The importance of insurance verification cannot be overstated. It is a crucial step in ensuring that patients receive the medical care they need while also protecting healthcare providers from financial losses. One of the most significant challenges healthcare providers face is navigating the complex process of insurance verification. This is where the Evenity Insurance Verification Form comes in – a streamlined solution designed to simplify the verification process.

In today's fast-paced healthcare environment, efficient insurance verification is more critical than ever. Delays in verifying insurance coverage can lead to delayed treatments, reduced patient satisfaction, and even financial losses for healthcare providers. By implementing a simple and effective insurance verification process, healthcare providers can reduce administrative burdens, minimize errors, and focus on what matters most – delivering quality patient care.

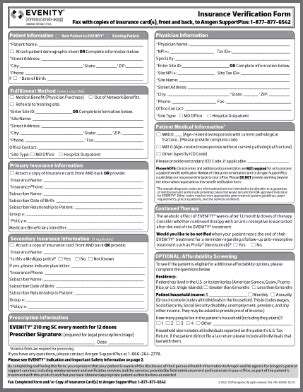

With the Evenity Insurance Verification Form, healthcare providers can ensure accurate and efficient verification of patient insurance coverage. In this article, we will break down the 5 easy steps to complete the Evenity Insurance Verification Form, making it easier for healthcare providers to navigate the process.

Step 1: Gather Patient Information

The first step in completing the Evenity Insurance Verification Form is to gather accurate patient information. This includes the patient's name, date of birth, policy number, and insurance provider. It is essential to ensure that all information is accurate and up-to-date to avoid any errors or delays in the verification process.

- Patient's name (as it appears on the insurance card)

- Date of birth

- Policy number

- Insurance provider

- Contact information (phone number and email)

Best Practices for Gathering Patient Information

- Verify patient information at every visit to ensure accuracy

- Use electronic health records (EHRs) to streamline data collection

- Train staff to accurately collect and record patient information

Step 2: Complete the Insurance Verification Form

Once you have gathered the necessary patient information, the next step is to complete the Evenity Insurance Verification Form. This form is designed to capture all the required information to verify patient insurance coverage.

- Patient demographics (name, date of birth, policy number)

- Insurance provider information (name, phone number, fax number)

- Verification questions (coverage type, policy effective date, copayment)

Tips for Completing the Insurance Verification Form

- Ensure all fields are completed accurately and thoroughly

- Use clear and legible handwriting

- Attach supporting documentation (insurance cards, identification) as needed

Step 3: Submit the Verification Request

After completing the Evenity Insurance Verification Form, the next step is to submit the verification request to the insurance provider. This can be done via phone, fax, or online portal, depending on the insurance provider's requirements.

- Verify the insurance provider's contact information

- Submit the verification request with all required documentation

- Follow up with the insurance provider to ensure timely response

Best Practices for Submitting Verification Requests

- Use a secure and reliable method for submitting verification requests

- Track and follow up on verification requests to ensure timely response

- Document all communication with the insurance provider

Step 4: Review and Verify Coverage

Once the verification request is submitted, the next step is to review and verify the patient's insurance coverage. This involves reviewing the response from the insurance provider to confirm coverage details.

- Review the verification response for accuracy and completeness

- Verify coverage details (coverage type, policy effective date, copayment)

- Update patient records with verified coverage information

Tips for Reviewing and Verifying Coverage

- Verify coverage details against the patient's insurance card

- Document any discrepancies or issues with coverage

- Update patient records promptly to ensure accurate billing

Step 5: Document and Store Verification Records

The final step in completing the Evenity Insurance Verification Form is to document and store verification records. This involves maintaining accurate and up-to-date records of patient insurance verification.

- Document all verification requests and responses

- Store verification records securely and in accordance with HIPAA regulations

- Retain verification records for a minimum of 3 years

Best Practices for Documenting and Storing Verification Records

- Use electronic health records (EHRs) to store verification records

- Ensure verification records are easily accessible and retrievable

- Train staff on the importance of maintaining accurate and secure verification records

By following these 5 easy steps, healthcare providers can ensure accurate and efficient verification of patient insurance coverage using the Evenity Insurance Verification Form. By implementing a simple and effective insurance verification process, healthcare providers can reduce administrative burdens, minimize errors, and focus on what matters most – delivering quality patient care.

We encourage you to share your experiences and tips for completing the Evenity Insurance Verification Form in the comments section below. Your feedback and insights can help others navigate the insurance verification process more efficiently.

What is the purpose of the Evenity Insurance Verification Form?

+The Evenity Insurance Verification Form is designed to simplify the insurance verification process for healthcare providers. It captures all the required information to verify patient insurance coverage, reducing administrative burdens and minimizing errors.

How long does the insurance verification process typically take?

+The insurance verification process can take anywhere from a few minutes to several hours, depending on the insurance provider's response time and the complexity of the verification request.

What are the benefits of using the Evenity Insurance Verification Form?

+The Evenity Insurance Verification Form offers several benefits, including reduced administrative burdens, minimized errors, and improved patient satisfaction. It also enables healthcare providers to focus on delivering quality patient care.