For many Filipinos, the Social Security System (SSS) is a vital component of their financial security and future plans. As a member of the SSS, it is essential to understand the various forms and procedures involved in managing your account. One crucial form that every SSS member should be familiar with is the E1 form, also known as the Personal Record Form. In this article, we will break down the E1 form and provide a step-by-step guide on how to fill it out and submit it to the SSS.

What is the E1 Form?

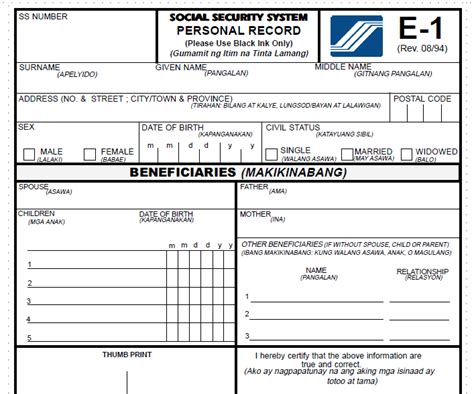

The E1 form, also known as the Personal Record Form, is a mandatory document that every SSS member must submit to the Social Security System. The form serves as a record of the member's personal details, employment history, and other relevant information. The E1 form is used by the SSS to verify the member's identity, update their records, and determine their eligibility for benefits.

Why is the E1 Form Important?

The E1 form is a crucial document that plays a significant role in the management of your SSS account. By submitting the form, you can:

- Update your personal records with the SSS

- Ensure that your employment history is accurate and up-to-date

- Verify your identity and prevent fraudulent activities

- Determine your eligibility for SSS benefits, such as loans, pensions, and death benefits

How to Fill Out the E1 Form

Filling out the E1 form can seem daunting, but it's a relatively straightforward process. Here's a step-by-step guide to help you fill out the form:

- Section 1: Member's Information

- Provide your full name, birthdate, and address

- Indicate your civil status, citizenship, and contact details

- Section 2: Employment History

- List your previous and current employers, including their addresses and dates of employment

- Provide your job title, salary, and reason for leaving (if applicable)

- Section 3: Beneficiaries

- List your beneficiaries, including their names, relationships, and dates of birth

- Indicate the percentage of benefits allocated to each beneficiary

- Section 4: Signature and Certification

- Sign the form and certify that the information provided is accurate and true

Tips and Reminders

- Make sure to fill out the form legibly and accurately

- Use a black or blue pen to sign the form

- Attach supporting documents, such as a valid ID and proof of employment, if required

- Submit the form to the SSS office nearest you

How to Submit the E1 Form

Once you've filled out the E1 form, you can submit it to the SSS office nearest you. Here are the steps to follow:

- Visit the SSS Office

- Go to the SSS office nearest you and bring the completed E1 form

- Make sure to bring supporting documents, if required

- Submit the Form

- Submit the form to the SSS officer and wait for verification

- The officer may ask you questions or request additional documents

- Get a Receipt

- Once the form is verified, you will receive a receipt as proof of submission

What to Expect After Submitting the E1 Form

After submitting the E1 form, you can expect the following:

- The SSS will verify the information provided and update your records

- You will receive a confirmation receipt as proof of submission

- You can check the status of your submission online or through the SSS hotline

Common Mistakes to Avoid

When filling out the E1 form, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some common mistakes to avoid:

- Inaccurate or incomplete information

- Make sure to provide accurate and complete information to avoid delays or rejection

- Missing signatures or certifications

- Ensure that you sign the form and certify that the information provided is accurate and true

- Insufficient supporting documents

- Attach supporting documents, such as a valid ID and proof of employment, if required

Conclusion

Filing your E1 form with the SSS can seem daunting, but it's a relatively straightforward process. By following the steps outlined in this article, you can ensure that your personal records are accurate and up-to-date. Remember to avoid common mistakes and submit the form to the SSS office nearest you. If you have any questions or concerns, don't hesitate to reach out to the SSS hotline or visit their website for more information.

We hope this article has been helpful in understanding the E1 form and the process of filing it with the SSS. If you have any comments or suggestions, please feel free to share them below.

What is the purpose of the E1 form?

+The E1 form is used to update the member's personal records, employment history, and other relevant information with the SSS.

What documents do I need to submit with the E1 form?

+You may need to submit supporting documents, such as a valid ID and proof of employment, depending on the requirements of the SSS.

How long does it take to process the E1 form?

+The processing time for the E1 form may vary depending on the workload of the SSS office. You can check the status of your submission online or through the SSS hotline.