The Federal Communications Commission (FCC) requires certain telecommunications companies to file Form 499, also known as the Telecommunications Reporting Worksheet. This form is used to assess and collect fees for various telecommunications services, including wireline and wireless voice services, broadband Internet access, and other forms of communication. For companies that must file Form 499, the process can seem daunting, especially for those who are new to the FCC's regulations. In this article, we will provide five tips for filing FCC Form 499 accurately and efficiently.

Understanding FCC Form 499 Requirements

Before we dive into the tips, it's essential to understand the requirements for filing FCC Form 499. The FCC requires companies that provide telecommunications services to file this form on a quarterly basis. The form is used to calculate the company's contribution to the Universal Service Fund (USF), which supports various telecommunications services, including low-income and rural broadband initiatives.

Tips for Filing FCC Form 499

Tip 1: Gather Accurate Data

To file FCC Form 499 accurately, you need to gather accurate data on your company's telecommunications services. This includes information on your revenue, customer base, and services offered. Ensure that you have a system in place to track this data throughout the quarter, so you can easily retrieve it when filing the form.

Types of Data Required

- Revenue data: You need to report your company's revenue from telecommunications services, including voice services, broadband Internet access, and other forms of communication.

- Customer data: You must report the number of customers you have for each service, including the number of wireline and wireless voice customers, broadband Internet access customers, and other types of customers.

- Service data: You need to report the types of services you offer, including voice services, broadband Internet access, and other forms of communication.

Tip 2: Understand the Filing Schedule

The FCC requires companies to file Form 499 on a quarterly basis. The filing schedule is as follows:

- April 1: File Form 499 for the first quarter (January 1 - March 31)

- July 1: File Form 499 for the second quarter (April 1 - June 30)

- October 1: File Form 499 for the third quarter (July 1 - September 30)

- January 1: File Form 499 for the fourth quarter (October 1 - December 31)

Tip 3: Use the Correct Form

The FCC offers two versions of Form 499: the Telecommunications Reporting Worksheet (FCC Form 499) and the Telecommunications Reporting Worksheet for International Carriers (FCC Form 499-A). Ensure that you use the correct form for your company's specific needs.

Differences Between Forms

- FCC Form 499: This form is used by domestic telecommunications companies to report their revenue and customer data.

- FCC Form 499-A: This form is used by international telecommunications companies to report their revenue and customer data.

Tip 4: Take Advantage of Online Filing

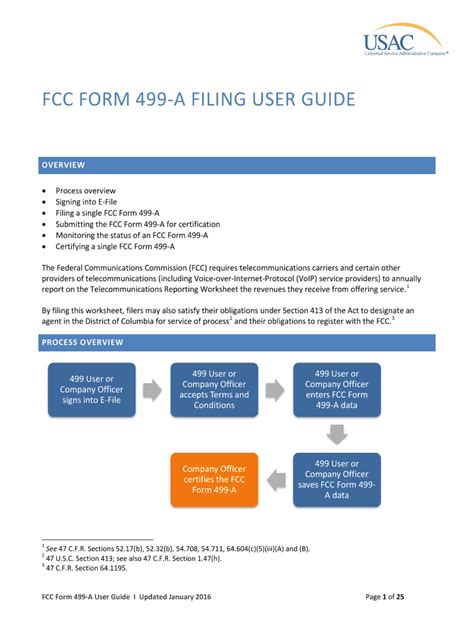

The FCC offers an online filing system for Form 499, which makes it easier and more efficient to file the form. The online system allows you to upload your data and submit the form electronically.

Tip 5: Seek Professional Help If Needed

If you're new to filing FCC Form 499 or need help with the process, consider seeking professional help. The FCC offers resources and guidance on its website, and you can also hire a telecommunications consultant to assist with the filing process.

Benefits of Professional Help

- Accurate filing: A professional can ensure that your form is filed accurately and on time, reducing the risk of errors and penalties.

- Compliance: A professional can help you comply with FCC regulations and ensure that you're meeting all the requirements for filing Form 499.

- Time-saving: A professional can save you time and effort by handling the filing process for you.

By following these tips, you can ensure that your company files FCC Form 499 accurately and efficiently. Remember to gather accurate data, understand the filing schedule, use the correct form, take advantage of online filing, and seek professional help if needed.

What is FCC Form 499?

+FCC Form 499 is a quarterly filing requirement for telecommunications companies to report their revenue and customer data to the Federal Communications Commission (FCC).

Who needs to file FCC Form 499?

+Telecommunications companies that provide voice services, broadband Internet access, and other forms of communication need to file FCC Form 499.

What is the deadline for filing FCC Form 499?

+The deadline for filing FCC Form 499 is quarterly, with the following due dates: April 1, July 1, October 1, and January 1.