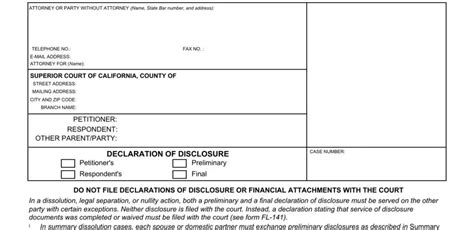

Family law can be a complex and often overwhelming field, with numerous forms and documents that must be completed accurately to ensure the best possible outcome for all parties involved. One such form is the FL-140, also known as the "Declaration of Disclosure". This form plays a crucial role in family law cases, particularly in divorce and separation proceedings.

The FL-140 form is a document that requires both spouses to disclose their financial information, assets, debts, and other relevant details. This information is essential for several reasons, including determining property division, spousal support, and child support. In this comprehensive guide, we will delve into the essentials of the FL-140 form, exploring its purpose, requirements, and benefits.

Understanding the Purpose of the FL-140 Form

The primary purpose of the FL-140 form is to ensure that both spouses have a clear understanding of each other's financial situation. By disclosing this information, spouses can make informed decisions about their case and work towards a fair and equitable resolution. The FL-140 form is typically used in divorce and separation cases, but it may also be required in other family law matters, such as paternity cases or modifications to existing orders.

Benefits of the FL-140 Form

The FL-140 form offers several benefits, including:

- Ensures transparency and accuracy in financial disclosures

- Helps spouses make informed decisions about their case

- Facilitates negotiations and settlements

- Reduces the risk of disputes and litigation

- Provides a clear understanding of each spouse's financial obligations and responsibilities

Completing the FL-140 Form: Requirements and Guidelines

The FL-140 form requires both spouses to provide detailed financial information, including:

- Income and employment information

- Assets, including real estate, vehicles, and personal property

- Debts and liabilities

- Expenses and financial obligations

- Retirement accounts and pensions

- Other relevant financial information

When completing the FL-140 form, spouses should follow these guidelines:

- Be accurate and truthful in disclosing financial information

- Provide detailed and specific information about assets, debts, and expenses

- Attach supporting documentation, such as pay stubs, tax returns, and bank statements

- Review and update the form as necessary to reflect changes in financial circumstances

Common Mistakes to Avoid When Completing the FL-140 Form

When completing the FL-140 form, spouses should avoid the following common mistakes:

- Failing to disclose all financial information, including assets and debts

- Providing incomplete or inaccurate information

- Failing to attach supporting documentation

- Not reviewing and updating the form as necessary

Consequences of Not Completing the FL-140 Form Accurately

Failing to complete the FL-140 form accurately can have serious consequences, including:

- Delays in the court process

- Increased costs and attorney fees

- Disputes and litigation

- Unfavorable court orders or settlements

- Potential penalties or sanctions for non-compliance

Seeking Professional Help with the FL-140 Form

Given the importance and complexity of the FL-140 form, spouses may want to consider seeking professional help from a qualified family law attorney. An attorney can provide guidance on completing the form accurately and ensure that all necessary information is disclosed.

In conclusion, the FL-140 form is a critical document in family law cases, requiring spouses to disclose their financial information and assets. By understanding the purpose and requirements of the form, spouses can ensure a smooth and efficient court process. If you are facing a family law matter, consider seeking professional help to ensure that your rights and interests are protected.

We invite you to share your thoughts and experiences with the FL-140 form in the comments section below. Your feedback and insights can help others navigate this complex process.

What is the purpose of the FL-140 form?

+The primary purpose of the FL-140 form is to ensure that both spouses have a clear understanding of each other's financial situation.

What information is required on the FL-140 form?

+The FL-140 form requires detailed financial information, including income, assets, debts, expenses, and other relevant financial details.

What are the consequences of not completing the FL-140 form accurately?

+Failing to complete the FL-140 form accurately can result in delays, increased costs, disputes, and unfavorable court orders or settlements.