Discover Card requesting IRS Form 4506-C can be a daunting experience, especially if you're not familiar with the process. The IRS Form 4506-C is a request for a transcript of your tax return, which Discover Card may request to verify your income or employment status. In this article, we'll explore five ways to handle Discover Card's request for IRS Form 4506-C.

Understanding the Purpose of IRS Form 4506-C

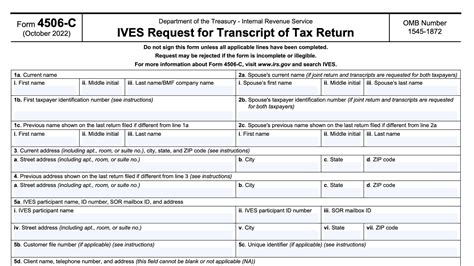

Before we dive into the five ways to handle Discover Card's request, it's essential to understand the purpose of IRS Form 4506-C. The IRS Form 4506-C is a request for a transcript of your tax return, which includes information about your income, employment status, and other financial details. Discover Card may request this form to verify the information you provided during the application process.

Why Does Discover Card Need IRS Form 4506-C?

Discover Card may request IRS Form 4506-C for several reasons, including:

- To verify your income: Discover Card may request IRS Form 4506-C to verify your income, especially if you're applying for a credit limit increase or a new credit card.

- To verify employment status: Discover Card may request IRS Form 4506-C to verify your employment status, especially if you're self-employed or have a variable income.

- To verify tax compliance: Discover Card may request IRS Form 4506-C to verify that you're in compliance with tax laws and regulations.

5 Ways to Handle Discover Card's Request for IRS Form 4506-C

Now that we've understood the purpose of IRS Form 4506-C, let's explore five ways to handle Discover Card's request:

1. Provide the Required Information

The easiest way to handle Discover Card's request is to provide the required information. You can download IRS Form 4506-C from the IRS website or contact Discover Card to request a copy. Once you have the form, fill it out accurately and completely, and return it to Discover Card.

2. Request an Extension

If you're unable to provide the required information immediately, you can request an extension from Discover Card. You can contact Discover Card's customer service department and explain your situation. They may grant you an extension, but be sure to follow up and provide the required information as soon as possible.

3. Provide Alternative Documentation

In some cases, you may not need to provide IRS Form 4506-C. You can provide alternative documentation, such as pay stubs or W-2 forms, to verify your income or employment status. Contact Discover Card to determine what alternative documentation they accept.

4. Dispute the Request

If you believe that Discover Card's request for IRS Form 4506-C is unreasonable or unnecessary, you can dispute the request. Contact Discover Card's customer service department and explain your concerns. They may review your account and determine that the request is not necessary.

5. Seek Professional Help

If you're unsure about how to handle Discover Card's request or need help with the process, consider seeking professional help. You can contact a tax professional or a credit counselor who can guide you through the process and ensure that you're in compliance with tax laws and regulations.

Conclusion

Discover Card requesting IRS Form 4506-C can be a daunting experience, but it's essential to handle the request promptly and accurately. By providing the required information, requesting an extension, providing alternative documentation, disputing the request, or seeking professional help, you can ensure that you're in compliance with tax laws and regulations. Remember to stay calm and seek help if you need it.

We hope this article has provided you with valuable information and insights on how to handle Discover Card's request for IRS Form 4506-C. If you have any questions or concerns, please leave a comment below.

What is IRS Form 4506-C?

+IRS Form 4506-C is a request for a transcript of your tax return, which includes information about your income, employment status, and other financial details.

Why does Discover Card need IRS Form 4506-C?

+Discover Card may request IRS Form 4506-C to verify your income, employment status, or tax compliance.

How can I get a copy of IRS Form 4506-C?

+You can download IRS Form 4506-C from the IRS website or contact Discover Card to request a copy.