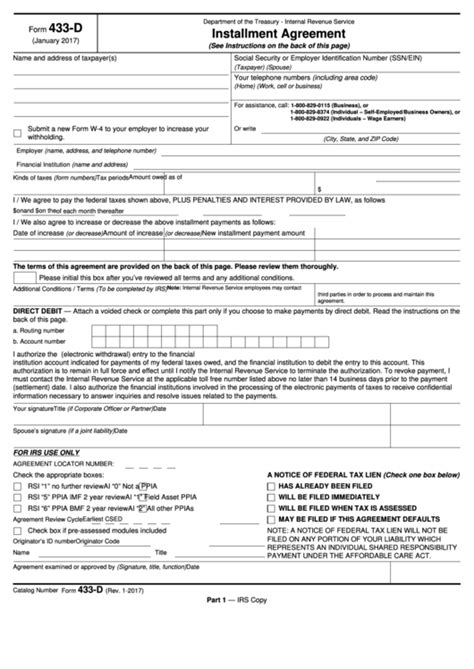

The Fillable Form 433-D, also known as the Installment Agreement, is a crucial document used by the Internal Revenue Service (IRS) to establish a payment plan for taxpayers who are unable to pay their tax debts in full. Completing this form correctly is essential to avoid any delays or rejections of your installment agreement request. In this article, we will provide a comprehensive guide on how to fill out the Form 433-D accurately.

Understanding the Purpose of Form 433-D

The primary purpose of Form 433-D is to provide the IRS with financial information about your income, expenses, assets, and liabilities. This information helps the IRS determine your ability to pay your tax debt and establish a suitable payment plan. By completing this form correctly, you can avoid additional penalties and interest on your tax debt.

Benefits of Filing Form 433-D

Filing Form 433-D offers several benefits to taxpayers, including:

- Avoiding additional penalties and interest on your tax debt

- Establishing a manageable payment plan that fits your financial situation

- Preventing the IRS from placing a lien on your assets or garnishing your wages

- Allowing you to make monthly payments towards your tax debt

Step-by-Step Guide to Completing Form 433-D

To ensure that your Form 433-D is completed correctly, follow these steps:

Section 1: Taxpayer Information

- Provide your name, address, and social security number or Employer Identification Number (EIN)

- List all tax years for which you owe taxes

Section 2: Income

- Report all sources of income, including wages, salaries, tips, and self-employment income

- Provide documentation to support your income, such as pay stubs or tax returns

Section 3: Expenses

- List all monthly expenses, including rent/mortgage, utilities, food, transportation, and minimum payments on debts

- Provide documentation to support your expenses, such as receipts or invoices

Section 4: Assets

- List all assets, including cash, savings, investments, and property

- Provide documentation to support the value of your assets, such as appraisals or bank statements

Section 5: Liabilities

- List all debts, including credit cards, loans, and mortgages

- Provide documentation to support the amount of your liabilities, such as statements or invoices

Section 6: Payment Proposal

- Based on your income, expenses, assets, and liabilities, propose a monthly payment amount

- Provide a schedule of payments, including the date and amount of each payment

Common Mistakes to Avoid When Completing Form 433-D

When completing Form 433-D, it's essential to avoid common mistakes that can lead to delays or rejections of your installment agreement request. Some common mistakes include:

- Inaccurate or incomplete information

- Failure to provide supporting documentation

- Proposing a payment amount that is not affordable

- Not signing and dating the form

Consequences of Inaccurate or Incomplete Information

Providing inaccurate or incomplete information on Form 433-D can lead to severe consequences, including:

- Rejection of your installment agreement request

- Additional penalties and interest on your tax debt

- Collection activities, such as liens or garnishments

Seeking Professional Help

Completing Form 433-D can be a complex and time-consuming process. If you're unsure about how to fill out the form or need help with the installment agreement process, consider seeking professional help from a tax attorney or enrolled agent.

Benefits of Professional Help

Seeking professional help can offer several benefits, including:

- Ensuring that your Form 433-D is completed accurately and correctly

- Negotiating with the IRS on your behalf

- Providing guidance on the installment agreement process

Conclusion

Completing Form 433-D correctly is crucial to establishing a manageable payment plan for your tax debt. By following the steps outlined in this guide and avoiding common mistakes, you can ensure that your installment agreement request is approved. Remember to seek professional help if you're unsure about the process or need guidance on completing the form.

What is the purpose of Form 433-D?

+Form 433-D is used to establish a payment plan for taxpayers who are unable to pay their tax debts in full.

What information do I need to provide on Form 433-D?

+You need to provide information about your income, expenses, assets, and liabilities, as well as propose a monthly payment amount.

What happens if I make a mistake on Form 433-D?

+Mistakes on Form 433-D can lead to delays or rejections of your installment agreement request, as well as additional penalties and interest on your tax debt.