Filing a 3949a form can be a daunting task, especially for those who are new to the process. The 3949a form is used by the Internal Revenue Service (IRS) to report suspected tax scams and identity theft. It is essential to fill out this form correctly to ensure that your report is processed efficiently and effectively. In this article, we will guide you through the 5 steps to file a 3949a form successfully.

Step 1: Gather Required Information and Documents Before you start filling out the 3949a form, you need to gather all the necessary information and documents. This includes:

- Your name and Social Security number or Individual Taxpayer Identification Number (ITIN)

- The name and Social Security number or ITIN of the person or business you are reporting

- A detailed description of the suspected tax scam or identity theft

- Any supporting documentation, such as receipts, invoices, or correspondence with the suspect

Having all the required information and documents ready will make the process of filling out the form much easier and less time-consuming.

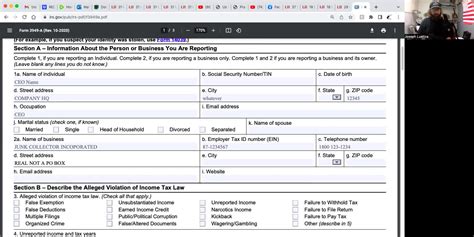

Step 2: Download and Fill Out the 3949a Form The 3949a form is available on the IRS website. You can download the form and fill it out electronically or print it out and fill it out by hand.

When filling out the form, make sure to provide clear and concise information. Use black ink and print legibly if you are filling out the form by hand.

Step 3: Complete Section 1-5 of the 3949a Form The 3949a form is divided into five sections. Make sure to complete all the sections accurately and thoroughly.

- Section 1: Report of Suspected Tax Scam or Identity Theft

- Section 2: Information About the Suspect

- Section 3: Information About the Victim (if applicable)

- Section 4: Description of the Suspected Tax Scam or Identity Theft

- Section 5: Additional Information and Comments

Step 4: Sign and Date the 3949a Form Once you have completed the form, sign and date it. Make sure to sign your name exactly as it appears on your Social Security card or ITIN.

Step 5: Submit the 3949a Form to the IRS Finally, submit the completed 3949a form to the IRS. You can mail it to the address listed on the form or fax it to the number provided.

It's essential to keep a copy of the completed form for your records.

By following these 5 steps, you can ensure that your 3949a form is filed successfully. Remember to report any suspected tax scams or identity theft to the IRS as soon as possible to prevent further damage.

Tips and Reminders

- Report suspected tax scams or identity theft to the IRS as soon as possible

- Keep a copy of the completed 3949a form for your records

- Provide clear and concise information on the form

- Use black ink and print legibly if filling out the form by hand

- Sign and date the form exactly as it appears on your Social Security card or ITIN

FAQ Section

What is the 3949a form used for?

+The 3949a form is used to report suspected tax scams and identity theft to the IRS.

Where can I download the 3949a form?

+The 3949a form is available on the IRS website.

How do I submit the completed 3949a form to the IRS?

+You can mail the completed form to the address listed on the form or fax it to the number provided.

We hope this article has provided you with the necessary information to file a 3949a form successfully. Remember to report any suspected tax scams or identity theft to the IRS as soon as possible to prevent further damage.