As the telecommunications industry continues to evolve, the Federal Communications Commission (FCC) plays a crucial role in regulating and overseeing the sector. One of the key tools used by the FCC to monitor and collect data from telecommunications providers is the FCC Form 499. In this article, we will delve into the world of FCC Form 499, exploring its importance, requirements, and benefits.

What is FCC Form 499?

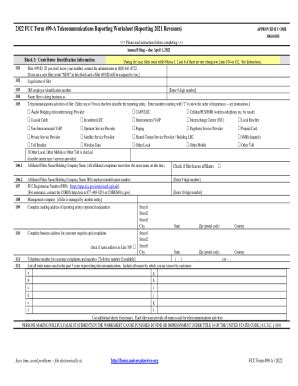

FCC Form 499 is a quarterly report filed by telecommunications providers to the FCC's Wireline Competition Bureau. The form collects data on telecommunications revenues, expenses, and other financial information. The data collected through this form is used to assess and distribute fees, as well as to monitor industry trends and competition.

Why is FCC Form 499 important?

FCC Form 499 plays a critical role in the FCC's efforts to regulate and oversee the telecommunications industry. The data collected through this form is used to:

- Assess fees and contributions to the Universal Service Fund (USF)

- Monitor industry trends and competition

- Inform policy decisions and rulemaking

- Ensure compliance with FCC regulations and requirements

Who must file FCC Form 499?

FCC Form 499 must be filed by all telecommunications providers that provide interstate telecommunications services. This includes:

- Incumbent Local Exchange Carriers (ILECs)

- Competitive Local Exchange Carriers (CLECs)

- Wireless carriers

- Cable providers

- Internet Service Providers (ISPs)

- Other telecommunications providers

What information must be reported on FCC Form 499?

FCC Form 499 requires telecommunications providers to report a range of financial and operational data, including:

- Revenues and expenses

- Number of subscribers and lines

- Minutes of use

- Data on international traffic

- Other financial and operational information

Benefits of filing FCC Form 499

While filing FCC Form 499 may seem like a burdensome task, there are several benefits to doing so, including:

- Compliance with FCC regulations and requirements

- Access to Universal Service Fund (USF) support

- Opportunities for funding and grants

- Enhanced transparency and accountability

- Improved industry data and trends analysis

How to file FCC Form 499

FCC Form 499 must be filed electronically through the FCC's Electronic Filing System (EFS). The form must be filed on a quarterly basis, with deadlines typically falling on the 15th of February, May, August, and November.

Tips and best practices for filing FCC Form 499

To ensure accurate and timely filing of FCC Form 499, follow these tips and best practices:

- Review FCC regulations and requirements carefully

- Use the FCC's Electronic Filing System (EFS) for electronic filing

- Ensure accuracy and completeness of reported data

- Keep records and documentation of reported data

- Seek guidance from the FCC or a qualified consultant if needed

Common mistakes to avoid when filing FCC Form 499

To avoid errors and ensure accurate filing of FCC Form 499, be aware of the following common mistakes:

- Inaccurate or incomplete data

- Late or missed filings

- Failure to report changes or updates

- Inadequate record-keeping and documentation

- Failure to seek guidance when needed

Conclusion and next steps

In conclusion, FCC Form 499 is a critical tool used by the FCC to monitor and regulate the telecommunications industry. By understanding the importance, requirements, and benefits of filing this form, telecommunications providers can ensure compliance and access valuable resources and support.

We invite you to share your experiences and insights on filing FCC Form 499 in the comments below. Additionally, if you have any questions or concerns, please don't hesitate to reach out to us.

What is the purpose of FCC Form 499?

+The purpose of FCC Form 499 is to collect data on telecommunications revenues, expenses, and other financial information from telecommunications providers.

Who must file FCC Form 499?

+FCC Form 499 must be filed by all telecommunications providers that provide interstate telecommunications services.

What information must be reported on FCC Form 499?

+FCC Form 499 requires telecommunications providers to report a range of financial and operational data, including revenues and expenses, number of subscribers and lines, minutes of use, and other financial and operational information.