The Electronic C5 Form, also known as the Certificate of Registration for Tax Compliance, is a crucial document for individuals and businesses operating in Jamaica. The form is used to register for tax compliance and to obtain a Tax Registration Number (TRN). In this article, we will provide a step-by-step guide on how to download the Electronic C5 Form Jamaica.

Importance of the Electronic C5 Form

The Electronic C5 Form is an essential document for anyone doing business in Jamaica. It is required for tax compliance and is used to register for a TRN. The TRN is a unique identifier assigned to individuals and businesses that are registered for tax purposes. It is used to identify taxpayers and to track their tax obligations.

Benefits of the Electronic C5 Form

There are several benefits to using the Electronic C5 Form. These include:

- Convenience: The Electronic C5 Form can be completed and submitted online, making it a convenient option for individuals and businesses.

- Speed: The Electronic C5 Form is processed quickly, and taxpayers can receive their TRN in a matter of minutes.

- Accuracy: The Electronic C5 Form reduces the risk of errors, as it is designed to ensure that all required information is provided.

Step-By-Step Guide to Downloading the Electronic C5 Form

Downloading the Electronic C5 Form is a straightforward process. Here are the steps to follow:

Step 1: Visit the Tax Administration Jamaica Website

To download the Electronic C5 Form, you will need to visit the Tax Administration Jamaica website at .

Step 2: Click on the "Forms" Tab

Once you are on the Tax Administration Jamaica website, click on the "Forms" tab.

Step 3: Select the Electronic C5 Form

From the list of available forms, select the Electronic C5 Form.

Step 4: Click on the "Download" Button

Click on the "Download" button to download the Electronic C5 Form.

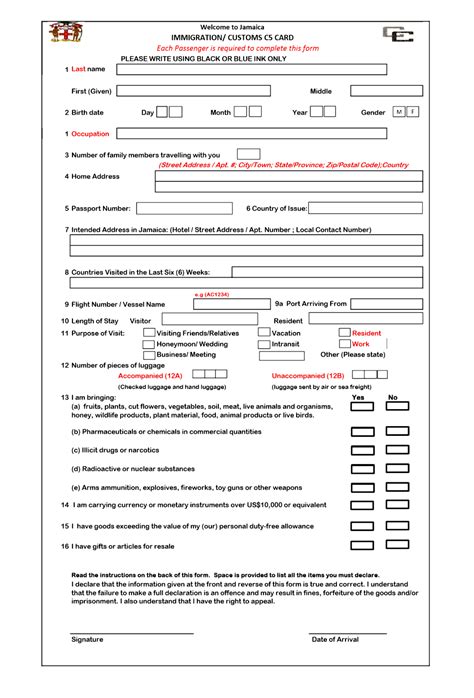

Completing the Electronic C5 Form

Once you have downloaded the Electronic C5 Form, you will need to complete it. Here are the steps to follow:

Step 1: Provide Personal and Business Information

Provide your personal and business information, including your name, address, and business name.

Step 2: Provide Tax Information

Provide your tax information, including your TRN and tax filing status.

Step 3: Attach Supporting Documents

Attach supporting documents, including proof of identity and proof of business registration.

Step 4: Submit the Form

Submit the completed form and supporting documents online.

Frequently Asked Questions

Here are some frequently asked questions about the Electronic C5 Form:

What is the Electronic C5 Form?

The Electronic C5 Form is a digital version of the Certificate of Registration for Tax Compliance.

Who needs to complete the Electronic C5 Form?

Individuals and businesses operating in Jamaica need to complete the Electronic C5 Form to register for tax compliance and to obtain a TRN.

How do I download the Electronic C5 Form?

You can download the Electronic C5 Form from the Tax Administration Jamaica website.

What information do I need to provide on the Electronic C5 Form?

You will need to provide personal and business information, tax information, and attach supporting documents.

What is the purpose of the Electronic C5 Form?

+The Electronic C5 Form is used to register for tax compliance and to obtain a Tax Registration Number (TRN).

How long does it take to process the Electronic C5 Form?

+The Electronic C5 Form is processed quickly, and taxpayers can receive their TRN in a matter of minutes.

Can I submit the Electronic C5 Form online?

+Yes, you can submit the Electronic C5 Form online through the Tax Administration Jamaica website.

We hope this article has provided you with a comprehensive guide on how to download the Electronic C5 Form Jamaica. If you have any further questions or need assistance with completing the form, please don't hesitate to contact us.