-141 form, you will need to gather all relevant financial documents, including pay stubs, W-2 forms, tax returns, bank statements, investment accounts, retirement accounts, credit card statements, and loan documents.

How do I calculate income and expenses on the FL-141 form?

+To calculate income and expenses on the FL-141 form, use pay stubs and W-2 forms to calculate employment income, tax returns and financial statements to calculate self-employment income, and bank statements and credit card statements to calculate expenses.