The concept of power of attorney (POA) is crucial in ensuring that an individual's financial and personal affairs are managed effectively in the event of incapacitation or unavailability. Fidelity, a well-established financial services company, provides a POA form that enables clients to appoint a trusted representative to handle their accounts and assets. In this article, we will delve into the Fidelity Power of Attorney form, its significance, and the key aspects you should be aware of.

Understanding the Importance of Power of Attorney

In today's fast-paced world, unexpected events can occur at any time, leaving individuals unable to manage their finances or make important decisions. A power of attorney is a vital document that allows you to appoint a trusted individual, known as the attorney-in-fact or agent, to act on your behalf. This ensures that your financial affairs are handled efficiently, and your wishes are respected.

What is a Fidelity Power of Attorney Form?

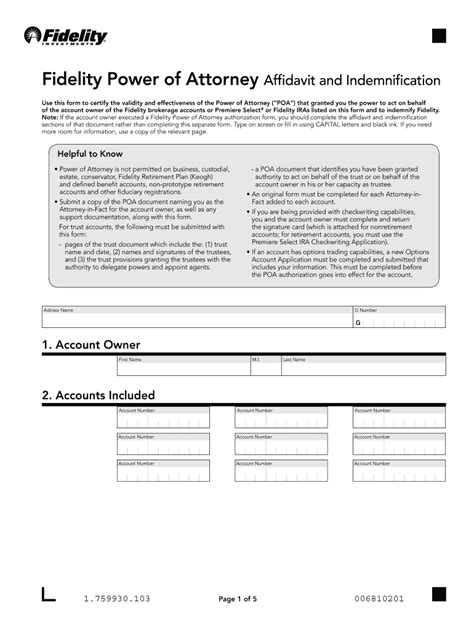

A Fidelity Power of Attorney form is a specific type of POA document designed for Fidelity clients. This form enables you to appoint an attorney-in-fact to manage your Fidelity accounts, including brokerage accounts, retirement accounts, and other investment accounts. The form outlines the scope of authority granted to the attorney-in-fact, ensuring that they can make informed decisions on your behalf.

Key Components of the Fidelity Power of Attorney Form

The Fidelity Power of Attorney form typically includes the following essential components:

- Grantor Information: Your name, address, and contact information as the grantor (the individual granting the power of attorney).

- Attorney-in-Fact Information: The name, address, and contact information of the individual you are appointing as your attorney-in-fact.

- Scope of Authority: A clear outline of the powers granted to the attorney-in-fact, including the ability to manage your Fidelity accounts, make transactions, and access account information.

- Effective Date: The date when the power of attorney becomes effective.

- Termination: The conditions under which the power of attorney will terminate, such as your death, incapacitation, or revocation.

- Signatures: Your signature as the grantor and the signature of the attorney-in-fact, acknowledging acceptance of the appointment.

Types of Fidelity Power of Attorney Forms

Fidelity offers two primary types of power of attorney forms:

- Durable Power of Attorney: This type of POA remains in effect even if you become incapacitated or unable to manage your affairs.

- Non-Durable Power of Attorney: This type of POA becomes ineffective if you become incapacitated or unable to manage your affairs.

Benefits of Using a Fidelity Power of Attorney Form

Using a Fidelity Power of Attorney form provides numerous benefits, including:

- Convenience: Appointing an attorney-in-fact allows you to ensure that your financial affairs are managed efficiently, even if you are unavailable.

- Peace of Mind: Knowing that your affairs are in good hands can provide peace of mind, especially during uncertain times.

- Flexibility: A Fidelity Power of Attorney form enables you to customize the scope of authority granted to your attorney-in-fact, ensuring that your specific needs are met.

Potential Risks and Considerations

While a Fidelity Power of Attorney form can be a valuable tool, it's essential to consider the potential risks and limitations:

- Abuse of Power: There is a risk that the attorney-in-fact may abuse their authority or act in their own interests rather than yours.

- Confidentiality: Your attorney-in-fact will have access to your confidential information, including account details and financial data.

- Tax Implications: Depending on the scope of authority granted, there may be tax implications to consider, such as gift taxes or estate taxes.

How to Complete and Submit the Fidelity Power of Attorney Form

To complete and submit the Fidelity Power of Attorney form, follow these steps:

- Obtain the Form: Download the Fidelity Power of Attorney form from the Fidelity website or request a copy from a Fidelity representative.

- Complete the Form: Fill out the form carefully, ensuring that all necessary information is accurate and complete.

- Sign the Form: Sign the form as the grantor, and have the attorney-in-fact sign the form as well.

- Submit the Form: Submit the completed form to Fidelity, either by mail or online, depending on the specified submission method.

Conclusion

A Fidelity Power of Attorney form is a vital document that enables you to appoint a trusted representative to manage your financial affairs in the event of incapacitation or unavailability. By understanding the key components, benefits, and potential risks of this form, you can ensure that your financial well-being is protected. If you have any questions or concerns about the Fidelity Power of Attorney form, it's recommended that you consult with a Fidelity representative or a qualified attorney.

Call to Action

We encourage you to share your thoughts and experiences with power of attorney forms in the comments section below. If you have any questions or concerns about the Fidelity Power of Attorney form, please don't hesitate to ask. Additionally, if you found this article informative and helpful, please share it with your friends and family who may benefit from this information.

What is a Fidelity Power of Attorney form?

+A Fidelity Power of Attorney form is a document that allows you to appoint a trusted representative to manage your Fidelity accounts and financial affairs in the event of incapacitation or unavailability.

What are the key components of a Fidelity Power of Attorney form?

+The key components of a Fidelity Power of Attorney form include grantor information, attorney-in-fact information, scope of authority, effective date, termination, and signatures.

What are the benefits of using a Fidelity Power of Attorney form?

+The benefits of using a Fidelity Power of Attorney form include convenience, peace of mind, and flexibility in managing your financial affairs.