The Electronic Federal Tax Payment System (EFTPS) is a free service provided by the U.S. Department of the Treasury that allows individuals and businesses to pay their federal taxes online, by phone, or through the EFTPS website. One of the key features of EFTPS is the Direct Payment Worksheet, which helps taxpayers calculate and schedule their tax payments. In this article, we will guide you through the 5 easy steps to complete the EFTPS Direct Payment Worksheet Long Form.

Why Use the EFTPS Direct Payment Worksheet?

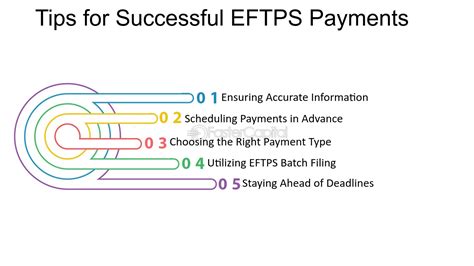

Before we dive into the steps, let's quickly discuss the benefits of using the EFTPS Direct Payment Worksheet. This worksheet is designed to help taxpayers accurately calculate their tax payments and avoid penalties. By using the worksheet, you can:

- Ensure accurate calculations and avoid math errors

- Schedule payments in advance to avoid late payment penalties

- Keep track of your payment history and upcoming payment due dates

- Easily make changes to your payment schedule as needed

Step 1: Gather Required Information

Before you start filling out the worksheet, gather the following information:

- Your tax return information, including your tax liability and any payments already made

- Your bank account information, including the routing number and account number

- Your payment schedule, including the payment frequency and due dates

Step 2: Calculate Your Total Tax Liability

Calculating Your Total Tax Liability

To calculate your total tax liability, you will need to refer to your tax return. Take note of the total amount of taxes you owe, including any interest and penalties.

- Use the tax return to calculate your total tax liability

- Make sure to include any interest and penalties

- Write down the total tax liability on the worksheet

Step 3: Determine Your Payment Frequency

Determining Your Payment Frequency

Next, you will need to determine your payment frequency. You can choose to make payments monthly, quarterly, or annually.

- Decide on a payment frequency that works best for you

- Consider your financial situation and cash flow

- Choose a frequency that will help you avoid late payment penalties

Step 4: Calculate Your Payment Amount

Calculating Your Payment Amount

Once you have determined your payment frequency, you will need to calculate your payment amount. To do this, divide your total tax liability by the number of payments you will make.

- Use the total tax liability and payment frequency to calculate the payment amount

- Make sure to round up to the nearest dollar to avoid underpayment

- Write down the payment amount on the worksheet

Step 5: Schedule Your Payments

Scheduling Your Payments

Finally, you will need to schedule your payments using the EFTPS system. You can do this online, by phone, or through the EFTPS website.

- Use the payment amount and frequency to schedule your payments

- Make sure to schedule payments for the correct due dates

- Keep track of your payment history and upcoming payment due dates

Additional Tips and Reminders

- Make sure to keep accurate records of your payment history and upcoming payment due dates

- Use the EFTPS system to make changes to your payment schedule as needed

- Consider setting up automatic payments to avoid late payment penalties

FAQs

What is the EFTPS Direct Payment Worksheet?

+The EFTPS Direct Payment Worksheet is a tool provided by the U.S. Department of the Treasury to help taxpayers calculate and schedule their tax payments.

How do I access the EFTPS Direct Payment Worksheet?

+You can access the EFTPS Direct Payment Worksheet by visiting the EFTPS website or by contacting the EFTPS customer service team.

What information do I need to complete the EFTPS Direct Payment Worksheet?

+You will need to gather your tax return information, bank account information, and payment schedule to complete the worksheet.

Take Action Today!

Don't wait until it's too late! Use the EFTPS Direct Payment Worksheet to calculate and schedule your tax payments today. With these 5 easy steps, you can ensure accurate calculations, avoid late payment penalties, and keep track of your payment history and upcoming payment due dates. Share this article with your friends and family to help them stay on top of their tax payments.