Understanding tax documents can be a daunting task, especially for those new to investing or tax season. The Etrade Consolidated 1099 form is one such document that can leave many feeling overwhelmed. However, with the right guidance, navigating this form can become a much more manageable task. In this article, we will break down the Etrade Consolidated 1099 form into smaller, more digestible parts, and provide you with five tips to help you better understand it.

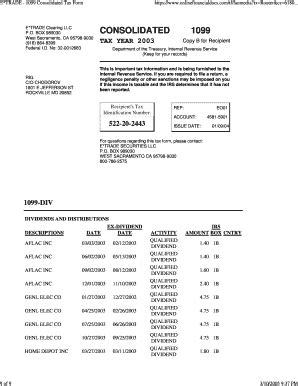

The Etrade Consolidated 1099 form is a comprehensive tax document that reports all of your investment income earned through Etrade, a popular online brokerage firm. This form is usually mailed to investors by mid-February and is also available online through the Etrade website. It's essential to carefully review this document, as it contains critical information that will help you accurately report your investment income on your tax return.

Tip 1: Understand the Different Boxes and Sections

The Etrade Consolidated 1099 form is divided into several boxes and sections, each containing specific information about your investment income. Here's a brief overview of what you can expect to find in each section:

- Box 1: Interest Income: This section reports the interest income earned from your investments, such as bonds, CDs, and money market accounts.

- Box 2: Dividend Income: This section reports the dividend income earned from your stock investments.

- Box 3: Capital Gains and Losses: This section reports the gains and losses from the sale of your investments, such as stocks, bonds, and mutual funds.

- Box 5: Non-Dividend Distributions: This section reports any non-dividend distributions, such as return of capital or redemption of shares.

Tip 2: Reconcile Your 1099 Form with Your Account Statements

It's essential to reconcile your Etrade Consolidated 1099 form with your account statements to ensure accuracy. Compare the information on your 1099 form with your account statements, and verify that the amounts match. If you notice any discrepancies, contact Etrade customer support to resolve the issue.

Tip 3: Report Taxable Income Accurately

The Etrade Consolidated 1099 form reports taxable income, which must be accurately reported on your tax return. Make sure to report the correct amounts in the corresponding sections of your tax return. For example, report interest income in Box 1 on Schedule 1 (Form 1040), and dividend income in Box 2 on Schedule 1 (Form 1040).

Tip 4: Take Advantage of Tax-Loss Harvesting

The Etrade Consolidated 1099 form reports capital gains and losses. If you have incurred losses, you can use tax-loss harvesting to offset gains from other investments. This strategy involves selling losing investments to realize losses, which can then be used to offset gains from other investments.

Tip 5: Seek Professional Help When Needed

Understanding the Etrade Consolidated 1099 form can be complex, and it's essential to seek professional help when needed. If you're unsure about how to report your investment income or have questions about the form, consider consulting a tax professional or financial advisor.

In conclusion, understanding the Etrade Consolidated 1099 form requires attention to detail and a basic understanding of tax reporting. By following these five tips, you'll be better equipped to navigate this complex document and accurately report your investment income on your tax return.

We encourage you to share your experiences with the Etrade Consolidated 1099 form in the comments below. Have you had any challenges understanding this form? How do you ensure accuracy when reporting your investment income?

Frequently Asked Questions

What is the Etrade Consolidated 1099 form?

+The Etrade Consolidated 1099 form is a tax document that reports investment income earned through Etrade, a popular online brokerage firm.

How do I reconcile my 1099 form with my account statements?

+Compare the information on your 1099 form with your account statements, and verify that the amounts match. If you notice any discrepancies, contact Etrade customer support to resolve the issue.

What is tax-loss harvesting?

+Tax-loss harvesting is a strategy that involves selling losing investments to realize losses, which can then be used to offset gains from other investments.