The world of sales tax exemptions can be complex and overwhelming, especially for businesses and organizations operating in Texas. To help navigate this intricate landscape, the Comptroller's office has created Form 50-283, a document that outlines the requirements for claiming sales tax exemptions in the Lone Star State. In this article, we will delve into the details of Comptroller Form 50-283, providing a comprehensive guide to Texas sales tax exemptions.

Understanding Texas Sales Tax Exemptions

Sales tax exemptions are a vital aspect of doing business in Texas, as they can help organizations reduce their tax liability and increase their bottom line. However, understanding the intricacies of these exemptions can be a daunting task, especially for those who are new to the world of sales tax. To help alleviate this burden, the Comptroller's office has created a range of resources, including Form 50-283, to guide businesses through the exemption process.

What is Comptroller Form 50-283?

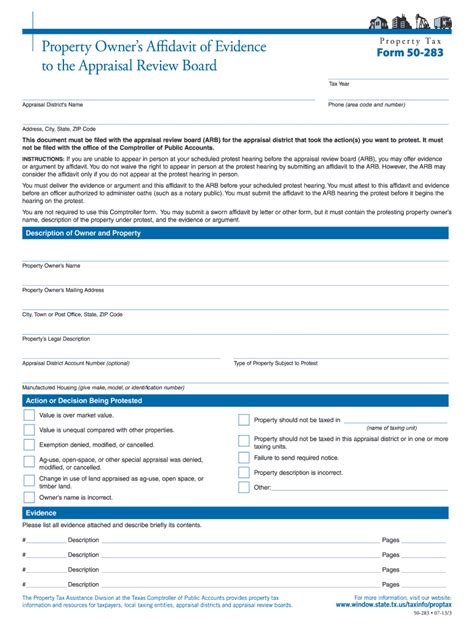

Comptroller Form 50-283, also known as the "Texas Sales Tax Exemption Certificate," is a document that allows businesses and organizations to claim sales tax exemptions on qualifying purchases. The form is used to certify that a particular purchase is exempt from sales tax, and it must be completed and signed by the purchaser or their authorized representative.

Eligibility for Sales Tax Exemptions in Texas

To be eligible for sales tax exemptions in Texas, businesses and organizations must meet certain criteria. These criteria vary depending on the type of exemption being claimed, but generally, they include:

- Being a registered business or organization in the state of Texas

- Having a valid sales tax permit or exemption certificate

- Making purchases that are exempt from sales tax under Texas law

Types of Sales Tax Exemptions in Texas

There are several types of sales tax exemptions available in Texas, including:

- Exemptions for certain types of businesses, such as non-profit organizations and government agencies

- Exemptions for specific types of products, such as groceries and medicine

- Exemptions for purchases made for resale or use in a manufacturing process

Completing Comptroller Form 50-283

Completing Comptroller Form 50-283 is a straightforward process that requires businesses and organizations to provide certain information about their exemption claim. The form must be completed in its entirety and signed by the purchaser or their authorized representative.

The form requires the following information:

- The name and address of the purchaser

- The name and address of the seller

- A description of the items being purchased

- The reason for the exemption claim

Common Mistakes to Avoid When Completing Form 50-283

When completing Comptroller Form 50-283, there are several common mistakes to avoid. These include:

- Failing to complete the form in its entirety

- Providing inaccurate or incomplete information

- Failing to sign the form

- Submitting the form late or after the exemption period has expired

Consequences of Failing to Comply with Sales Tax Exemption Requirements

Failing to comply with sales tax exemption requirements can have serious consequences for businesses and organizations. These consequences may include:

- Loss of exemption status

- Assessment of penalties and interest

- Audit and examination by the Comptroller's office

Best Practices for Managing Sales Tax Exemptions in Texas

To avoid these consequences and ensure compliance with sales tax exemption requirements, businesses and organizations should follow best practices for managing sales tax exemptions in Texas. These best practices include:

- Maintaining accurate and complete records of exemption claims

- Regularly reviewing and updating exemption certificates

- Ensuring that all employees understand the exemption process

- Seeking guidance from the Comptroller's office or a qualified tax professional when needed

Conclusion and Next Steps

In conclusion, Comptroller Form 50-283 is a critical document for businesses and organizations claiming sales tax exemptions in Texas. By understanding the requirements and best practices for managing sales tax exemptions, businesses can reduce their tax liability and increase their bottom line. If you have any questions or concerns about sales tax exemptions in Texas, we encourage you to seek guidance from the Comptroller's office or a qualified tax professional.

We hope this guide has provided valuable insights into the world of sales tax exemptions in Texas. If you have any comments or questions, please don't hesitate to reach out. We'd love to hear from you!

FAQ Section:

What is the purpose of Comptroller Form 50-283?

+Comptroller Form 50-283 is used to certify that a particular purchase is exempt from sales tax.

Who is eligible for sales tax exemptions in Texas?

+Businesses and organizations that meet certain criteria, including being a registered business or organization in the state of Texas and having a valid sales tax permit or exemption certificate.

What are the consequences of failing to comply with sales tax exemption requirements?

+The consequences of failing to comply with sales tax exemption requirements may include loss of exemption status, assessment of penalties and interest, and audit and examination by the Comptroller's office.