The world of real estate investing can be complex, especially when it comes to navigating the tax implications of buying and selling properties. One powerful tool that investors use to defer capital gains taxes is the like-kind exchange, also known as a 1031 exchange. To facilitate this process, the IRS requires investors to file Form 8824, which can be a daunting task for those unfamiliar with the process. In this article, we will delve into the world of like-kind exchanges, provide a filled Form 8824 example, and offer guidance on how to navigate this complex tax strategy.

Understanding Like-Kind Exchanges

A like-kind exchange is a tax-deferred exchange of one investment property for another of similar nature and value. This strategy allows investors to swap one property for another without recognizing capital gains, thereby deferring taxes that would otherwise be due. Like-kind exchanges are subject to specific rules and requirements, and the IRS requires investors to file Form 8824 to report these transactions.

The Importance of Form 8824

Form 8824 is a crucial document that investors must file with the IRS to report like-kind exchanges. The form requires detailed information about the properties involved in the exchange, including their value, acquisition dates, and sale dates. Accurate completion of Form 8824 is essential to ensure that the exchange is properly documented and that taxes are deferred correctly.

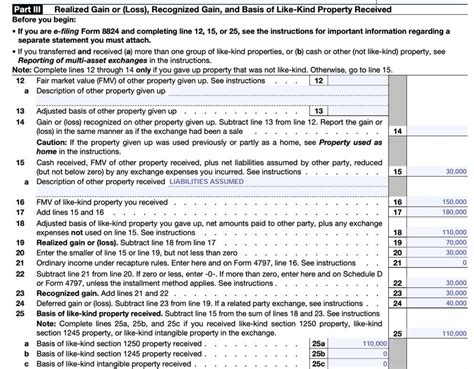

Filled Form 8824 Example

To illustrate how to complete Form 8824, let's consider an example. Suppose John, a real estate investor, wants to exchange a rental property he owns in California for a similar property in Florida. The California property, which John has owned for five years, has a fair market value of $500,000. The Florida property, which John will acquire through the exchange, has a fair market value of $525,000.

Here's a filled Form 8824 example for John's like-kind exchange:

Section 1: Property Identification

- Property 1 (California rental property):

- Description: Single-family residence

- Address: 123 Main St, Anytown, CA

- Date acquired: January 1, 2018

- Fair market value: $500,000

- Property 2 (Florida replacement property):

- Description: Single-family residence

- Address: 456 Ocean Dr, Miami, FL

- Date acquired: June 1, 2023

- Fair market value: $525,000

Section 2: Exchange Information

- Date of exchange: June 1, 2023

- Type of exchange: Like-kind exchange (Section 1031)

- Boot received: $0 (no cash or other non-like-kind property received)

Section 3: Gain or Loss

- Recognized gain: $0 (deferred through like-kind exchange)

- Recognized loss: $0 (no loss recognized)

Section 4: Basis

- Basis of Property 1 (California rental property): $350,000 (original purchase price plus improvements)

- Basis of Property 2 (Florida replacement property): $375,000 (fair market value minus boot received)

Section 5: Statement

- Explanation of exchange: "Like-kind exchange of California rental property for Florida replacement property, pursuant to Section 1031 of the Internal Revenue Code."

Tips for Completing Form 8824

- Ensure accurate property identification, including addresses and descriptions.

- Verify the dates of acquisition and sale for both properties.

- Calculate the fair market value of both properties correctly.

- Report any boot received or recognized gain or loss accurately.

- Maintain detailed records of the exchange, including appraisals and settlement statements.

Common Mistakes to Avoid

- Failing to file Form 8824 or filing it late can result in penalties and interest.

- Inaccurate or incomplete information can lead to audit issues or disqualification of the exchange.

- Failure to report boot received or recognized gain or loss can result in tax liabilities.

Conclusion

Like-kind exchanges can be a powerful tax strategy for real estate investors, but they require careful planning and documentation. Form 8824 is a critical component of this process, and accurate completion is essential to ensure that taxes are deferred correctly. By following the example provided and tips outlined in this article, investors can navigate the complexities of Form 8824 and ensure a successful like-kind exchange.

Call to Action

If you're considering a like-kind exchange or need assistance with completing Form 8824, consult with a qualified tax professional or real estate expert. Don't hesitate to ask questions or seek guidance to ensure that your exchange is properly documented and that taxes are deferred correctly.

FAQ Section

What is a like-kind exchange?

+A like-kind exchange is a tax-deferred exchange of one investment property for another of similar nature and value, allowing investors to swap one property for another without recognizing capital gains.

What is Form 8824?

+Form 8824 is a document filed with the IRS to report like-kind exchanges, requiring detailed information about the properties involved, including their value, acquisition dates, and sale dates.

What are the benefits of a like-kind exchange?

+Like-kind exchanges allow investors to defer capital gains taxes, freeing up funds for future investments and reducing tax liabilities.