As a Reddit user, you may have come across the IRS Consent Form 4506-C while navigating the complexities of tax-related discussions. Whether you're a taxpayer seeking clarity on your financial obligations or a financial advisor offering guidance to others, understanding the ins and outs of this form is essential. In this comprehensive guide, we will delve into the world of IRS Consent Form 4506-C, exploring its purpose, benefits, and step-by-step instructions for completion.

What is IRS Consent Form 4506-C?

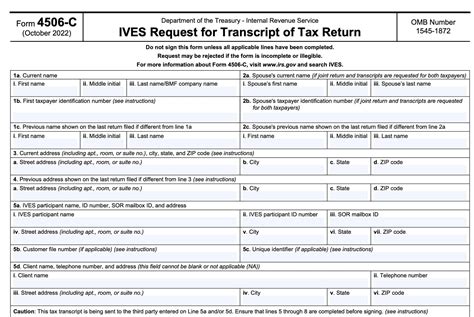

The IRS Consent Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a crucial document that allows taxpayers to authorize the Internal Revenue Service (IRS) to disclose their tax return information to third-party entities. This form is typically used by taxpayers who need to verify their income or tax filing status for various purposes, such as loan applications, tax audits, or social services.

Purpose of IRS Consent Form 4506-C

The primary purpose of the IRS Consent Form 4506-C is to provide taxpayers with a secure and controlled environment to share their sensitive tax information with authorized third-party entities. By signing this form, taxpayers grant permission to the IRS to release their tax return transcripts, which can be used for a variety of purposes, including:

- Verifying income for loan applications

- Confirming tax filing status for social services

- Supporting tax audit or examination

- Facilitating tax planning and preparation

Benefits of Using IRS Consent Form 4506-C

Using the IRS Consent Form 4506-C offers several benefits to taxpayers, including:

- Convenience: Taxpayers can easily authorize the IRS to disclose their tax return information to third-party entities, eliminating the need for multiple requests.

- Security: The form ensures that sensitive tax information is shared securely and only with authorized entities.

- Flexibility: Taxpayers can choose which tax return transcripts they want to disclose and for what purpose.

- Compliance: The form helps taxpayers comply with tax laws and regulations by providing a standardized process for disclosing tax return information.

Step-by-Step Instructions for Completing IRS Consent Form 4506-C

Completing the IRS Consent Form 4506-C is a straightforward process that requires taxpayers to provide basic information and specify the scope of the disclosure. Here's a step-by-step guide to help you complete the form:

- Taxpayer Information: Provide your name, Social Security number or Individual Taxpayer Identification Number (ITIN), and date of birth.

- Tax Return Transcript Request: Specify the tax return transcripts you want to disclose, including the tax year and type of transcript (e.g., Form 1040, Form W-2, etc.).

- Authorized Entity: Identify the third-party entity authorized to receive your tax return transcripts, including their name, address, and phone number.

- Disclosure Period: Specify the duration for which the disclosure is authorized, including the start and end dates.

- Taxpayer Signature: Sign and date the form to confirm your authorization.

Common Uses of IRS Consent Form 4506-C

The IRS Consent Form 4506-C is commonly used in various situations, including:

- Loan Applications: Taxpayers may need to provide tax return transcripts to lenders as part of the loan application process.

- Tax Audits: Taxpayers may need to disclose their tax return information to the IRS or state tax authorities during an audit or examination.

- Social Services: Taxpayers may need to provide tax return transcripts to government agencies or social services organizations to verify their income or tax filing status.

- Tax Planning and Preparation: Taxpayers may need to disclose their tax return information to tax professionals or financial advisors to facilitate tax planning and preparation.

FAQs About IRS Consent Form 4506-C

Here are some frequently asked questions about the IRS Consent Form 4506-C:

- Q: Who can I authorize to receive my tax return transcripts? A: You can authorize the IRS to disclose your tax return transcripts to any third-party entity, including lenders, tax professionals, or government agencies.

- Q: How long is the disclosure period? A: The disclosure period varies depending on the purpose of the disclosure, but it can range from a few months to several years.

- Q: Can I revoke my authorization? A: Yes, you can revoke your authorization at any time by submitting a written request to the IRS.

What is the purpose of the IRS Consent Form 4506-C?

+The primary purpose of the IRS Consent Form 4506-C is to provide taxpayers with a secure and controlled environment to share their sensitive tax information with authorized third-party entities.

How do I complete the IRS Consent Form 4506-C?

+Complete the form by providing your taxpayer information, specifying the tax return transcripts you want to disclose, identifying the authorized entity, and signing and dating the form.

Can I revoke my authorization?

+Yes, you can revoke your authorization at any time by submitting a written request to the IRS.

Conclusion

In conclusion, the IRS Consent Form 4506-C is a vital document that allows taxpayers to authorize the disclosure of their tax return information to third-party entities. By understanding the purpose, benefits, and step-by-step instructions for completing this form, taxpayers can ensure that their sensitive tax information is shared securely and only with authorized entities. Whether you're a taxpayer seeking clarity on your financial obligations or a financial advisor offering guidance to others, this comprehensive guide has provided you with the knowledge and expertise to navigate the complexities of the IRS Consent Form 4506-C.

Share your thoughts and experiences with the IRS Consent Form 4506-C in the comments below!